If you know video game enthusiasts, you know just playing isn’t enough.

It’s about the experience.

Making the most of it depends on what kind of monitor or television you play the game on and what accessories you use (think controllers, keyboards, mice, etc.).

My three sons range in age from 19 to 24, and they all love to play video games.

I just dabble when I can find the time, but my kids are pretty hardcore about their games.

They are very particular, not just about the games they play, but more importantly, the equipment.

Not just any old accessories will do.

The keyboards and mice can’t lag — your movements and inputs have to be instantaneous within the game.

Headsets need good sound quality.

And these accessories aren’t cheap!

That leads me to the company I’m going to share with you.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a company that has a strong share of the gaming accessory market. It’s one we are “Strong Bullish” on.

The underlying stock is situated to outperform the broader market by at least three times over the next 12 months.

Pro tip: This stock was one of the highest-rated stocks in our weekly hotlist. To find out more about our weekly hotlist, click here.

Before we get into the stock, let’s look at where the video game market is going in the future.

Video Game Market Goes Strong, Thanks to COVID-19

The COVID-19 pandemic did nothing to slow down the global video game market in 2020.

Instead, pandemic lockdowns opened the market as people were forced to stay at home.

According to WePC, the video gaming market jumped more than 9% from 2019 to 2020.

Video Game Market Value to Jump 72% By 2025

Research shows that, from 2020 to 2025, the global video game market will increase 72% to a whopping $268.8 billion.

That is almost a doubling of the market from 2019.

This includes video games, consoles, computers and accessories.

Innovative companies in the market will see sales grow and profits explode.

Investors in those companies will too.

Cover All the Bases With Logitech Stock

Logitech International SA (Nasdaq: LOGI) has already established itself as a leader in video game and computer accessories.

The company is based in Lausanne, Switzerland.

It designs, manufactures and markets products like keyboards, mice, headsets and speakers sold in major retailers around the world.

Logitech’s Total Income to Pass $6 Billion by 2025

Logitech’s total income was already on an upward trajectory before COVID-19.

But, from March 2020 to March 2021, that revenue jumped from $2.9 billion to $5.2 billion — a 79% increase in 12 months.

By 2025, the total revenue projection for Logitech is expected to be more than $6 billion — a 110% increase from 2020 figures.

The company’s net income — profits after taking out operational expenses — is projected to rise from $449.7 million in 2019 to $810.5 million in 2025.

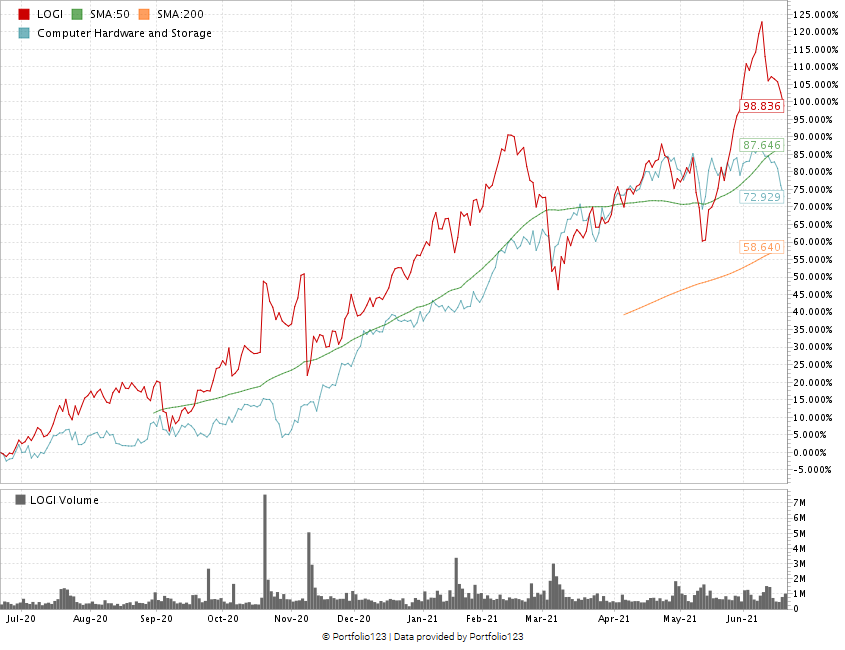

Logitech Stock Pops Up 99% in One Year

Over the last 12 months, Logitech stock has gone from around $62 per share to nearly $127 — a 100% gain.

For context, the computer hardware and storage sector of the market has only gained about 73% in the same time.

That momentum fits our trading principle of buying high and selling higher.

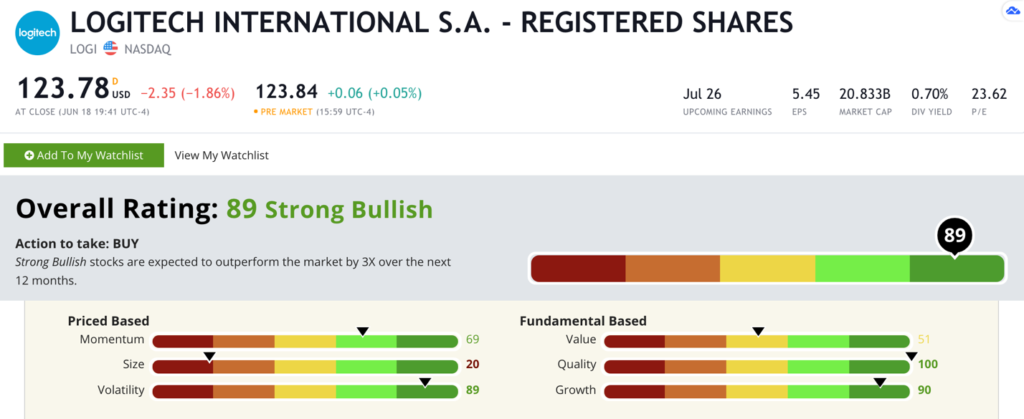

LOGI's Green Zone Rating

Using Adam’s six-factor Green Zone Ratings system, Logitech International SA scores an 89 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

Logitech International SA’s Green Zone Rating on June 21, 2021.

Logitech rates in the green in four of our six factors:

- Quality — The company’s returns on assets, equity and investment are all in double digits and significantly better than the computer hardware and storage industry. Logitech earns a 100 on quality.

- Growth — Logitech has a 12-month sales growth rate of 76.5% and an earnings-per-share growth rate of 108.5% … making it a great growth stock. It scores a 90 on this metric.

- Volatility — The rise in Logitech’s share price has met with very little pullback over the last 12 months. That gives the company an 89 on volatility.

- Momentum — Its stock price jump 100% in a year, and that’s a strong indication that momentum is in Logitech’s favor. That earned the company a 69 on this metric.

Logitech earns a 51 on value — right in the middle of all other stocks rated. Its price-to-earnings ratio is 22, which beats the industry average of 24. The company’s price-to-sales and price-to-book are only slightly higher than the rest of the industry.

The company does score a 20 on size due to its nearly $21 billion market cap. That size is less of a concern considering its high scores on quality, growth, volatility and momentum.

Bottom line: Logitech saw a huge jump in total revenue, despite the COVID-19 pandemic.

Its projections suggest that revenue is only going to grow.

That translates into strong profits for smart investors who get in on this trend now.

On top of its stock performance and strong rating scores, Logitech also pays out a dividend. Its forward dividend yield is about $0.87 per share.

All things point to Logitech being a strong investment worthy of a look for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.