May was rough for the S&P 500 as it dropped 6.5%, its worst decline since December of last year when the index crashed 9%. But things have started to brighten in June with the stock market rising throughout its first week, and Tuesday marked the second-best day of the year and the index was up 1.2% through afternoon trading Friday.

But will this June bounce last?

The Nasdaq and S&P 500 closed at record highs toward the end of April, but the month of May was awash with events that sent the markets cratering back to Earth. Trade tensions with China rose throughout the month, President Donald Trump threatened new tariffs on Mexico and the bond market flashed a recession warning sign with an inverted yield curve.

According to CNBC, three of the S&P’s 11 sectors were at correction levels after declining 10% or more entering the month of June.

But the stock market has been on the rise again as news of a possible interest rate cut by the Federal Reserve, along with resistance by some in the GOP to Trump’s tariffs on Mexico, have given investors some confidence again. Tuesday was the second-best day of the year for the stock market, and the climb continued through Wednesday and Thursday. History, however, does not have the best track record.

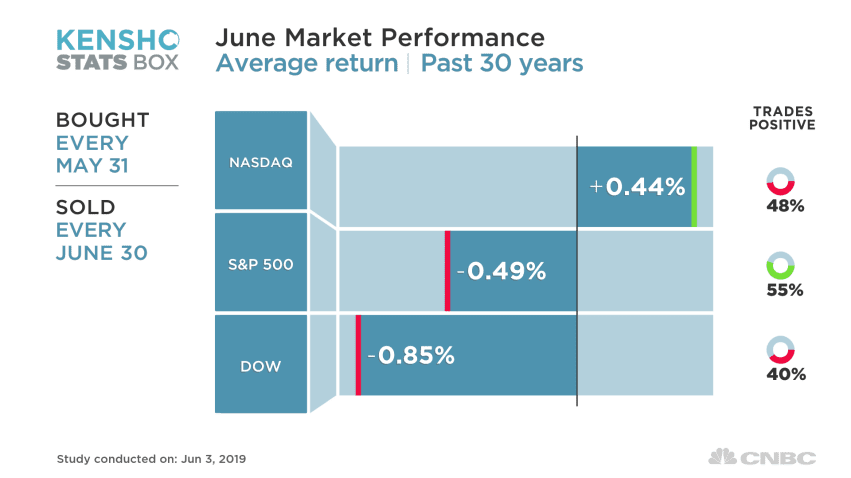

The summer has almost always been a weak period in the markets as people trade in time in front of the computer for the golf course or pool. In the last three decades, June has seen the S&P 500 trade positively only 55% of the time while losing an average of 0.49% over the month, according to a CNBC analysis of Kensho which is a machine learning tool used to find potential profits for Wall Street banks and hedge funds.

The Dow Jones Industrial Average traded positively only 40% and lost an average of 0.85% during that same time frame.

The Nasdaq may be the safest bet with positive trading 48% of the time in June while gaining a paltry 0.44%.

The old adage of “sell in May and go away” could still ring true, but only time will tell.