Return to normal.

That point when life goes back to the way it was before COVID-19.

People look forward to when they can go out and not worry about bringing a mask with them.

They aren’t alone.

Businesses are also ready for when shops can fully open without restrictions.

Many companies have shut down, causing millions of layoffs and furloughs.

But last week’s Labor Department report indicated that more than 900,000 Americans are returning to work. That’s a great sign that things are closer to returning to normal.

And I found a company that will benefit from this shift.

Pro tip: This stock was the highest-rated stock in our weekly hotlist. To find out more about our weekly hotlist, click here.

It rates an 88 overall on Adam O’Dell’s six-factor Green Zone Rating system.

This company rates high on value (94), growth (91) and quality (83).

And an industry-wide trend will push this stock even higher in the coming months.

Trucking Industry on the Way Up

I drove by PortMiami recently and noticed a huge amount of truck traffic coming in and out.

But it hasn’t always been that way.

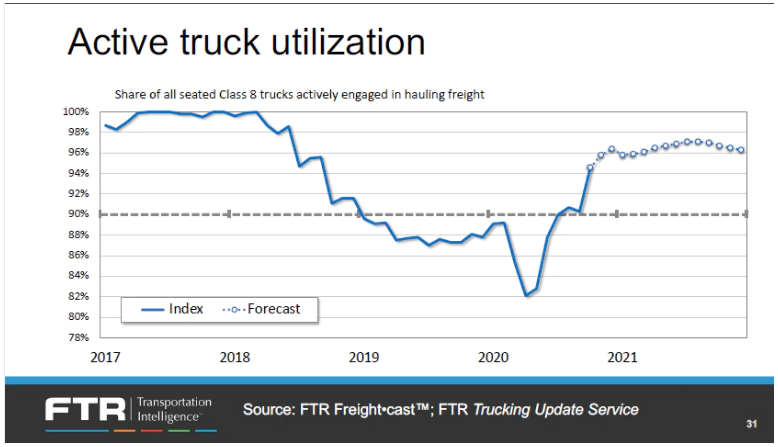

Trucking Forecast Shows Return to Normal

A recent study by FTR Transportation Intelligence showed that only 82% of trucks were used to transport goods across the country during the COVID-19 pandemic.

That is expected to reach 98% of Class 8 trucks over the coming months. These are the big 18-wheelers (hauling 33,000+ pounds) that you see every day.

That’s great news for the trucking transportation industry. More trucks on the road mean more goods delivered and more drivers working.

Knight-Swift Stock Will Boom as Life Returns to Normal

Knight-Swift Transportation Holdings Inc. (NYSE: KNX) is one trucking company that will benefit from a return to normal.

It provides truckload transportation services in the United States, Mexico and Canada.

Knight-Swift employs 22,700 and has a market capitalization of $8.12 billion.

Its revenue dropped slightly in 2020 to $4.7 billion from $4.8 billion in 2019.

Forecasts show that Knight-Swift’s total revenue will jump to a high of $5.7 billion by 2023 — a 21% increase from last year.

Knight-Swift’s diluted earnings per share are also expected to grow over the next three years.

Its earnings per share fell to $2.40 in 2020 — down from a high of $4.34 in 2017.

But EPS expectations are high:

- $3.39 in 2021.

- $3.82 by 2023.

That’s a 59% increase from last year!

