When mortgage rates were at record lows, Americans flocked to buy new single-family homes.

Now that the trend has reversed, the rate increase is pricing Americans out of new homes and into apartments and duplexes.

This means an increase in multifamily housing construction across the country:

The chart above shows the value of new multifamily home construction over 12 years.

The increased demand is pushing up the value of that construction.

From 2021 to 2025, the value of new multifamily construction will grow 46.2%.

Today’s Power Stock provides financing for affordable multifamily housing in the U.S.: America First Multifamily Investors L.P. (Nasdaq: ATAX).

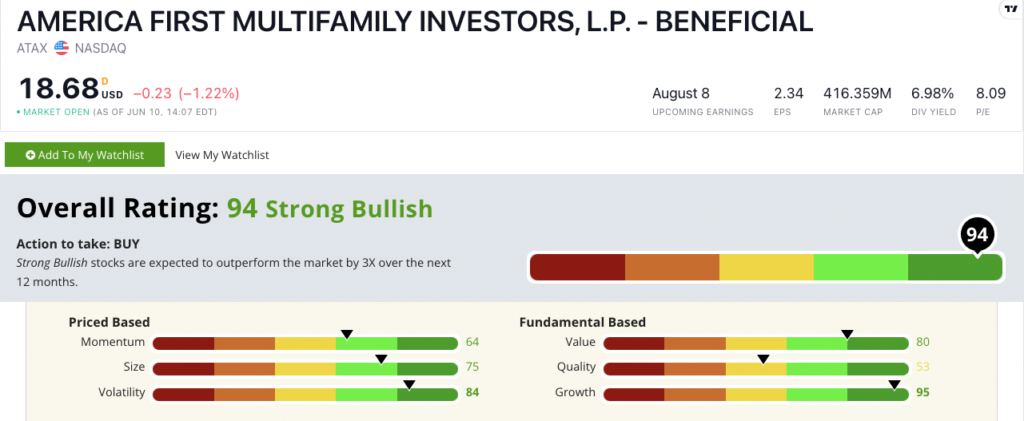

ATAX Stock Power Ratings in June 2022.

Without getting knee-deep in financial jargon, ATAX holds revenue bonds that the government issues to build affordable multifamily housing.

It holds real estate as well, but its primary interest is in government bonds. The company makes most of its money on the interest from those bonds.

America First stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ATAX Stock: Top Growth Potential

After looking at ATAX’s financials, the company is poised to set a new annual record for sales in 2022:

- In the first quarter this year, ATAX recorded sales of $36 million — that’s an 80% increase over the previous quarter!

- For 2021, the company’s sales of $84 million tied its record high from 2018. It’s on track to break that record this year.

ATAX scores a 95 on our quality metric due to those strong sales figures.

Its annual earnings-per-share growth rate is also fantastic — 625.1%.

The company’s sales in the first quarter of 2022 were not only higher than the quarter before, but they were 107.5% more than first-quarter 2021.

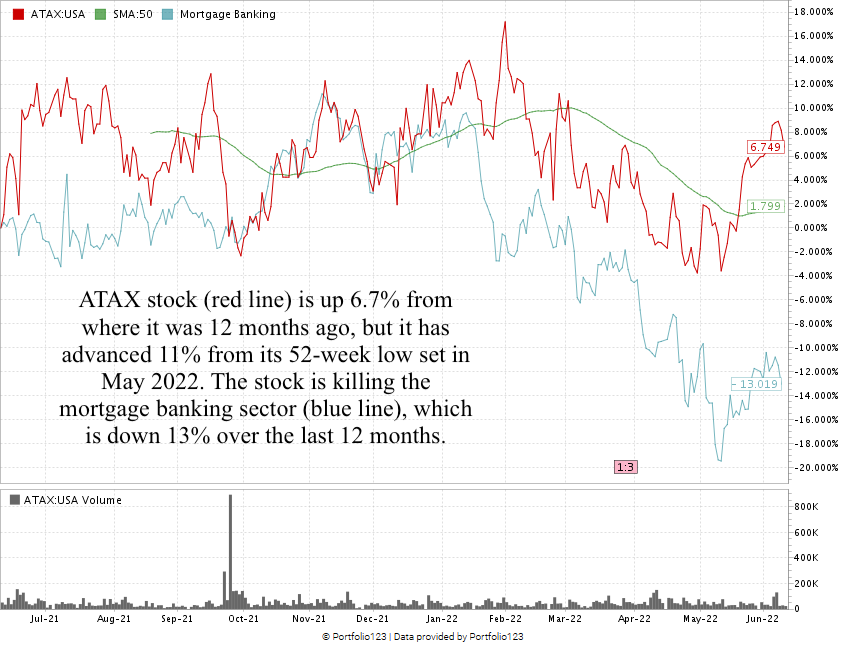

The chart above shows that ATAX has gained 6.7% over the last 12 months. Its peers in the mortgage banking sector, on the other hand, average a 13% loss over the same time.

After it dropped to a 52-week low in the first week of May, the stock has rebounded 11% in the weeks since.

America First stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The recent jump in mortgage rates has priced many Americans out of the housing market.

As more turn to multifamily housing, demand will increase, and America First will be there to help. This makes it an excellent addition for your portfolio.

Bonus: The company’s forward dividend yield of 7% means the company will pay you $1.32 per share, per year just to own the stock.

Stay Tuned: No. 1 Auto Repair Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top-rated automotive parts and repair company.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.