I don’t expect to die anytime soon. But I still have life insurance … just in case!

I also don’t expect my home to burn down. But I have homeowner’s insurance … just in case!

You don’t buy insurance because you need it. You buy it because you might need it later.

Conservative dividend stocks play a similar role in a portfolio.

Stay in the Market With Solid Dividend Stocks

You don’t want an entire portfolio of stodgy, conservative dividend payers because these companies lack growth in most cases. You want to have growth names too, as that is where you can find big stock winners.

But when sentiment turns and the market goes into banker mode with people hoarding cash, low-volatility, high-dividend stocks give your portfolio stability.

These stocks serve much the same role as bonds. They throw off dividends regardless of the market’s direction.

And because these stocks fall far less (or even rise) when the market sinks, they give you something to sell in order to rebalance and buy the dip in the growth stocks you want to hold when the bear market has run its course.

Kellogg Stock: The Power of Big Brands

With this in mind, take a look at Kellogg Company (NYSE: K), the brand behind some of America’s most iconic breakfast cereals and packaged foods.

Kellogg is the definition of a boring, low-volatility stock that pays out a nice 3.4% dividend. Its beta — a metric that measures a stock’s volatility — is less than half the market average.

While the S&P 500 and Nasdaq are deep in bear market territory, Kellogg is positive for the year! It has traded in a pretty tight band throughout 2022.

Year to date, Kellogg is up almost 5%, while the S&P 500 is down more than 20%!

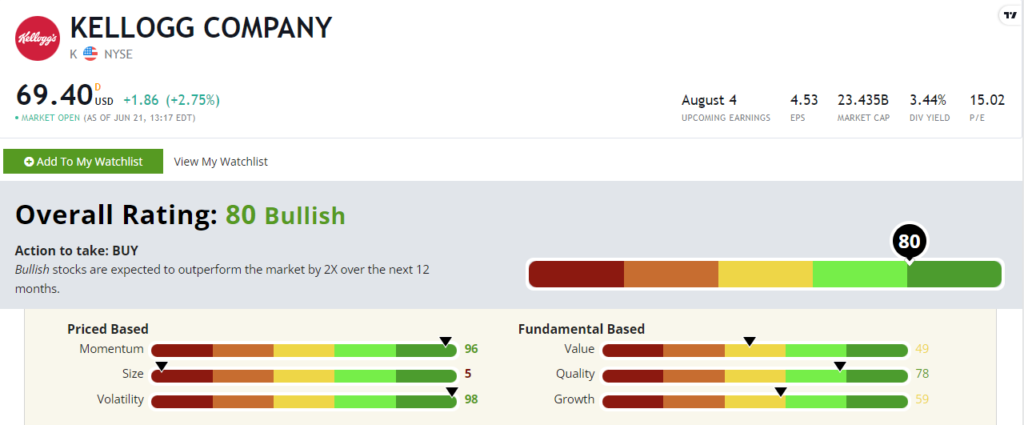

And our Stock Power Ratings system shows that outperformance might last for a while. K rates a “Bullish” 80 within Adam O’Dell’s proprietary system.

Kellogg Co.’s Stock Power Rating on June 21, 2022.

Let’s focus on where Kellogg shines within this current market environment.

Kellogg rates a 96 on our momentum factor. I want to know why the stock is exhibiting such strong momentum. That comes down to its volatility and quality factors.

Kellogg rates a 98 on our volatility factor. In plain English, that means that this stock is less volatile than 98% of the 8,000 stocks that we rate.

Kellogg enjoys steady demand for its products regardless of the state of the economy. It has to get bad out there before customers cut Frosted Flakes out of their budgets. And while inflation is a problem today, Kellogg has a long history of successfully passing rising costs on to its consumers.

This brings us to the quality factor, which in Kellogg’s case, goes hand in hand with volatility.

We use various profitability metrics to measure a stock’s quality. Adam just wrote about how stocks with higher quality ratings fare better in down markets. And Kellogg is a great example of that.

Because Kellogg’s brands are well-recognized and have decades of history, consumers are willing to pay a modest premium for them. That premium creates higher profits and fatter margins. Kellogg rates a solid 78 on our quality factor.

What to Do With K Stock Today

Now, for the question of the moment: Should you buy Kellogg stock today?

Sure! I think it always makes sense to have a core of dependable stocks like Kellogg in your portfolio, and today is as good of a day as any to add exposure.

I don’t think you need to back up the truck and load up on K stock here. In a perfect world, you’d want to accumulate your shares before or after the bear market strikes rather than in the middle of it.

And it might make sense to see how the company’s plans to split into three separate companies works out before taking a major new position.

By all means, buy some Kellogg shares and enjoy the dividends. But keep some cash on the sidelines because this bear market is creating fantastic opportunities within certain mega trends.

To see how Adam and I are following trends like renewable energy, click here to watch Adam’s “Infinite Energy” presentation now.

This is just one trend we believe will drive the market higher in the years ahead. If you join Green Zone Fortunes, you’ll gain access to our model portfolio where you can find stock plays in biotech, infrastructure and more.

Click here to watch Adam’s presentation and join us in Green Zone Fortunes.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.