My family and I drove from South Florida to Kansas a few years ago.

It was late … about 2 a.m. … and we needed gas.

We were in the middle of nowhere Arkansas. Finding an open gas station was difficult.

Then, out of nowhere, I was blinded by the lights of a convenience store.

Gone were the fears of pushing our car along the dark highways of the Midwest … all thanks to simple lighting.

In 2014, the lighting industry generated $15.8 billion in revenue.

By 2027, Statista expects that number to jump 125.3% to $35.6 billion.

Today’s Power Stock is a $287.5 million lighting provider for companies (including gas stations) in the U.S.: LSI Industries Inc. (Nasdaq: LYTS).

Cincinnati-based LSI Industries makes indoor and outdoor lighting for commercial, industrial and retail markets.

The company recently unveiled solar-powered lights for convenience stores.

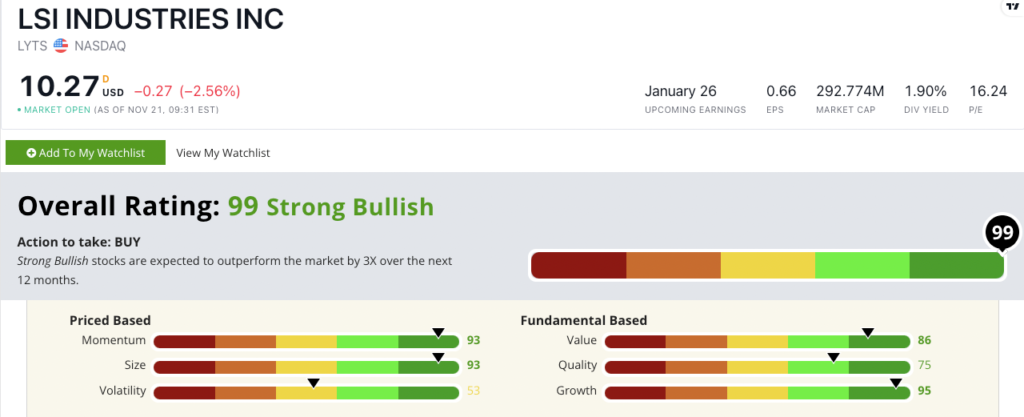

LYTS scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

LSI Industries Stock: Outstanding Growth + “Maximum Momentum”

I discovered two notable items when looking into LYTS stock:

- Its quarterly net income was $6.3 million — a 100% increase from a year ago.

- The company’s operating income — profit after deducting operating expenses — was $10 million. That’s an increase of 125% over the same period a year ago.

Those numbers show why LYTS scores a 95 on our growth metric.

It earns a solid 86 on value, based on its price-to-sales ratio of 0.63, compared to the industry average of 4.48.

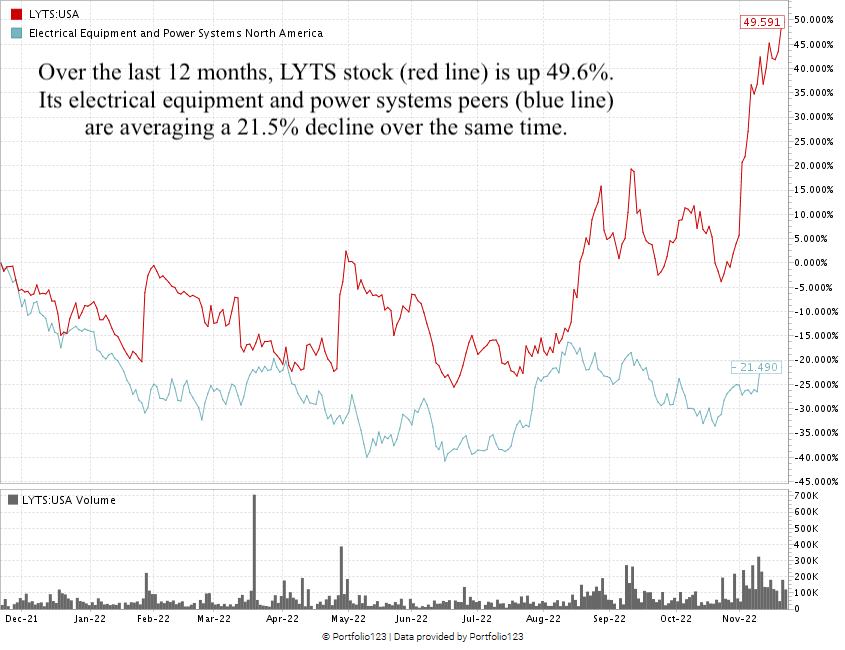

As I write, LSI Industries stock is up 49.5% over the last 12 months. Its industry peers averaged a drop of 20.8% over the same time.

LYTS’ run includes a 100.9% gain from a low point in June 2022 to a new 52-week high in November.

It shows the “maximum momentum” we love to see in stocks.

LSI Industries stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish.” We expect it to beat the broader market by at least 3X in the next 12 months.

The lighting industry is set to reach more than $35 billion in revenue in the next five years.

That’s why LYTS is a great contender for your portfolio.

Bonus: Shareholders earn a nice 1.9% dividend yield. The company will pay you $0.20 per share per year to own the stock.

Stay Tuned: Don’t Put Your Money on This Sports Betting Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a sports betting stock to avoid, even as millions tune in to watch the World Cup.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets