The stock market has been particularly volatile since early October and things are about to get worse according to Bank of America, which notes the formation of the dreaded “death cross” in the S&P 500.

Things already haven’t been going well for the S&P 500, which fell 5 percent over the past week and 8 percent over the past three months. It even dipped into correction territory — a fall of 10 percent from its recent peak — before rebounding.

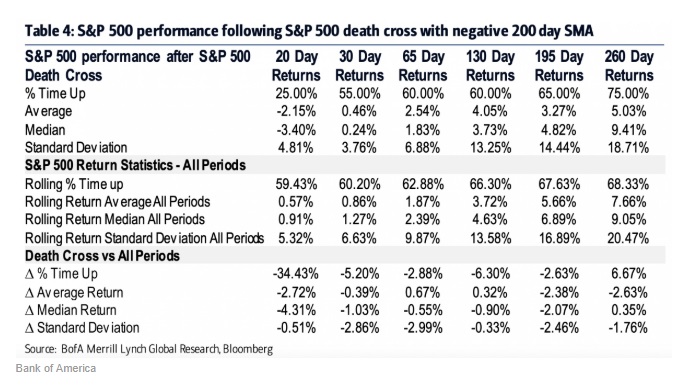

A death cross happens when the 50-day moving average falls below the 200-day moving average in an index, which happened earlier this month for the S&P 500. Bank of America’s technical analysts say this time will be especially painful for investors.

Per Markets Insider:

A death cross forming in the S&P 500 is never a welcome development for investors. After all, the long-term technical indicator denotes short-term momentum is slowing, and is widely viewed as a bearish signal.