The latest unemployment report showed there are more workers. According to the Bureau of Labor Statistics:

Total nonfarm payroll employment rose by 531,000 in October, and the unemployment rate edged down by 0.2% to 4.6% … reported today. Job growth was widespread, with notable job gains in leisure and hospitality, in professional and business services, in manufacturing, and in transportation and warehousing.

There was also encouraging data on wage growth:

In October, average hourly earnings for all employees on private nonfarm payrolls increased by 11 cents to $30.96, following large increases in the prior six months. Over the past 12 months, average hourly earnings have increased by 4.9 percent.

But wages only tell part of the story. An increasing number of jobs are in sectors where hours vary. The schedules of retail and restaurant workers, for example, change every week.

For workers with jobs whose hours vary, the average salary is just one factor in how much money they make. Equally important is the question of how many hours they worked.

BLS provided this data as well and noted: “The average workweek for all employees on private nonfarm payrolls decreased by 0.1 hour to 34.7 hours.”

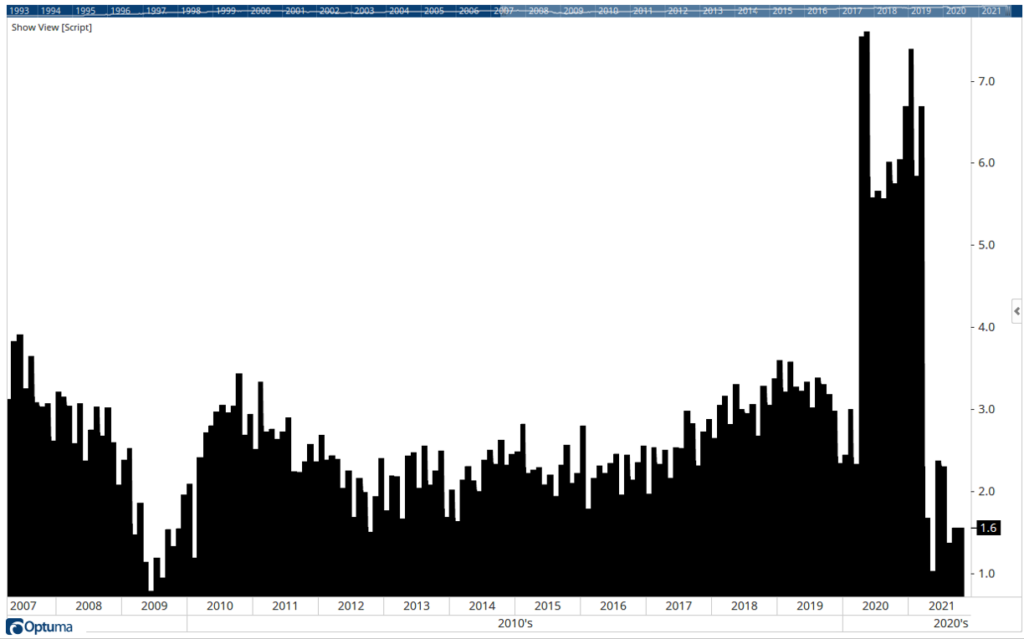

Hourly wages factor into the number of hours worked. The chart below shows the annual change in this data series.

Number of Jobs with Irregular Schedules

Source: Optuma.

Pandemic Eclipsed Gains in Actual Wages

There were big gains in actual wages during the pandemic, but those gains faded as the economy reopened; companies focused on schedules that minimized labor costs. In the past 12 months, actual wages rose just 1.2%.

This explains why higher prices often trouble consumers. While hourly pay may be higher, those dollars buy less than they did a year ago. At the same time, hours for many workers fell, and the amount of money in their paycheck just isn’t keeping up with inflation.

This chart shows the economy still challenges many people with jobs. Eventually, those challenges will burst into a problem that sinks the economy into recession. But that day may be years into the future.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.