Interest rate cuts are back on the menu!

With the Federal Reserve cutting its benchmark rate for the first time in 2025 and another two cuts projected for the closing months of the year, new opportunities to invest will crop up every day.

As I showed you yesterday, small-cap stocks have been gaining momentum since the Fed hinted at an impending rate trim late in July.

And with access to cheaper financing fueling even more growth for these smaller companies, this corner of the market will keep gaining steam…

That means my weekly “New Bulls” list — and especially my screen of stocks outside the S&P 500 — will be something worth checking out every Thursday.

Let’s see which stocks entered the “Bullish” zone of my Green Zone Power Rating system this time around…

This Week’s S&P 500 “New Bulls”

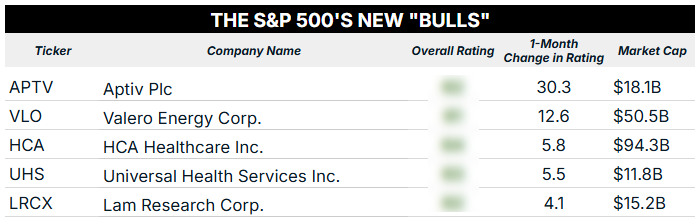

Five stocks passed my rules set for the “New Bulls” screen:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

Here’s what landed on the list this week:

This is an interesting mix of stocks…

We’ve got two companies providing health care services in HCA Healthcare Inc. (HCA) and Universal Health Services Inc. (UHS), an energy giant in Valero Energy Corp. (VLO) and a “picks and shovels” semiconductor play with Lam Research Corp. (LRCX).

Aptiv PLC (APTV) rounds out the list after jumping 30 rating points higher over the last month!

The auto parts supplier held much promise during the electric vehicle (EV) boom, but the stock has been in a slump since early 2022, when that mega trend lost much of its steam.

Now, Aptiv is working on splitting up its business into two arms:

- One that supplies electrical distribution systems.

- And one that sells safety and software solutions.

The supply side is Aptiv’s bread and butter, providing steady capital and keeping the business rolling. At the same time, the software side is set to provide stronger growth opportunities.

Investors are buying into the idea. APTV stock is up roughly 72% from its April lows, showing the “maximum momentum” we like to see in stocks.

The spin-off is planned to be complete in early 2026, and with “Bullish” Green Zone Power Ratings, APTV stock should continue outperforming leading up to — and beyond the split.

If you want to see how any of these stocks stack up, click here to see how you can join my flagship investing service, which includes unlimited access to my system as one of many benefits.

Now, let’s shift gears and see which small-cap and other stocks outside the S&P 500 are newly “Bullish” this week.

12 Small-Cap and Micro-Cap “New Bulls”

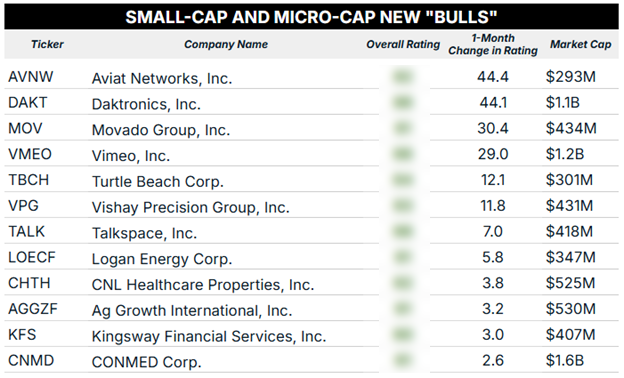

I’m doing something a little different with this week’s screen outside of the S&P 500. We’re still focused on “New Bulls” based on my Green Zone Power Rating system, but with the Fed initiating its 25 basis-point rate cut, I want to highlight stocks on the smaller side of the market-cap spectrum.

Below you’ll find the 12 small-cap (market caps between $500 million and $2 billion) and micro-cap (market caps <$500 million) stocks that hit “Bullish” status this week:

With six stocks improving by double digits — including two with 40+ point jumps — we’ve got some great new opportunities within the smaller corner of the market.

Lower interest rates mean that companies will be able to access cheaper financing to fuel future growth. And that, in turn, attracts new investors hunting for outperformance.

Larger companies will have the same benefit, of course, but it’s a matter of scale … $10 million of new capital is peanuts for a $100 billion company, while that same amount is massive for a $1 billion company.

The bottom line is this: We’re kicking off a period in which smaller stocks will see an outsized benefit compared to their larger peers.

And that makes this “New Bulls” research a must-see each week…

To good profits,

Editor, What My System Says Today