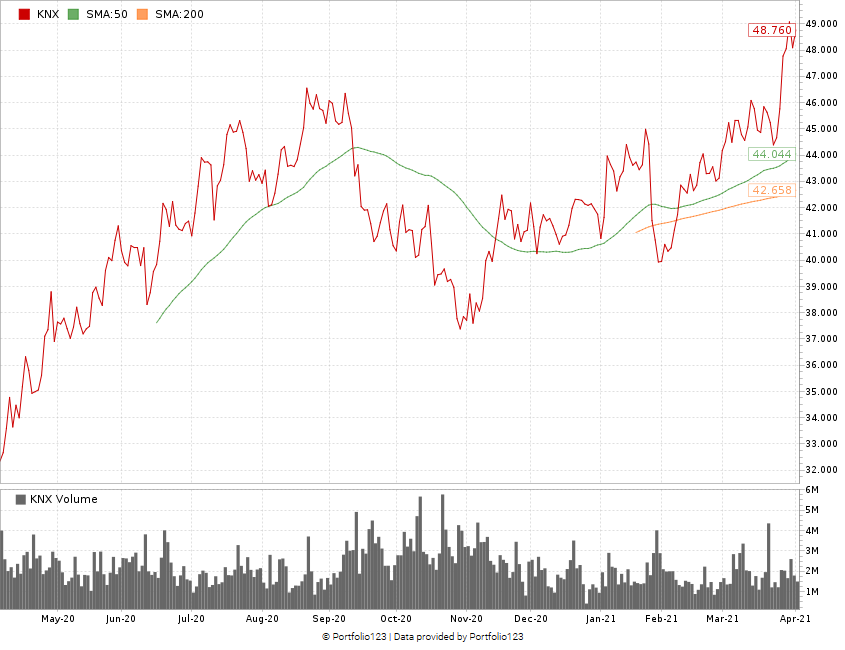

KNX Hits “Golden Cross”

After hitting a low of $29 per share in March 2020, KNX moved to more than $46 per share in September.

It fell back as concerns over COVID-19 restrictions pushed the trucking industry down. But it has rebounded to a 52-week high of nearly $50 per share.

That’s a 71% increase off its March 2020 low.

Its stock price also hit a “golden cross” where its 50-day moving average crossed above its 200-day moving average.

It’s a bullish signal for the coming weeks and months.

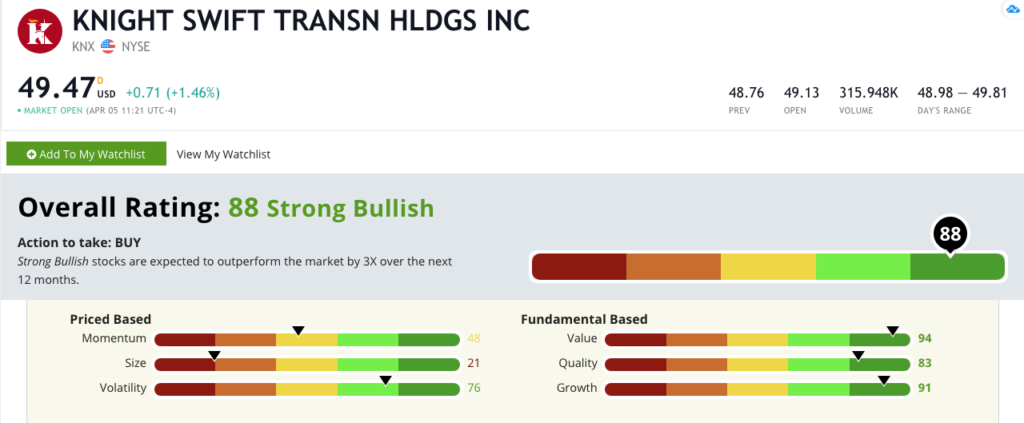

Knight-Swift’s Green Zone Rating

Using Adam’s six-factor Green Zone Ratings system, Knight-Swift rates an 88 overall.

Knight-Swift Transportation Holding Inc.’s Green Zone Rating on April 5, 2021.

That means we are “Strong Bullish” on Knight-Swift and expect it to beat the broader market by at least three times over the next 12 months.

KNX ranks in the green on value (94), growth (91), quality (83) and volatility (76).

It has low volatility coupled with strong returns on investment, assets and equity.

Knight-Swift has a three-year annual sales growth rate of 24.4% and a one-year annual EPS growth rate of 33.8%.

As an added bonus, Knight-Swift shareholders are treated to a cash dividend.

Its forward dividend yield is about 0.66% or about $1.16 per share per year.

The bottom line: America is returning to normal after a devastating COVID-19 pandemic.

Are we there yet? No, but we are getting closer.

As we do, industries like trucking are going to be in demand. And that’s great for those underlying stocks.

That’s why a leader like Knight-Swift Transportation Holdings Inc. is a company to buy.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.