Investors have created thousands, if not millions, of market indicators. They analyze price-to-earnings ratios (P/E), price-to-book ratios (P/B) and hundreds of other tools based on financial statements. They also slice and dice price action into stochastics, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD) and other technical tools.

Some of these tools are valuable. But investors can also make money without looking at financial statements or any data related to the stock market.

Junk bonds are one of the most profitable trading tools available. Yet, this is among the least followed indicators.

All bonds are loans. To reward investors for lending money, the borrower pays interest to people who fund the loans. Riskier loans carry higher interest rates.

Junk bonds, more formally called high-yield bonds, are issued by companies that are sometimes at risk of bankruptcy. So, yields on junk bonds are much higher than yields on risk-free Treasury securities.

High-yield bonds are also volatile.

How to Beat the Market With Junk Bonds

Because investors in the bonds can lose everything if the issuing company goes into bankruptcy, traders tend to sell quickly when they are worried. Likewise, because the bonds offer high yields, traders tend to buy quickly when they are confident that risks are low.

This rapid-fire buying and selling make junk bonds a useful stock market indicator. We can even develop complete trading strategies based on the yields.

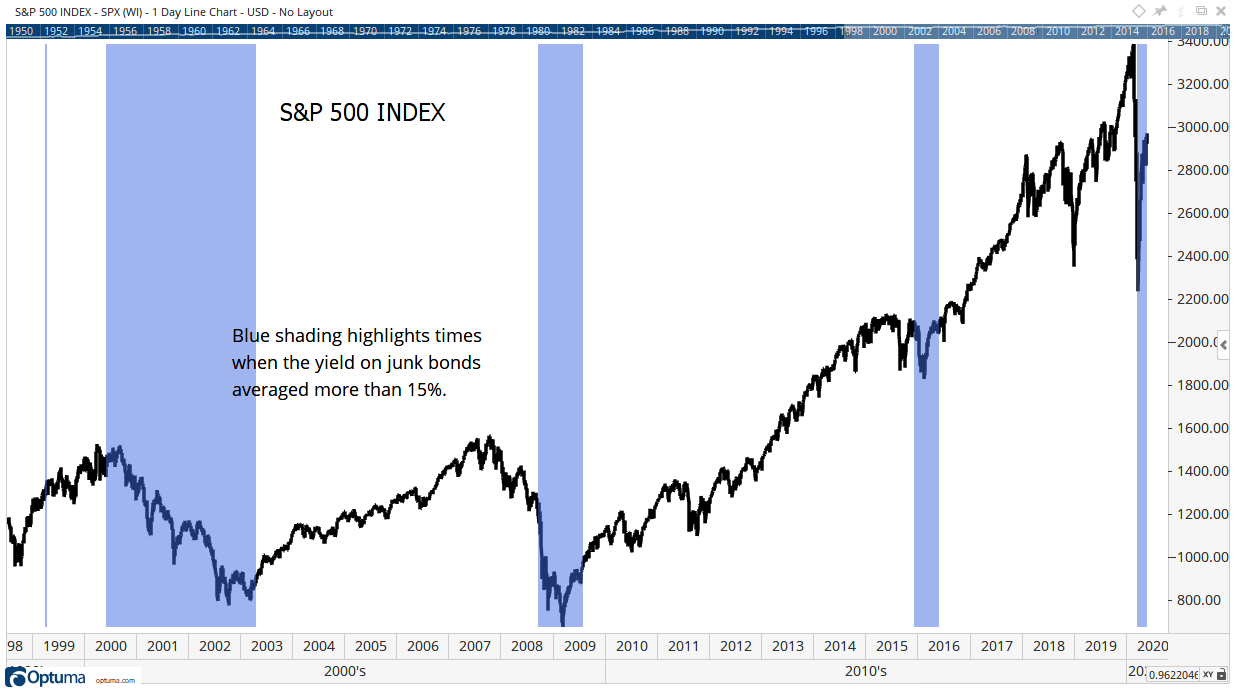

The simplest junk bond strategy is to sell stocks and hold cash when yields are too high. The chart below shows that strategy missed the biggest stock market declines.

Source: Optuma

The rules for this strategy are simple. Sell stocks whenever the ICE BofA CCC & Lower US High Yield Index Option-Adjusted Spread (OAS) tops 15%. You don’t need to calculate the OAS or even know what an OAS is. The Federal Reserve provides the data here.

Charts display the results, but we can also quantify the returns. Owning the S&P 500 while the OAS yield is over 15% resulted in a loss of 37.9% over the last 20 years. On the other hand, owning the index when the yield is below 15% resulted in a gain of 186%.

This is a simple timing tool beat buy and hold.

There are more sophisticated junk bond strategies that we’ll cover in the future.

But this straightforward one is actually good enough to help investors improve returns by simply avoiding large losses.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.