From Russia’s ongoing invasion of Ukraine to territorial disputes between China and its Asian neighbors in the South China Sea, the need for beefed-up defense is front and center.

With so much instability, the U.S. is pouring more and more resources into defense spending:

The chart above shows actual and estimated defense spending in the U.S. from the Congressional Budget Office.

By 2032, defense spending will be nearly $1 trillion — a 40% increase from 2021.

That brings me to today’s Power Stock: defense systems and aerospace manufacturer Lockheed Martin Corp. (NYSE: LMT).

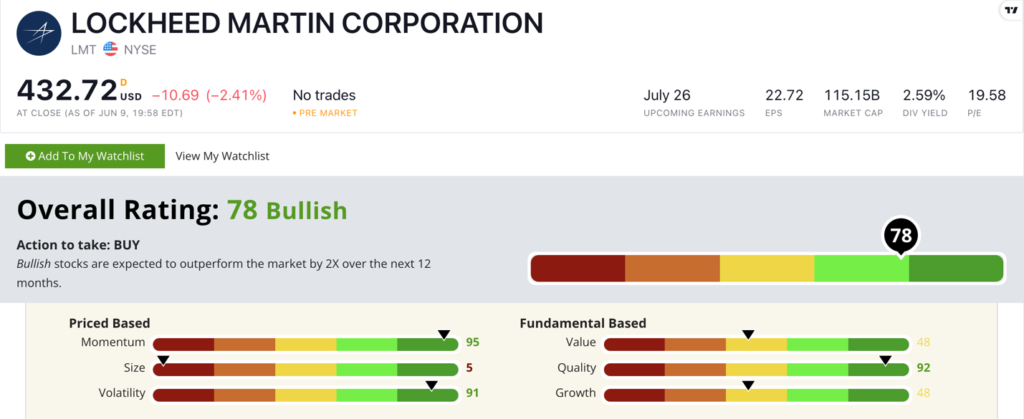

LMT Stock Power Ratings in June 2022.

LMT researches, designs and manufactures global defense technology, weapons systems and aircraft.

Its flagship military aircraft is the F-35 Lightning fighter, one of which sells for an all-in price of $100 million-plus.

The U.S., Italy, Great Britain, Australia, Norway, Denmark and Canada have all purchased the F-35.

Lockheed Martin stock scores a “Bullish” 78 on our Stock Power Ratings system, and we expect it to beat the broader market by 2X in the next 12 months.

LMT Stock: Fantastic Quality, Low Volatility

The company’s 2021 was a record year. Here are two items that piqued my interest:

- In 2021, Lockheed Martin increased its gross profit to $9.1 billion — a 13.6% increase over 2020.

- The company has increased sales every year since 2015.

LMT is a top-quality stock, as you can see from its Stock Power Ratings above.

Its return on equity is an excellent 76.1%. The aerospace and defense industry average, on the other hand, is negative.

The company’s return on investment is a respectable 15.4%. The industry average is just 0.9%.

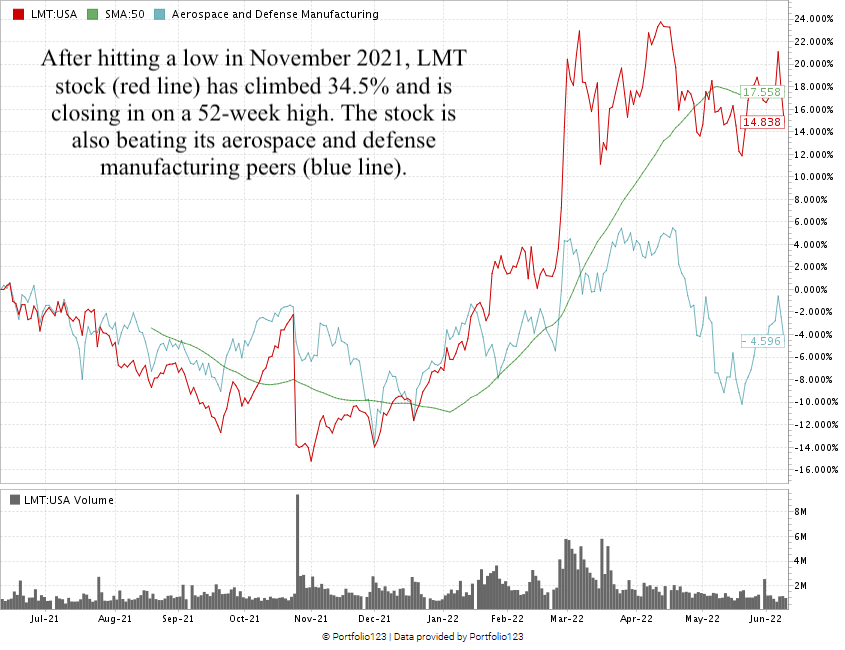

LMT hit a 52-week low in November 2021 but roared back after that.

Since then, LMT has jumped 34.5% and is 10% off its 52-week high. For the last 12 months, it’s up 14.8% and kicking the tails of its industry peers, which are down 4.6%.

Lockheed Martin stock scores a 78 overall on our proprietary Stock Power Ratings system.

That means we’re “Bullish” and expect it to beat the broader market by at least two times in the next 12 months.

Facing uncertain times, nations are ramping up defense spending in a big way.

They are focusing on aerospace and defense systems … right in LMT’s wheelhouse. That makes it an excellent stock for your portfolio.

Bonus: Lockheed Martin’s forward dividend yield of 2.6% translates to a $11.20 per share, per year payout for shareholders.

Stay Tuned: Strong Bank for Huge Rental Market

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a mortgage banker whose stock I think you’ll want to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to Feedback@MoneyandMarkets.com — my team and I would love to hear from you!