If you’re thinking of buying a recession-proof stock, look no further than Kroger Co. (NYSE: KR).

Companies that specialize in items such as food and utilities will always be in demand, no matter how high the prices of those goods get.

I’m sure you’ve noticed that inflation has pushed prices up everywhere.

In December 2021, the rate of inflation was 7%. That’s the highest level since 1982!

High inflation means we’re less likely to spend on items that we don’t need.

But it won’t stop us from buying consumer staples, including cleaning products, food and medicine.

Using Adam O’Dell’s proprietary six-factor Green Zone Ratings system, I found a consumer staple stock that has continued to rise as the market dropped.

Kroger stock jumped 9% in the first 10 trading days of January. This is a positive sign for its future.

It rates “Bullish” in Green Zone Ratings, which means it is poised to beat the broader market by at least two times over the next 12 months.

I’ll show you why you should buy Kroger stock now.

Consumer Staples Stocks Forge Ahead in 2022

Higher inflation wreaks havoc on the stock market.

The Federal Reserve is considering raising interest rates to combat it. This will lower the future earnings of high-growth stocks.

So, investors turn to high-value income stocks that pay a dividend.

This trend is taking hold in 2022: The Consumer Staples Select exchange-traded fund (NYSE: XLP), a basket of consumer staples stocks, has outperformed the S&P 500 since the start of the year.

XLP is 0.1% off its starting price on January 1, while the broader S&P 500 is down 2.2%.

We can find big profits in this trend.

Consumer Staples Leader: Kroger Co.

Cincinnati-based Kroger Co. (NYSE: KR) operates grocery stores across the United States.

As of 2021, the company owns 2,742 retail food stores and gas stations across 35 states and the District of Columbia, as well as an online retail store.

In its most recent quarterly earnings, Kroger reported:

- 103% increase in digital sales.

- 1% increase in total sales without fuel.

- An increase in operating profit from $792 million in the third quarter of 2020 to $868 million in the third quarter of 2021.

KR expects its total annual revenue for 2021 to increase by 8.4% over 2020, to $132.5 billion.

It projects total revenue to reach $141.7 billion by 2024 — a 16% increase from 2020.

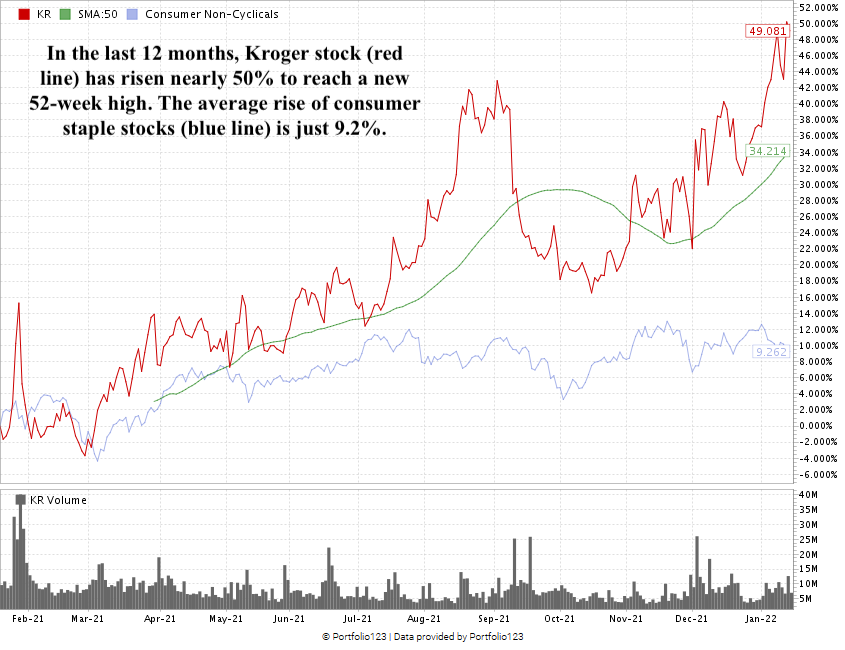

Kroger stock reached a 52-week high of $47 per share in September but pulled back to around $38 by mid-October. That’s a 19% drop in a month!

After that low, the stock surged 13% from Christmas to now. Kroger has advanced around 50% in the last 12 months and hit a new 52-week high on January 13.

Kroger Stock Rating

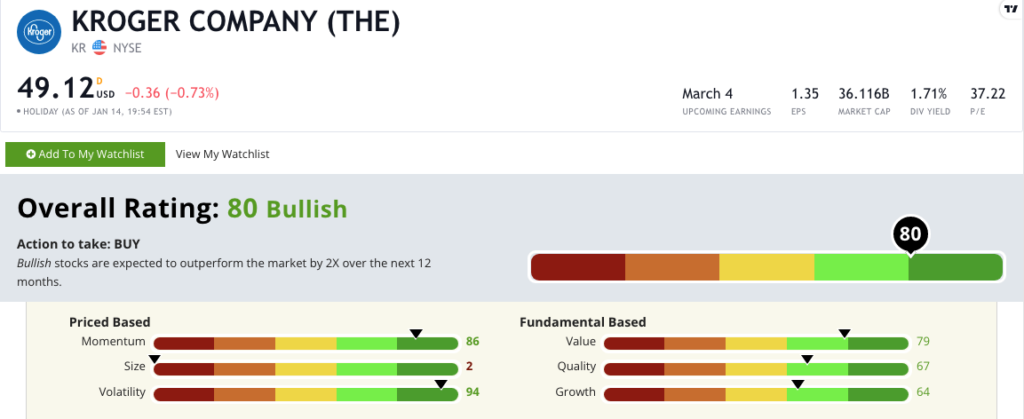

Using Adam’s six-factor Green Zone Ratings system, Kroger Co. stock scores an 80 overall. That means we’re “Bullish” on the stock and expect it to beat the broader market by at least two times in the next 12 months.

Kroger Co.’s Green Zone Rating on January 17, 2022.

Kroger stock rates in the green in five of our six rating factors:

- Volatility — Since October 2021, Kroger has jumped 29% without much getting in its way. The company scores a 94 on volatility — meaning its volatility is lower than 94% of the stocks we rate.

- Momentum — In the last 12 months, Kroger’s stock price rose almost 50%. This is the definition of “maximum momentum.” Its 86 momentum rating is just what we look for in a stock.

- Value — KR trades at a price-to-sales ratio of 0.27. Compared to the food and beverage retail average of 0.95, we know Kroger stock is a much better value than its food and beverage retail peers. It scores a 79 on value.

- Quality — With positive returns on assets, equity and investments compared to negative returns for the food and beverage retail industry, KR scores a solid 67 on quality.

- Growth — KR’s one-year annual earnings-per-share growth rate is 60.6%. Its one-year annual sales growth rate is 8.4%. It scores a “bullish” 64 on growth.

KR rates a 2 on size. With a market cap (shares outstanding times current share price) of $36.1 billion, Kroger is a large-cap stock. But the stock’s size lends to the low volatility I mentioned — and if inflation continues, we’ll be happy to hold stocks with size and staying power.

Another benefit of KR is its 1.71% forward dividend yield. Folks who own Kroger stock will earn $0.84 per share this year just for owning the stock.

Bottom line: Inflation isn’t going anywhere. The prices of goods and services will remain high.

The stocks that perform well under those circumstances are those that specialize in selling things we need.

Kroger Co. does just that in the majority of the U.S., and it deserves a spot in your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. This isn’t the first grocery store I’ve shared with you in recent months. In October, I recommended a high-growth, high-momentum stock that’s up more than 15%. Read more about it here.

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.