The current economic recovery from COVID-19 is following a K-shaped pattern. This means many are benefitting from growth — they are in the upward slope of the K. Meanwhile, many others are still suffering — forming the downward-sloping line in the K.

This characteristic of the recovery is attracting attention. As ABC News reported, “The pandemic-induced recession is over for the world’s wealthiest, but it could take a decade or more for the world’s poorest to recover, according to a report published Monday by the U.K.-based nonprofit Oxfam International.”

Businesses are also experiencing a K-shaped recovery.

Small businesses are in the lower leg of the K. A headline in The New York Times read, “It Could Be a Great Year, if Your Business Survives Winter.” The article details the struggles small companies around the country face.

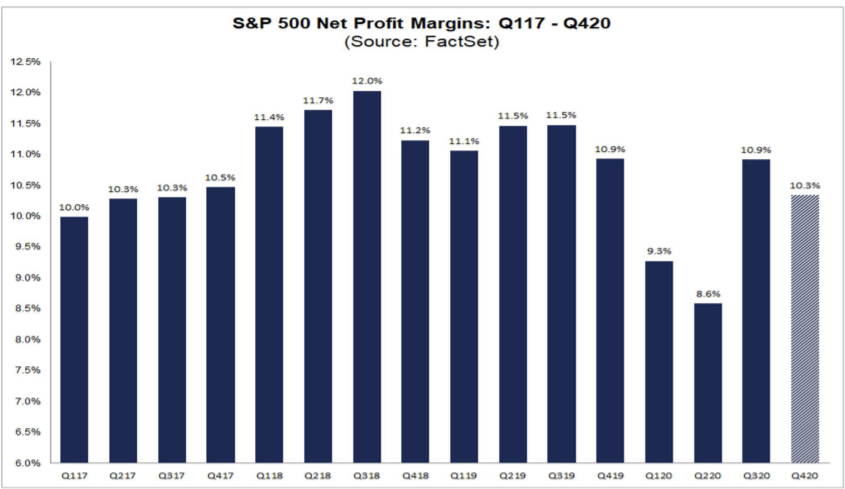

For large, publicly-traded companies, profits are recovering quickly, and profit margins are roaring back, as the chart below shows.

S&P 500 Profit Margins Are Recovering

Small Businesses Need Help to Avoid K-Shaped Recovery

Net profit margins show how much profit a company earns on each dollar of sales. Companies in the S&P 500 are earning over $0.10 for each dollar in sales.

Small businesses generally report smaller profit margins. Local restaurants report profit margins of 3-5% in good times.

Low margins mean smaller businesses have less cash to survive slowdowns. They face greater risks of survival and are recovering slower.

Healthy profit margins for larger companies explain the rapid recovery in the stock market. They are a sign of the K-shaped recovery that continues to unfold.

For investors, the K-shaped recovery presents challenges. Those low-margin small businesses support jobs in local communities. Those jobs provide the funds consumers need to spend at the large companies that make up the S&P 500.

Unless the recovery trickles down to small businesses soon, large businesses’ profit margins will contract as their customers stop spending.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.