I screen a lot of potential investments through our Stock Power Ratings system.

Here’s why.

There are a little over 6,000 stocks on the New York Stock Exchange and Nasdaq and thousands more that trade overseas or in the over-the-counter market.

It’s impossible to research them all. There aren’t enough hours in the day.

I need a way to narrow down the field to a manageable number worthy of more in-depth research.

My colleague Adam O’Dell’s proprietary Stock Power Ratings system is the best one-stop shop for this I have found.

When I’m hunting for dividend stocks, I look for a few things:

- The growth factor rating needs to be at least average — if not quite a bit better than average. Without long-term revenue and profit growth, long-term dividend growth won’t happen.

- I also like to see strong quality in place. Profitability and a strong balance sheet are key. You’d want to see both in place for a long-term dividend to hold.

- I also want to see a high volatility factor score (which means the stock is less volatile). And that’s my focus today. I don’t want heartburn in a dividend stock. Speculative trading provides enough of that. I don’t need it in my income portfolio.

And about volatility…

How to Spot Low-Volatility Dividend Stocks

If you’re looking for a good place to start your research, take a look under the hood of the Invesco S&P 500 Low Volatility ETF (NYSE: SPLV).

This exchange-traded fund (ETF) invests in the 100 least-volatile stocks of the S&P 500.

ETFs are required to publicly disclose their holdings. You can find SPLV’s here.

We can essentially piggyback on its research while tailoring it to our own needs and avoiding its management fee!

Again, this is a place to start your research.

Some of the stocks are rubbish.

As a general rule, I’ve never been a fan of utilities stocks, and those make up a good 18% of the index. I don’t see a reality in which I would tie up my precious capital in utilities when there are other opportunities out there offering better long-term growth.

Some of the stocks — like Warren Buffett’s Berkshire Hathaway (NYSE: BRK.B) — are old favorites of mine. But that one doesn’t offer a yield.

A little digging reveals what we’re looking for.

Waste Management Stock: A Solid Recession Play

One dividend-payer worth a look is grubby garbage collector Waste Management Inc. (NYSE: WM).

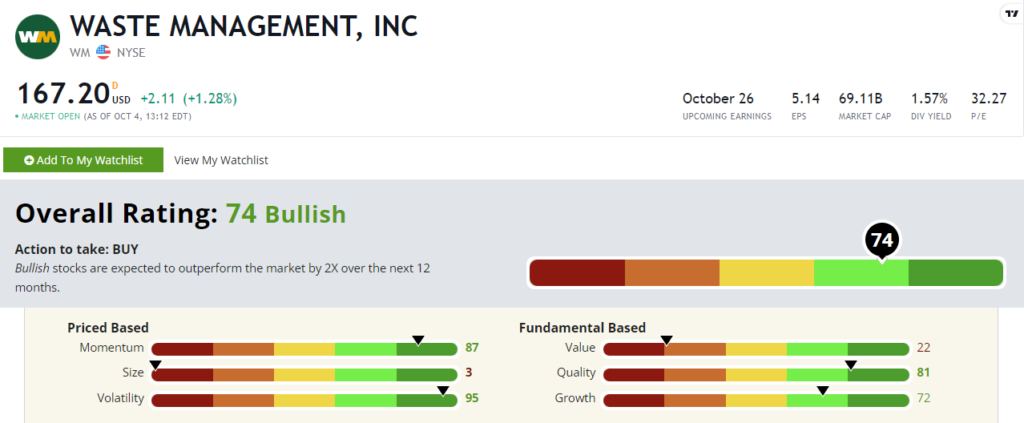

The stock sports a beta of just 0.76 and rates a 95 on our volatility factor. The stock rates a “Bullish” 74 overall.

WM’s Stock Power Ratings in October 2022.

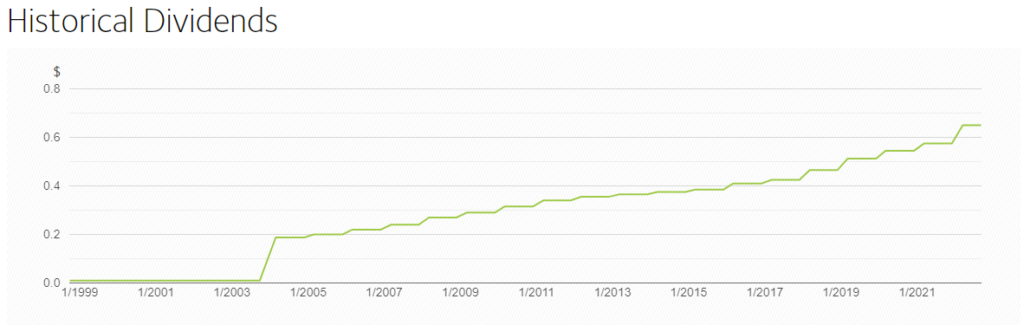

The stock isn’t a high yielder by any stretch of the imagination at just 1.6%. But Waste Management does raise its dividend every year. This year alone it hiked its payout by just over 13%.

The dividend has doubled since 2010.

Source: Waste Management.

I have no idea what comes next in the U.S. economy.

My best guess is that the charge higher in interest rates “breaks something,” and we have real financial distress over the next few months.

Already, the housing market looks rickety due to rising mortgage rates, and the U.K. came close to having a legitimate currency crisis last month.

A nasty recession can’t be ruled out.

But you know what? Someone still has to cart your garbage away.

Waste Management has one of the most recession-proof business models on the planet. And it has a history of raising its dividend — even in crisis. It increased its payout throughout the 2008 meltdown and recession that followed.

Again, it’s possible that the 2022 bear market is over. We’ve seen a couple of nice rallies form after recent sell-offs.

But whether it is or it isn’t, a low-volatility dividend stock such as Waste Management can offer a little peace of mind.

If you want even more of my income insights, you should check out the latest issue of Green Zone Fortunes, where I recommend one of my favorite high-yield income stocks. It has a multidecade history of raising its payout across a laundry list of market conditions — bear … bull … flat … whatever!

To find out more, click here to learn how we’ve added an income twist to the Green Zone Fortunes model portfolio.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.