Parents look forward to important firsts. A first word or a first step is a memorable moment. Adults do the same thing. The first day on a job or the first day of vacation is exciting for anyone.

But not all firsts are happy occasions.

Recently, an unusual first occurred in the bond market: Junk bonds yield less than inflation.

Junk Bonds Can’t Keep Up

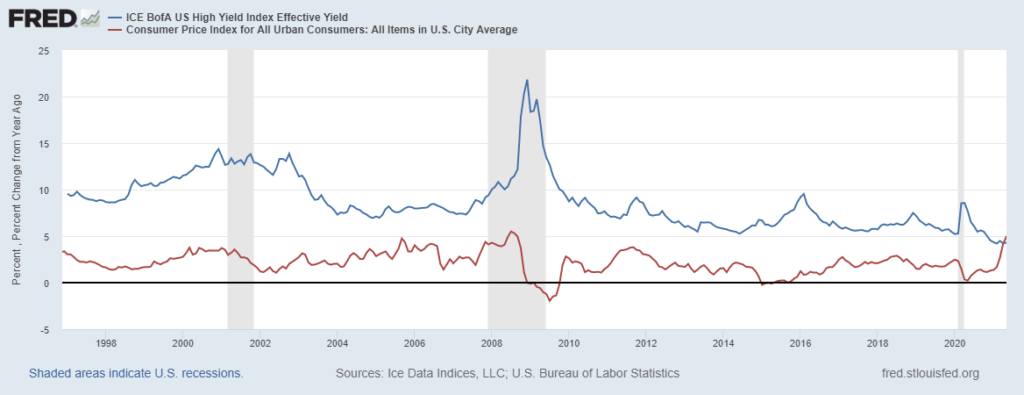

Source: Federal Reserve.

This is a natural result of policies pursued by central banks around the world. For years, central banks pushed interest rates to zero, which led investors to hunt for yield.

Inflation Has Overtaken Junk Bond Yields

To generate income, investors accepted more and more risk. The current situation in high-yield bonds is a natural response to the low-yield policies.

Junk bonds — or, more formally, high-yield bonds — are the riskiest bonds. They are issued by companies that face challenges. These companies are more likely to default on their debt than high-quality companies are. The risk of default has historically resulted in high yields.

As recently as 2009, the high-yield index was above 20%. In the most recent recession, the index topped 8.5%. The current yield of 4.3% is the lowest seen in more than 20 years.

Most alarming, the current yield is less than the rate of inflation. In the chart above, inflation is the red line. The relationship between yields and inflation has been constant throughout history. Risky assets offer yields that are higher than inflation.

Junk bonds should pay investors enough to compensate for the risks of inflation and default. At the current level, investors are not receiving any premium to protect them against default.

In recessions, we should see more than 10% of high-yield bonds default. If that were to happen at current levels, some funds that invest in these assets could fail. That could be the start of a credit crisis like the one that sent yields above 20% just 12 years ago.

Ignoring this first, as the Fed and investors are doing, is a mistake and will lead to a catastrophe.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.