The Federal Reserve’s mid-June decision to increase interest rates by 75 basis points will be a tailwind for banks.

Banks pay you to deposit your money, but they lend that money out at a higher interest rate.

This creates the net interest margin, a key revenue source for banks nationwide.

The Federal Deposit Insurance Corporation (FDIC) calculates how much banks earn every year.

You can see in the chart above that U.S. banks earned $263 billion in net income last year — a 92.8% increase from 2020.

Banks were raking in cash before the Fed raised rates. With this latest hike, I expect net income to skyrocket from here.

That bring us to today’s Power Stock: regional bank John Marshall Bancorp Inc. (Nasdaq: JMSB).

JMSB Stock Power Ratings in June 2022.

JMSB operates eight full-service banks in northern Virginia.

Those branches offer personal products (think checking and savings accounts), as well as commercial, construction and development, mortgage and industrial lines of credit.

John Marshall Bancorp. stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

JMSB Stock: Market-Beating Momentum + Strong Growth

After a closer look at JMSB, two items caught my eye:

- In the first quarter of 2022, it recorded net income of $7.7 million — a 51.2% increase from the same quarter a year ago! It was the 13th consecutive quarter of record earnings.

- The stock’s inclusion on the Russell 2000 Index — the benchmark for small-cap stocks.

JMSB stock scores an 81 on our Stock Power Ratings system’s growth metric.

That comes from a one-year annual earnings-per-share growth rate of 35.1%, along with the 51.2% growth in net income I mentioned.

But this stock’s market-beating momentum and low volatility make a statement:

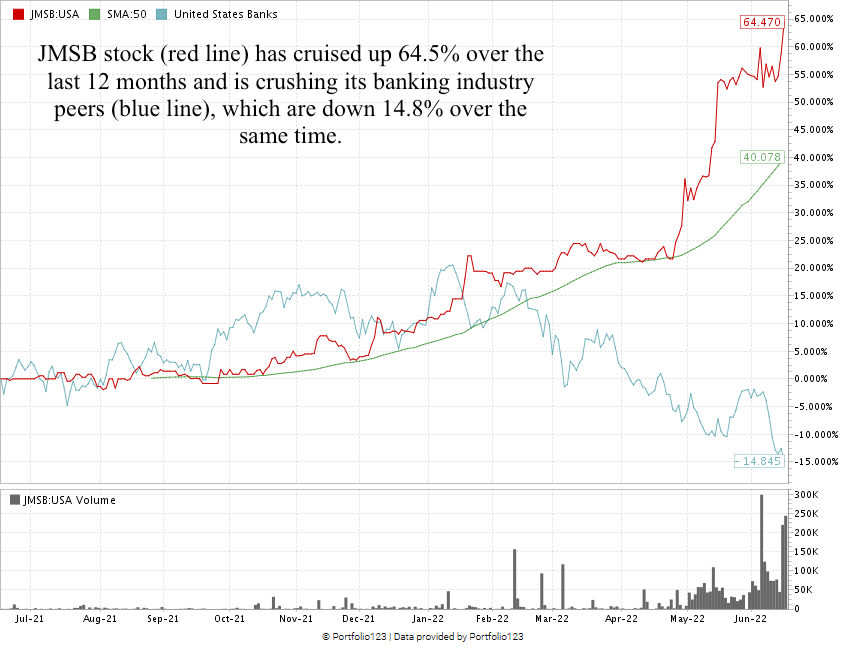

Over the last 12 months, JMSB has shown the “maximum momentum” we love to see in stocks.

It’s up 64.5% in that time — including a 31.9% jump from April to June.

The stock is hammering its banking industry peers, which are down an average of 14.8% over the same 12 months.

John Marshall Bancorp stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Banks are in for a windfall from the Fed’s rate hike, which increases their net interest margins.

JMSB showed solid growth potential before these recent rate hikes, and I’m confident its performance will get stronger.

I hope you can see now why JMSB is a strong potential investment for your portfolio!

Stay Tuned: Top Consumer-Driven Company

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company that delivers tech solutions for customers across business sectors.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com.