Conventional wisdom suggests renewable energy will become the primary power source of the world… At some point.

I’ll give you the fact that the future of clean energy is promising — everything from wind and solar farms to electric vehicles.

We all know it’s coming.

The fact of the matter is that its dominance won’t arrive tomorrow … next week … or even next year.

Our global dependence on oil and gas will remain for a long time to come.

One of the big reasons is time.

It’s going to take decades to implement the technology and infrastructure to become fully reliant on clean energy over fossil fuels.

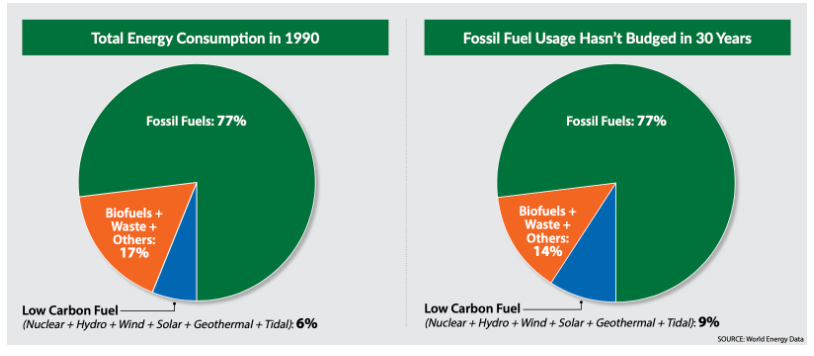

Need proof? Just look at this chart that our chief investment strategist, Adam O’Dell, featured in his July issue of Green Zone Fortunes.

World Energy Data found that we used just as much fossil fuels in 2020 as we did in 1990. And renewable sources inched up from 6% of total consumption to just 9% over the same time frame. (If you want to see why Adam was referencing this chart for his latest Green Zone Fortunes recommendation, click here to learn how to access the issue.)

It’s clear that while the renewable market contains so much potential, oil and gas aren’t going away anytime soon.

Today, I’m going to examine a little-known trend in fossil fuels and use Adam‘s proprietary Green Zone Power Ratings system to pinpoint a “Strong Bullish” stock to take advantage.

Industrials Need Liquid Fuels

The biggest consumer of fossil fuels globally is the industrial sector.

Plants around the world use massive amounts of oil, natural gas and coal to produce the items we use every day.

It has been ingrained in the industrial infrastructure for decades, and reversing that isn’t easy.

American automaker General Motors doesn’t expect its 100% renewable energy initiative to fully take hold until 2035 at the earliest.

And you can see in the chart below that industrials are planning to expand the use of liquid fuels.

In 2020, the global industrial sector used 61.7 quadrillion British thermal units of liquid fuels.

EIA expects that number to climb almost 60% to 98.3 quadrillion by 2050 — despite our best efforts to convert to clean energy.

Today’s Power Stock will take full advantage of this expanding trend in liquid fuel usage.

Liquid Fuel Stock to Buy: International Seaways (INSW)

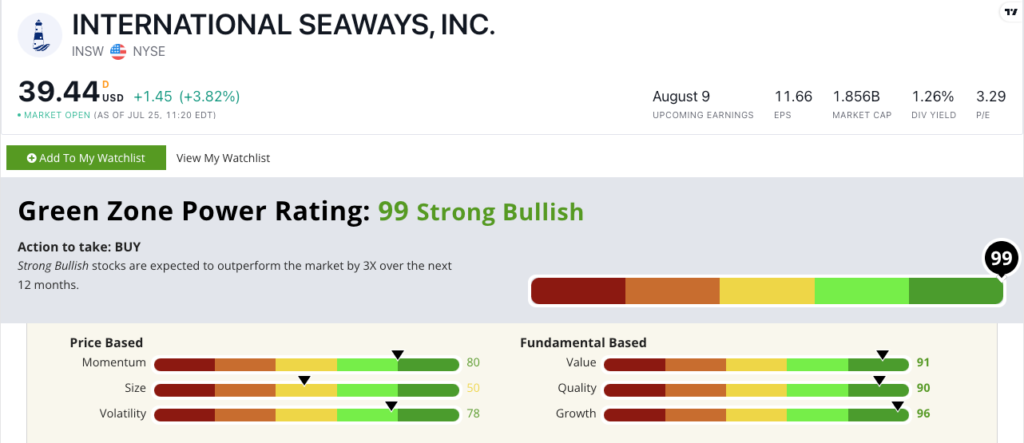

International Seaways Inc. (NYSE: INSW) rates 99 out of 100 on our Green Zone Power Ratings system. This means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

It also means this stock rates in the top 1% of all stocks in Adam’s system.

INSW operates 75 vessels ranging in size from VLCC (up to 320,000 dead-weight tons) to Aframax (up to 80,000 dead-weight tons) that transport crude oil and other liquid fuels around the world.

Pro tip: This isn’t the first time we’ve mentioned INSW. Adam wrote about this company back in 2021 when it only rated 71 overall.

INSW earns its highest rating on Growth (96) due to its one-year annual sales growth rate of 214.8% and its earnings-per-share growth rate of 323.9%. That means it continues to be the carrier of choice to bring oil and gas to different parts of the world.

It gets a high mark on Value (91) thanks to a price-to-earnings ratio that’s 3X lower than its industry average.

On Quality, INSW earns a 90 because of a net margin of 54.6% compared to the industry average of only 5.6%.

Bottom line: The global dependence on oil and gas isn’t going away anytime soon.

It’s too engrained in our industrial infrastructure, meaning it will take decades for industries around the world to convert to complete reliance on clean energy.

So, oil and gas are going to be around for quite a while.

INSW is one of the most reliable carriers of oil and gas around the world. With its outstanding growth and strong value, it is certainly a stock worth looking at for your portfolio.

Of course, while today’s Power Stock has a lot of potential in the energy sector, if you want the best ways to follow what Adam is calling the “Oil Super Bull,” you need to check out his presentation.

This is a broad mega trend that is going to last for years (if not decades), and Adam is targeting energy stocks with 10X profit potential in a matter of years for his premium subscribers. One is already up more than 130% since he recommended it in September — and he believes it’s just getting started.

Click here to see how you can join him in 10X Stocks and start investing in his high-conviction recommendations now.

Stay Tuned: Is Warren Buffett on the Right Oil Track?

Tomorrow, Managing Editor Chad Stone is going to explore the Oracle of Omaha’s energy portfolio to see how it stacks up using Green Zone Power Ratings.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets