COVID-19 led to economic shutdowns around the world. Based on the information available to policymakers, that was a justifiable response.

In developed economies, governments sought to prevent hardship from the economic impacts of shutdowns. In the U.S., this included stimulus checks, extended unemployment benefits and other programs to maintain incomes for as many people as possible.

Stimulus is what made COVID-19 more like a war than a public health crisis in some ways. Governments borrowed money to finance stimulus. That made their response more like a wartime economy.

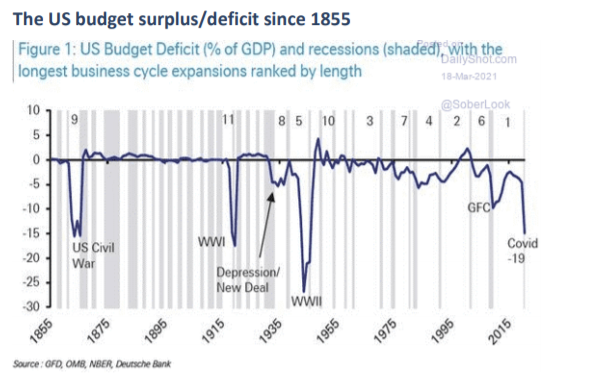

To finance wars, governments have long used deficit spending. European monarchs did this for centuries before the United States was founded. The U.S. continued that practice, as the chart below shows. Deficits spiked during the Civil War and both World Wars.

Debt Funded War in the Past, and the COVID Response Now

Source: Zoetrope of Finance.

Like War, COVID Response Will Shape the Economy

Large deficits led to inflation after wars throughout history. The current deficit is in line with spending tactics used in the nation’s largest wars.

In recent weeks, economists have published research highlighting the differences between wars and pandemics on inflation. Their conclusion is that pandemics are not inflationary.

The government’s response to COVID-19 has been similar to the mobilization efforts seen in wartime.

Mobilization involves equipping military forces. Government spending flows through the economy, and the money supply increases. After the war, the money remains in the economy and inflation results.

With the COVID-19 response, Congress and the Federal Reserve have both created unprecedented amounts of money. That money is one reason stock prices are rising. It could explain increases in cryptocurrencies and residential real estate. It also explains a surge in savings.

As the COVID-19 crisis draws down, consumers will have more options to spend their excess savings and the profits they’ve made from investments. That’s exactly how inflation started after all of the country’s major wars.

Significant economic changes followed wars and are likely to follow COVID-19. In time, we will understand the magnitude of those changes.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.