I have three children, two of whom are growing boys. They eat. A lot. Like a marauding army or a swarm of locusts. If you turn your back on them for a minute, they’ll pick the pantry clean.

I had this on my mind as I was researching dividend stocks this week. The pandemic was a godsend for packaged food companies. With restaurants shuttered, Americans ate a lot more meals at home … and gorged on a lot of sugary comfort food while they were at it.

Packaged food stocks never quite enjoyed the “stay-at-home” bump you’d expect. Investors flocked to tech names instead, and there was always the perception that any benefit would be short-lived.

But here’s the thing. Even as the economy opens up and life gets closer to normal, restaurant demand might not fully recover to pre-pandemic levels. Pleasure dining likely will. Meeting friends at a restaurant is fun, and you don’t have to clean up after them once the party’s over. But business lunches will be a lot slower to recover as many Americans work from home indefinitely.

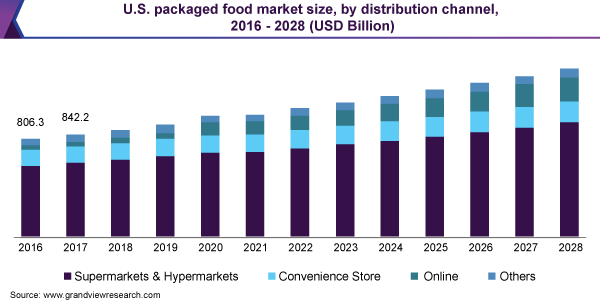

More people staying at home for longer suggests that demand for packaged foods should stay high for a while. The packaged food market size grew to more than $996 billion in 2020, according to Grand View Research. That’s expected to grow at a compound annual growth rate of 4.1% through 2028.

Packaged Food Is Trending Higher

Source: Grand View Research.

That brings me to The Kraft Heinz Co. (Nasdaq: KHC). Apart from its namesake Heinz ketchup, Kraft Heinz owns a large collection of brands you’d recognize: Oscar Mayer, Philadelphia, Velveeta, Lunchables, Planters, Maxwell House, Capri Sun, Kool-Aid and Jell-O, to name a few.

Kraft and Heinz merged in 2016 to form the company we know today. And it hasn’t been a smooth ride. The merger was not executed well and came with a mountain of debt that was off-putting to investors. Shares of the combined company started sliding almost immediately after the merger. Today, KHC trades for less than half its 2017 highs.

The shares bottomed out in March of last year and have almost doubled since then. But after the shellacking the stock has taken over the past five years, it’s still reasonably cheap (at least by the standards of this market). Shares trade at a forward price-to-earnings of 17 and offer a 3.7% dividend.

It’s the dividend that caught my attention. I try to avoid dividend stocks that are in a downtrend. After all, you’d feel silly buying a stock for its 3.7% yield only to see the share price cut in half, as Kraft Heinz’s share price was. But the shares have been trending higher for the past year, and it seems that the post-merger selling has finally stopped.

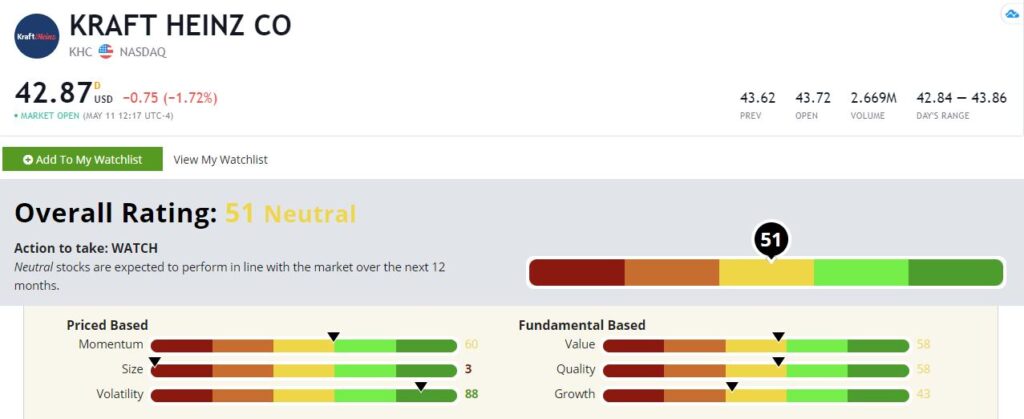

Let’s see how Kraft Heinz stacks up in our Green Zone Ratings system.

Kraft Heinz Green Zone Ratings Breakdown

KHC rates a 51, right smack dab in the middle of the pack. That isn’t a deal-breaker if we’re looking at this as a dividend play. Let’s pick apart the details to see what we can glean.

The Kraft Heinz Company’s Green Zone Rating on May 11, 2021.

Volatility — At 88, Kraft Heinz rates well on volatility. This is exactly what we want in a dividend stock. We want stability, not heartburn. Remember, a high score here means low volatility and steady stock movement.

Momentum — The stock rates a respectable 60 on momentum. In a market that has favored tech and go-go growth stocks over the past several years, 60 isn’t a bad score for a stodgy old food stock. We don’t need a dividend stock to have “rip the cover off the ball” momentum. We want it to be stable and generally drift higher. KHC crawled out of the March 2020 crash and has gained almost 100% since then!

KHC Is Well Off Its 2020 Bottom

Quality — Kraft Heinz rates fairly well on quality with a score of 58. Our quality score is driven by profitability and by balance sheet management. This is a food company with extensive property, plants and equipment, so it’s not going to rate as high as a capital-lite software company. For a packaged foods company, 58 isn’t bad.

Value — Kraft Heinz rates a 58 on value. That’s not deep value territory by any stretch, but it puts it solidly in the top half. We’ll take it.

Growth — The company rates a lackluster 43 on growth, but this is due in part to its limited operating history. The combined company was formed in 2015. Our metrics incorporate data that goes back as far as 10 years. This is not a high-growth company, of course, but its “true” growth score should be a little higher than 43.

Size — Kraft Heinz is not a small company by any stretch. It rates a 3 on our size metric, so we won’t be getting much of a small-cap bounce here.

Bottom line: Is Kraft Heinz a stock that will make you filthy rich? Probably not. But it’s a company with valuable, recognized brands that fell out of investor favor but now seems to have found a bottom. It’s a reasonably-priced dividend payer that should make a nice, no-drama addition to a retirement portfolio.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.