Shutdowns continue in many parts of the country, including major commercial centers like New York City. Small businesses in these areas might never recover.

There’s an obvious economic loss for the small business owners and employees. This will be disastrous for millions. There is also a hidden danger to the economy. Landlords of these small businesses are also battling for survival.

For some, landlords have taken on a villainous role during this crisis. Many seem to see them as faceless corporations sitting on vaults of cash demanding tribute.

In many cases, that’s not accurate. Landlords of strip malls, for example, are often small businesses themselves. They rent space to other small businesses in the hope of profiting in the long run. As the restaurants and small stores in the mall lose businesses, so do the landlords.

From the landlord’s perspective, the future might be grim.

Many businesses, especially in large cities, aren’t paying their full rent. In some states, they’re protected by eviction moratoriums. When those moratoriums expire, tenants behind on their rent might just close, leaving empty retail space in their wake. This could lead to bankruptcies among landlords unable to generate cash flow to pay taxes due on their properties.

Some bankruptcies seem inevitable. In a best-case scenario, they would flow evenly through the system.

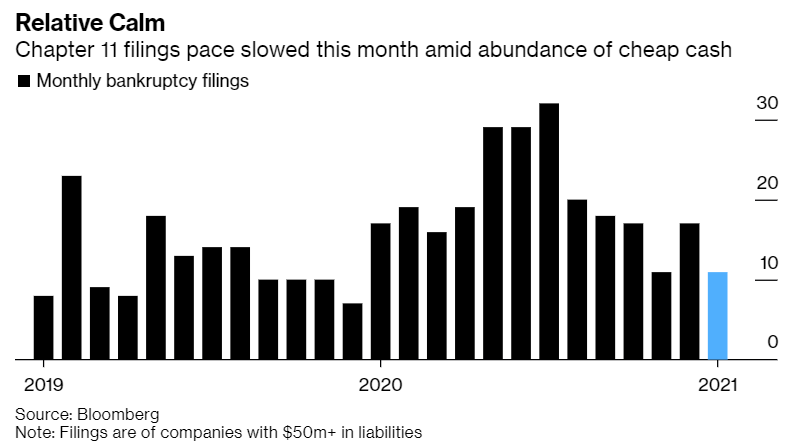

That’s not happening. Just 11 companies with more than $50 million of liabilities have filed for bankruptcy in the U.S. so far this year, a relative slowdown compared with the 20 filed each month on average last year, according to data compiled by Bloomberg.

Chapter 11 Filings Are Artificially Calm

Source: Bloomberg.

Slow Chapter 11 Bankruptcy Rates Show the Worst Is Yet to Come

Bankruptcy trends tend to be similar among large and small companies in recessions. There will be more bankruptcies among small companies, but the trend’s direction should be the same.

Stimulus and eviction moratoriums are helping many. They are also delaying the inevitable in many cases. It would be best to allow firms without promising long-term prospects to fail now. Propping them up hurts viable firms and leaves a second recession hanging over the economy.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.