I believe the genomics mega trend (aka DNA science) will make early investors a lot of money.

Of course, finding the right stocks within this mega trend is tricky. It’s one reason I developed my Green Zone Ratings system. This six-factor approach to stock analysis gives us a great starting point at finding the best of the best — and avoiding costly mistakes.

One of Wall Street’s most popular maxims is: “To make higher returns, you must take more risk.”

And you might think the entire biotech market segment carries more risk than, say, all consumer staples stocks.

But that’s not necessarily the case. Let’s consider the low-volatility stock factor …

Why Low-Volatility Stocks Outperform

Before we get into some of the behavioral factors that make low-volatility stocks appealing, I want to touch on an important stock volatility metric: beta. In simple terms, beta is a measure of how volatile an individual stock is.

The entire stock market has a beta of 1.0 — that’s the measuring stick, “beta equals one.”

An individual stock with a beta greater than one is more volatile than the market and often labeled a “high-beta stock.” In the biotech and biopharma space, there are more than a few small, unprofitable companies whose stocks are indeed high-beta.

On the other hand, stocks with betas lower than one are less volatile than the market and are often called “low-beta stocks.” Pfizer Inc. (NYSE: PFE), a large-cap biopharma stalwart, carries a beta of just 0.65.

Back to the behavioral factors of volatility…

So, what does the academic research say about which stock is likely to outperform — the small, unprofitable “high-beta” one or the “low-beta” Pfizer?

For a few reasons, low-beta stocks tend to outperform.

For one, there’s a pervasive limit and aversion to using leverage. Meaning, a wise investor might choose to buy shares of Pfizer, a low-risk, low-beta stock … and simply leverage their investment (using “margin” or borrowed money effectively) to earn a higher return.

But get this … most investors are scared of using leverage. It’s like a certain “four-letter word” to most folks. So, instead of using leverage on a low-beta stock … many investors choose to buy shares of a higher risk high-beta stock. And that leads to more demand for high-beta stocks (causing them to become overpriced) and less demand for low-beta stocks (causing them to become underpriced).

An even more interesting explanation for why many novice investors flock to high-beta stocks, even though the academic literature is clear on low-beta stocks being a better long-term choice, is the “lottery-ticket” effect.

In the words of Larry Swedroe, one of the foremost experts on factor investing (and one of my favorite authors):

In the real world, there are investors with a “taste,” or preference, for lottery-like investments. This leads them to “irrationally” invest in high-volatility stocks (which have lottery-like distributions) despite their poor returns. They pay a premium to gamble. Among the stocks that fall into the “lottery ticket” category are IPOs, small-cap growth stocks that are not profitable, penny stocks and stocks in bankruptcy.

High Beta Reveals the Worst Losers

Here’s the thing …

You won’t necessarily earn the absolute highest return if you buy stocks with the absolute lowest beta possible. Buying stocks with very low beta … and low beta … and “average” beta — these more or less all give you fairly similar returns.

What’s most helpful about the low-volatility factor is the types of stocks you’ll likely want to avoid at all cost: the highest-beta stocks.

This means that when you sort all stocks into 10 “buckets,” based on their volatility or beta — you want to avoid buying stocks in the worst one or two buckets (i.e., the market’s top 10% or top 20% most volatile stocks).

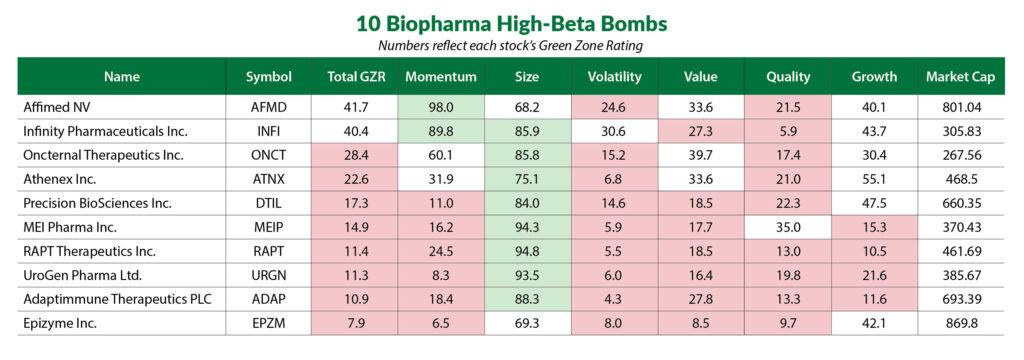

I call these “high-beta bombs,” and I ran the numbers to find 10 within the biopharma industry group. You can see them in the table below, along with their overall Green Zone Ratings.

These biotech stocks share three common traits:

- They’re small … with market caps of less than $1 billion.

- They’re highly volatile … with betas in the top 10% of all stocks (three-year lookback).

- They’re unprofitable … with zero positive earnings-per-share over the past five quarters.

Next time, I’ll show you how the volatility factor helped reveal these “high-beta bombs” and give you two “backdoor” biotech plays better suited as long-term investments.

That’s all for now…

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets

Story updated on June 16, 2021.