Whenever prices fall, investors say things like “it’s only a paper loss,” or “I’m in it for the long run.” Often, they believe that.

Individual long-term investors learned to say things like that from professionals. Financial advisers tell clients they should ignore short-term volatility and focus on long-term returns. Of course, the adviser still collects a 2% fee every year while you ignore the short-term.

The truth is that long-term investors have lost money ignoring short-term sell signals. An excellent example is the investor who wanted to retire in 2000 or 2008 and ended up working longer to make up for the losses. Although the losses were “on paper,” they were still life-changing.

Even Long-Term Investors Must Think in the Short-Term

Another important truth is that prices don’t always come back. One example is the Japanese stock market, which remains more than 40% below the all-time high reached more than 30 years ago.

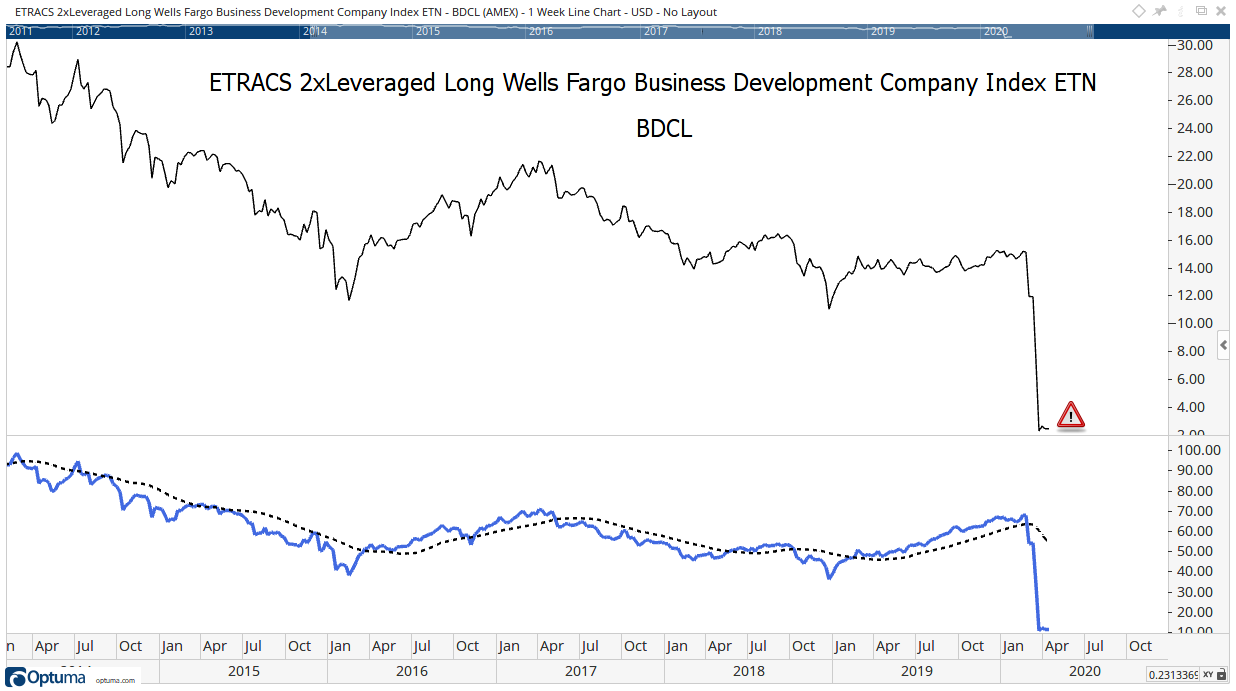

Another example is the ETRACS 2×Leveraged Long Wells Fargo Business Development Company Index Exchange Traded Note (ETN). This ETN is no longer traded because it was not safe.

Source: Optuma

This is an ETN, not an exchange-traded fund, or ETF. An ETN holds derivatives and can lose 100% of its value in one day. ETFs own stocks and are unlikely to lose all of their value so quickly.

I’m not sure what this ETN tracked, but I am sure the specifics of the holdings were disclosed in the prospectus that was a couple of hundred pages long.

It seems safe to say many of the investors who bought the ETN didn’t understand it either. Few read the prospectus. Instead, they were attracted to the dividend yield of 14.9%.

But the yield wasn’t safe. In the chart above, the symbol on the right side indicates trading was suspended. Investors got a few cents on the dollar back on their investment.

This wasn’t the only ETN that stopped trading recently. An article in The Wall Street Journal indicated many investors suffered significant losses in ETNs. Some lost their life savings.

But they shouldn’t have. There were warnings that a downtrend was near.

At the bottom of the chart is a relative strength indicator and a moving average (MA) of the indicator. Signals are given when the indicator crosses the MA. The specifics of the indicator aren’t important. Any popular momentum indicator provides useful information.

In the chart above, the sell signal came more than a month before the ETN stopped trading. Taking the signal and acting would have avoided a loss of almost 100%.

Following trading signals requires more effort. But no one ever said collecting a 14.9% dividend should be easy. Investors should have expected to work for that kind of return.

It’s important that even long-term investors pay attention to the short term. You can avoid large losses by heeding warnings when they are clear and present dangers to your investments.

A note from Michael Carr: Next week, I’ll be sharing details on a strategy I’ve been trading for a local animal rescue. It’s a short-term strategy where I focus on managing risk. On average, trades are closed about two days after they’re opened so it does require some effort. But the results indicate the effort can be rewarded. I placed $10,000 in that account on January 1 and we made more than $7,600 in gains by May 31. To learn more, click here.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.