It’s SAT season again.

And that means students are studying long lists of synonyms and antonyms — just like we did many years ago.

I’m sure high school students today still ask: “How will I ever use this in real life?”

That’s especially true for antonyms. Odds are high that no one outside of school has ever asked you to pick the opposite from a list of random words.

However, that’s a skill you should brush up on because it might just help you spot the end of the Magnificent Seven uptrend…

1 Indicator Times the Fall of Big Tech

The Magnificent Seven are the tech stocks currently driving the market higher.

Led by Nvidia (NVDA), the list of stocks, all trading on the Nasdaq exchange, includes Microsoft (MSFT), Meta (META), Apple (AAPL), Amazon.com (AMZN), Alphabet (GOOGL) and Tesla (TSLA).

This group now represents more than a quarter of the S&P 500 Index. This means the market is almost certain to struggle when these stocks stumble. That makes them a leading indicator of the market, that is, if we can find a way to track it.

This is where antonyms come into play.

But before we get to the antonym for the top tech stocks, let’s look at this strategy in action.

During the pandemic, stay-at-home stocks soared. Take Zoom Video Communications Inc. (Nasdaq: ZM), for example. The company taught us all to say, “You’re on mute,” as the stock soared more than 760% in the first 10 months of 2020.

That run-up was clearly a bubble. But we still want to participate in gains like that when they’re available.

To see when the ZM party was ending, we could look at its antonym.

The opposite of ZM is Boston Properties Inc. (NYSE: BXP) — the largest office REIT as we entered the pandemic.

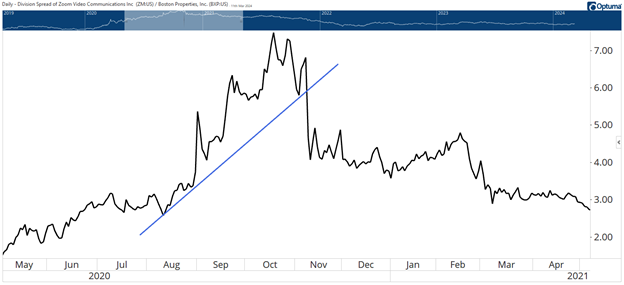

The ratio of ZM to BXP is shown below. This chart captures the relative strength of the two stocks. When the black line is going up, that indicates ZM is stronger. BXP is stronger when the line is falling.

ZM Led; Then BXP Took Over

The trendline in blue defines the transition from rising to falling.

This simple indicator got you out of ZM just three weeks after it peaked — about 15% below its all-time high. Today, the stock is still about 67% below that 2020 high.

Now, as for an antonym for the Magnificent Seven…

Find the Opposite of Big Tech Stocks

These are all tech stocks with rapid growth. Their opposite could be value stocks. To build a list of seven of the best value stocks, I turned to Warren Buffett.

The largest non-tech holdings in his portfolio are as follows (Note: All of these trade on the NYSE — not the tech-heavy Nasdaq.):

- American Express Company (AXP).

- Bank of America Corporation (BAC).

- Chevron Corporation (CVX).

- The Kraft Heinz Company (KHC).

- The Coca-Cola Company (KO).

- Moody’s Corporation (MCO).

- Occidental Petroleum Corporation (OXY).

The ratio of the Magnificent Seven and the Anti-Magnificent Seven is shown below:

Mag 7’s Relative Strength Is Losing Steam

The relative strength of tech’s biggest names has slowed in the past few months. You can see that by comparing the steep angle of the blue line in both charts. This is driven largely by Tesla’s recent underperformance. That’s the first sign of a potential breakdown in the market leaders.

We don’t need to guess where the second sign of weakness will develop. We just need to watch this indicator. When the trendline breaks, we’ll need to be ready to exit Big Tech.

Until next time,

Mike Carr

Chief Market Technician