Saving for retirement is tough, and many Americans aren’t saving nearly enough, according to a new study from Charles Schwab.

The study polled 1,000 401(k) participants around the country, and most individuals polled believe they need $1.7 million to retire comfortably.

“That’s a pretty good number if you average out age and median salary across the U.S.,” Nathan Voris, a managing director at Schwab Retirement Plan Services, told CNBC.

“The bulk of folks do not get there,” he added.

Voris argues that is a good place to start, but it’s a hard target to hit if someone doesn’t start saving soon enough.

Someone starting in their 20s could hit that number by saving 10% to 15% of their annual salary, but anyone who tries to start saving after age 45 would have to set aside as much as 35% every year, according to Schwab.

Retirement preparedness is not a new issue, either.

A recent study from the Employee Benefit Research Institute found that about two-thirds of U.S. workers said they are somewhat to very confident their savings will enable them to live comfortably in retirement. But only 42% polled in the study had done any sort of calculations. Fewer than one-third had even attempted to calculate medical expenses needed — spoiler alert: It’s a lot.

Things aren’t all doom and gloom, though.

People are seemingly more prepared for retirement now, as the Pension Protection Act of 2006 has helped employees enroll in 401(k) plans.

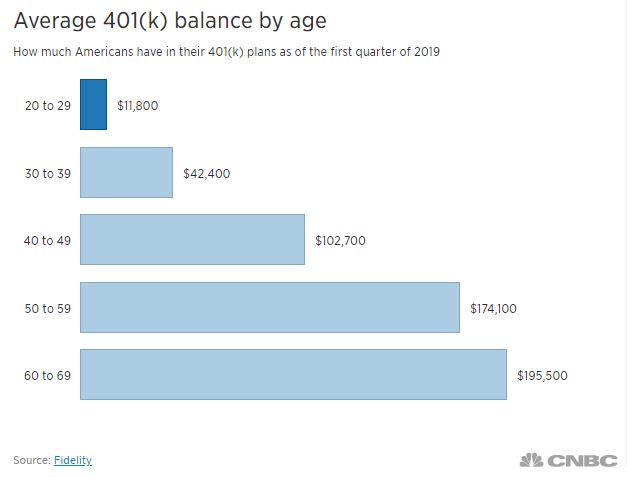

A Fidelity report found that 401(k) balances are hitting all-time highs, according to CNBC. Fidelity is the nation’s largest 401(k) plan provider.

Fidelity found that 401(k) balances rose by 466% to almost $300,000 in the last 10 years.

Another thing retirement savers can look forward to is the Secure Act, which was passed almost unanimously by the House of Representatives in May. It awaits a vote from the Senate, but is currently being held up by opposition from Sen. Ted Cruz, R-Texas, and others who are attempting to tack on some riders before passing the bill.

The Secure Act, or Setting Every Community Up for Retirement Enhancement Act, would make 401(k) plans eligible for part-time workers, and it would also push back the required minimum distribution age for retirement accounts from 70 1/2 to 72.