U.S. employment data for November was released last week. The data was considered weak by analysts and members of the Federal Reserve.

Chicago Fed President Charles Evans called the jobs report “disappointing,” adding that the deceleration in job growth “is much too great at this point, and I think the virus outbreaks are part of it.”

Just 245,000 new jobs were created in November. That was significantly less than the 460,000 analysts expected, according to Bloomberg.

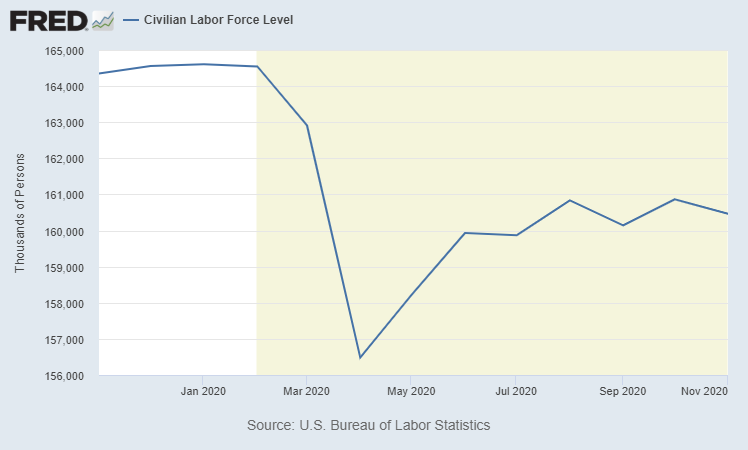

Despite the low number of new jobs, the unemployment rate fell to 6.7% from 6.9% in October. One reason for the decline was that another 400,000 people dropped out of the labor force in October. There are now 4.1 million fewer people interested in working than there were in January.

As shown in the chart below, the workforce recovered just 49% of its pandemic losses since the economic shutdowns in the spring.

U.S. Workforce Hasn’t Recovered Enough

Source: Federal Reserve.

A Low Unemployment Rate Isn’t Always Good

Damage to the economy is even worse than that chart shows, and is an indicator that the labor market is getting worse. The number of discouraged workers more than doubled in the last year.

The Bureau of Labor Statistics defines discouraged workers as those who would like to work but haven’t looked for a job in the past four weeks because they “believed no jobs were available for them or there were none for which they would qualify.”

The number of discouraged workers tends to continue rising even after the end of recessions and declines only after recovery is well underway.

Data for the employment report is collected early in the month, with the latest report being based on surveys conducted the week that ended November 13. Since then, American workers have filed 1.5 million new claims for unemployment insurance.

In addition, many counties and states imposed stricter restrictions on activity because of the coronavirus in the past few weeks.

This indicates the latest data could be too optimistic. The employment picture is deteriorating, and that will show up in next month’s report.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.