The U.S. economy is thought to have four different cycles: early, mid, late and recession. And Bank of America Merrill Lynch’s investing and economic team recently sent a 115-page note to clients, outlining the status of the economy and how best to invest around its ups and downs.

Wall Street has been signaling “late cycle,” the last phase before a recession that is marked by decelerating economic growth and peaks in profit margins, sales and stock multiples.

And, as BofAML points out, this July will mark the longest economic expansion in U.S. history, going for more than nine years now.

So it’s about time for a recession, with BofAML’s analysts finding 15 of 25 major sectors the firm follows indicating a late cycle has been triggered.

Economists and strategists alike are in agreement.

“Putting the pieces of the puzzle together, we see an economy that is set to slow into the end of next year as fiscal stimulus fades and the Fed brings interest rates higher,” wrote Michelle Meyer, U.S. economist for the firm, in the note. “We will need to recalibrate from a 3 percent economy back to a low-2 percent economy, as has been typical throughout this expansion.”

So what, exactly, do you do with your money during the late cycle?

Per CNBC:

How to invest in late cycle

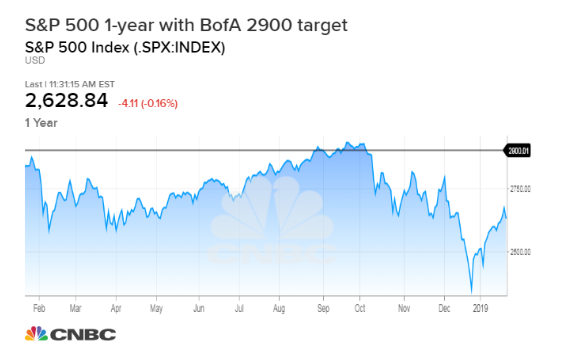

Bank of America Merrill Lynch says investors can still post a good return this year in the overall market and specific types of companies.

But the firm warns that at some point during this phase we will see a market peak and the end of the bull, and that point likely will be around the highs hit last year or a little higher — around 3,000 on the S&P 500. Its year-end forecast is 2,900, representing a 10 percent gain from around the 2,629 level, where the benchmark was trading on Wednesday.

“Our team still sees upside to equities, owing mostly to still-supportive fundamentals and more reasonable valuations, but believes this year will likely mark the peak,” the note states.

The firm says that high-quality, low-risk and large-cap stocks will be your best bet during this phase and have been historically. Momentum stocks (see Netflix) typically perform well also during late-cycle phase, the firm said, as long as interest rates don’t rise.

There are a few sectors you may want to avoid in this environment.

“In addition to higher input costs from tariffs, we also see labor costs as a risk to labor intensive sectors’ margins,” wrote Savita Subramanian, chief U.S. equity and quant strategist. “Consumer Discretionary, Industrials, and Consumer Staples are the most labor-intensive sectors (highest employee/sales ratios), where we see risk to Discretionary margins in particular which have been driven up amid years of cost cutting.”

“Companies with pricing power should fare best,” she added.

Already in a bear market?

The firm also raises the possibility that the stock market is already in a bear market, something that will happen typically in this economic phase.

It notes that at some point last October, 79 percent of its 19 bear market signposts were triggered. As of today, just 53 percent, or 10 out of 19, of the signposts are flashing a bear market. These indicators include interest rates, trailing return, rising volatility and consumer confidence readings.

If we are in a bear market or when we hit one, BofAML notes health care and consumer staples typically perform well. The firm also notes that despite their poor bear market track records, technology and bank stocks may hold up OK this time around.

Steady ship

To be sure, it’s possible this continues to be an atypical economic recovery and we remain in a midcycle phase for a long time, just marked by slower-than-normal growth at that phase.

That’s what J.P. Morgan Chase CEO Jamie Dimon told CNBC on Wednesday.

“The U.S. economy is kind of like a ship that’s going, it’s going ex- the shutdown 2 to 2.5 percent, and that’s going to keep going for a while,” Dimon said.

But most on Wall Street are starting to say a new phase has begun and a recession is ahead as early as 2020.