Almost a year ago, investors were convinced cruise lines were in trouble. The rapidly advancing pandemic was stranding ships at sea, and the stocks of companies in the sector were plummeting.

Now, Carnival Corp. is talking to investors about a $600 million junk bond deal. These bonds would be unsecured, which means investors are relying on the company’s recovery to cover the debt.

Bloomberg notes that Carnival “has taken advantage of wide-open credit markets to borrow its way through the pandemic that has essentially put the entire cruise industry on hold for almost a year.”

Carnival is not alone. Chesapeake Energy went into bankruptcy last year after being unable to service its sizable debt. Now, investors submitted orders for $12 billion of $1 billion worth of debt the company was selling.

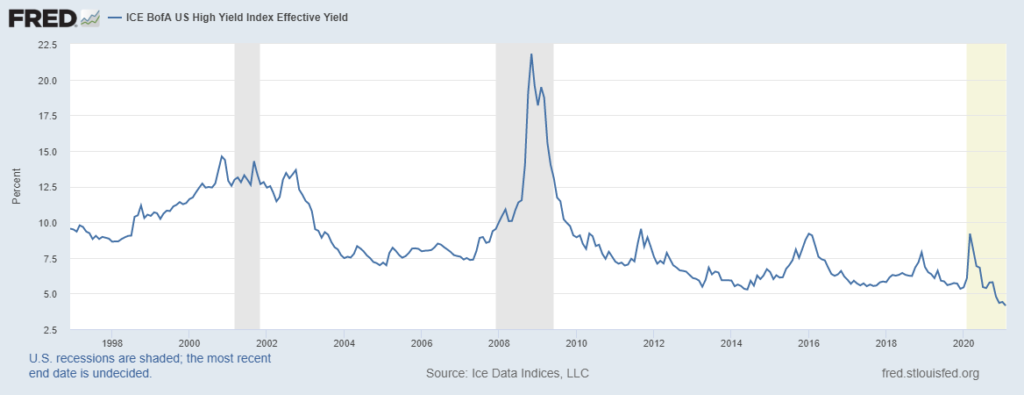

Demand has pushed the yield on junk bonds down since last March. This month, the yield on the ICE Bank of America U.S. High Yield Index fell to record lows near 4%.

High-Yield (Junk) Bond Returns

Source: Federal Reserve.

Investors’ Desperation Drives Junk Bond Popularity

Low yields on bonds are generally associated with low risk. But, by definition, high yield or junk bonds are the riskiest income investments in the market. The low yields show that investors are disregarding risk because they are income starved.

Traders told Bloomberg that “demand for the debt has outweighed supply by so much that some money managers are even calling companies to press them to borrow instead of waiting for deals to come their way. A majority of new issues, even those rated in the riskiest CCC tier of junk, have been hugely oversubscribed.”

In other words, there is irrational exuberance in the junk bond market where investment managers are encouraging financially weak companies to borrow money even if they don’t need the funds. This isn’t a sign of a healthy market and is likely to end with large losses for investors who abandon their discipline in a hunt for income.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.