I suspect you know of John Cena, Dwayne Johnson and Dave Bautista.

These guys are huge movie stars now.

But that’s not where they got their start.

All three are former professional wrestlers.

Pro wrestling started small, with regional events drawing a few hundred spectators.

Now it’s a multibillion-dollar industry with millions of die-hard fans. You might say the same for the actors I mentioned. At last glance, Dwayne Johnson (“The Rock”) had 324 million followers on Instagram!

This chart shows the average viewership of all pro wrestling TV programs from 2016 to 2020.

Aside from the big run-up in 2019, the takeaway here is consistency.

No matter which franchise they watch, pro wrestling fans — 5.5 million watching on TV — are loyal.

This leads to big profits for these entertainment companies … and for smart investors.

Today’s Power Stock is the most recognizable name in pro wrestling: World Wrestling Entertainment Inc. (NYSE: WWE).

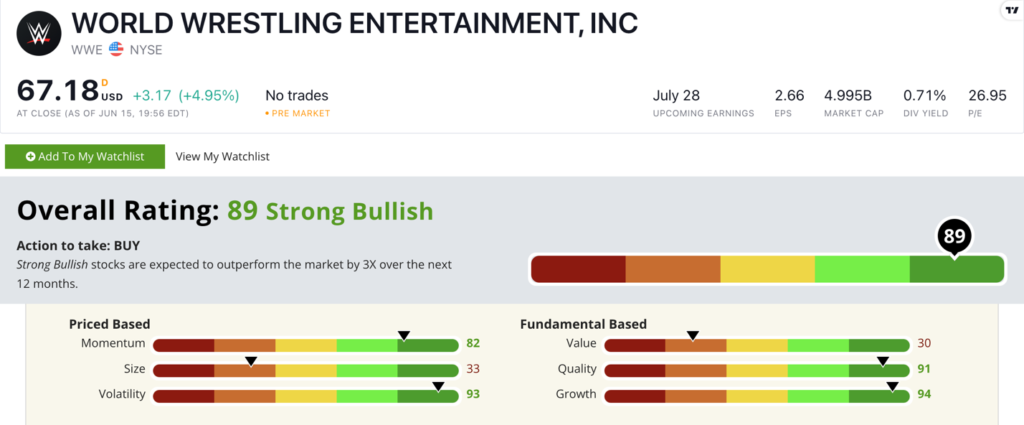

WWE Stock Power Ratings in June 2022.

WWE started as a regional promoter of professional wrestling. It’s grown into a global event and media empire with a $4 billion market cap as I write this.

The company expanded into movie producing, video games and merchandise.

World Wrestling Entertainment stock scores a “Strong Bullish” 89 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

WWE Stock: Top Growth + Low Volatility

WWE had an outstanding first quarter of 2022.

Here’s what stood out to me:

- Its quarterly revenue came in at $333.4 million — an increase of 27% over the same quarter a year ago … and a record!

- Expanded its original programming partnership with A&E, which includes more than 130 new hours of premium series and specials.

WWE stands out as a high-growth stock, rating a 94 on the metric.

The company grew its earnings per share (EPS) by 47.3% from the fourth quarter of 2021 to the first quarter of 2022. Over the last year, its EPS expanded 35.8%.

WWE is a strong quality stock, with return on equity at 53.1% — seven times higher than the media and publishing industry average!

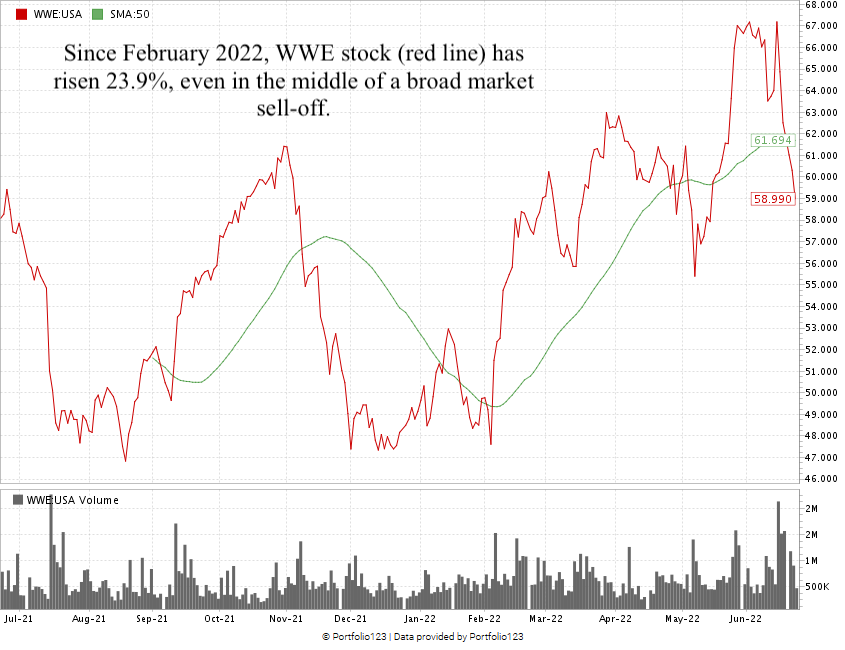

Since a drop in share price in early 2022, WWE stock has gained 23.9% … even in the middle of a market sell-off.

While the rest of the media and publishing industry lags with a 41.7% average loss in stock price over the last 12 months, WWE thrives.

World Wrestling Entertainment Inc. stock scores an 89 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Professional wrestling fans are loyal, spending thousands on tickets to live events, merchandise and pay-per-view shows.

This loyalty is the backbone of the industry and is why WWE is a strong contender (pun intended!) for your portfolio.

Stay Tuned: Excellent Bank Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a small finance stock that deserves a spot in your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.