In early 2021, I mentioned an impending bull market in energy — and a dividend-paying energy stock that would only get better as the sector headed higher.

Well, the energy bull market is here. While the Inflation Reduction Act that’s awaiting President Joe Biden’s signature will boost renewable energy stocks, there are still opportunities within more traditional plays.

I updated you on this stock back in February, and blue-chip gas pipeline operator Kinder Morgan Inc. (NYSE: KMI) keeps getting better.

KMI’s Stock Power Ratings Improvement

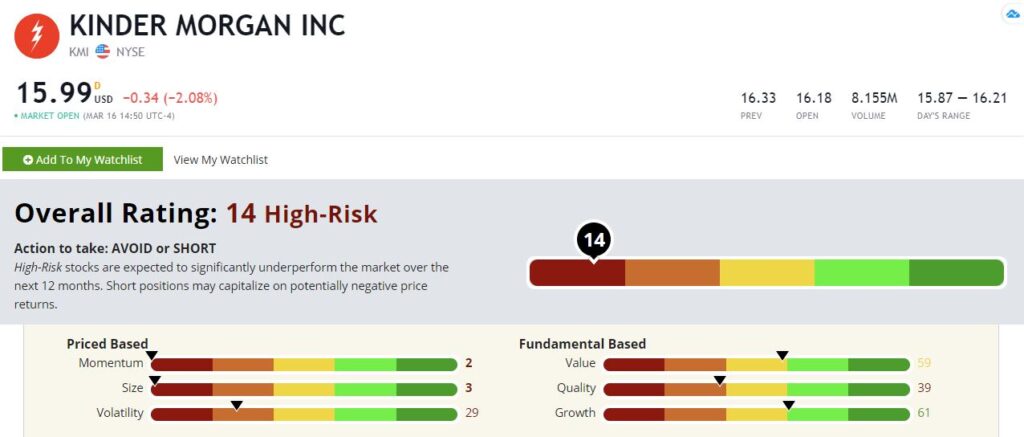

When I mentioned KMI back in March 2021, I noted that its score within Adam O’Dell’s proprietary Stock Power Ratings system was awful:

It registered a pitiful 14 out of 100 at the time, but I thought that number would rebound as the energy bull market got underway.

I was right on the money.

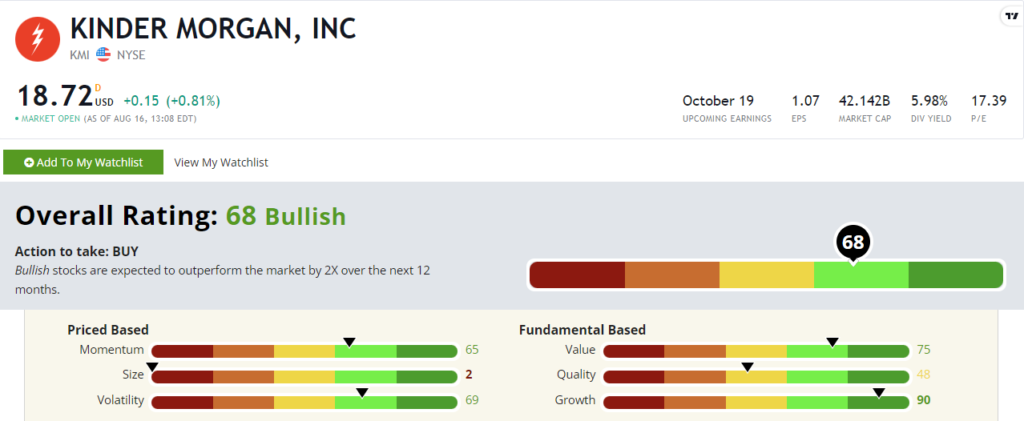

Now Kinder Morgan rates a respectable, “Bullish” 68.

(Note: If you bought KMI when I first mentioned it back in March 2021, you are up around 50%! Drop us a line at Feedback@MoneyandMarkets.com to brag about your gains.)

“Bullish” stocks within our system are set to outperform the market by two times over the next 12 months.

Time will tell if Kinder Morgan continues to climb up the ranks. But with market sentiment focused more on value in 2022, I expect KMI’s strong performance to continue.

Kinder Morgan’s Monster Dividend and Stock Ratings

At current prices, Kinder Morgan yields an excellent 5.9%.

There aren’t many companies as stable as Kinder Morgan sporting yields like that today. And while the Federal Reserve raising interest rates is noteworthy, it will be years before rates are high enough to compete with KMI’s monster dividend.

Let’s break down KMI using the six factors of Stock Power Ratings.

Growth — This may come as a real shock to those who are used to equating “growth” with “tech,” but Kinder Morgan rates an exceptional 90 on our growth factor.

The past decade was brutal for oil and gas producers, but demand for pipelines has improved. And while we are bullish on the renewable energy mega trend, we are still decades away from only using renewables. Natural gas will be a major part of the grid for a long time to come, and Kinder Morgan will get that gas to its destination.

Value — Kinder Morgan also rates well on our value factor at 75. Energy stocks were cheap for years. They have gained favor in 2022, but it’s noteworthy that KMI sports solid value and growth ratings.

Volatility — Energy prices are volatile. That’s even truer today, as multiple situations around the world are pressuring the energy market.

But KMI’s business focuses on fee-based gas transportation. It’s like a toll road for natural gas, making it one of the most stable businesses you can find. So Kinder Morgan’s volatility score of 69 isn’t a surprise. Note: A high score here means the stock is less volatile.

Momentum — Kinder Morgan’s momentum rating has improved to 65 as I write this. The energy bull market has benefited KMI. The stock is up more than 14% year to date, and its recent momentum is something to celebrate:

Quality — Kinder Morgan rates a 48 on quality, but we need a little context. Profitability and balance sheet strength (specifically low debt) drive our quality rating. Well, pipelines tend to have high noncash expenses like depreciation, which lower accounting earnings. Pipelines also tend to carry a fair amount of debt. So a lower quality score here isn’t out of the norm.

Size — Kinder Morgan also sports one of the biggest collections of infrastructure assets in the world. So it’s no surprise that KMI rates a 2 on our size factor. That’s what more than $42 billion in market cap gets you.

Bottom line: If you’re looking for a dividend payer with solid growth prospects as the energy bull market rages on, KMI deserves a spot in your portfolio.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Story updated on August 17, 2022.