Since 2023, the famed Magnificent 7 stocks have accounted for more than half the S&P 500’s 70%+ gains.

These seven stocks: Nvidia Corp. (NVDA), Microsoft Corp. (MSFT), Apple Inc. (AAPL), Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META) and Tesla Inc. (TSLA), have been at the heart of the AI stock trend since the launch of ChatGPT in November 2022.

Past successes in the tech cycle, paired with AI innovations, gave the so-called “Mag 7” a leading edge as the bull market gained steam.

But now, a new “second wave” of AI tech is calling the Mag 7’s dominance into question. Is their reign in the tech sector finally over?

Today, I’ll analyze the Mag 7’s performance, then dive into a new crop of stocks that may replace some of these strong performers as the AI trade continues.

Let’s start with the Mag 7…

Magnificent 7 Fuel Stock Market Rise

It’s no secret that the seven stocks mentioned above have been the catalyst for the S&P 500’s rise since 2023.

According to Bloomberg, the Mag 7 accounts for nearly 35% of the entire benchmark index.

Mag 7 Powers Market Higher Since 2023

Since 2023, all seven stocks have gained at least 100%, compared to the S&P 500’s 73.7% increase.

NVDA has led the charge with a 1,100% jump since 2023, but META has performed strongly as well with a 495% gain.

Expectations are for these seven stocks to continue moving ahead. Bloomberg Intelligence projects that earnings among the seven companies will rise by an average of more than 15% on revenue growth of 13% in 2026.

The rest of the S&P 500 is only expected to grow earnings by 13% on a 5.5% increase in revenue.

However, related to the AI trade, there is some divergence in the group’s stock market performance.

NVDA, GOOGL, META and MSFT are still considered to be in a strong position to carry the AI trade with their shares up between 21% and 33% this year.

But the remaining three — AAPL, AMZN and TSLA — have a less clear future related to AI.

Could those lagging three stocks be replaced?

The numbers suggest … yes.

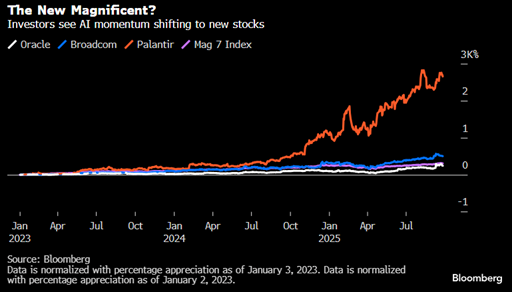

Out With The Old, In With The New

Three stocks may be better suited for a “New Mag 7” after outperforming Apple, Amazon and Tesla.

Not only have their market performance been stronger, but their business classification is more in line with AI tech development.

These “replacements” are Palantir (PLTR), Broadcom (AVGO) and Oracle (ORCL).

PLTR is the top performer in the tech-heavy Nasdaq 100 Index, jumping 138% in 2025 on increased demand for its AI software — part of its 2,700% move higher since 2023.

Chipmaker Broadcom is now the seventh-largest company in the U.S. by market capitalization (and is up 504.6% since 2023), while ORCL shares have moved 70% higher this year as its AI-related cloud computing business thrives.

Let’s look at both the “Old” and “New Mag 7” through the lens of our Green Zone Power Rating system to see what we can expect performance-wise in the coming months…

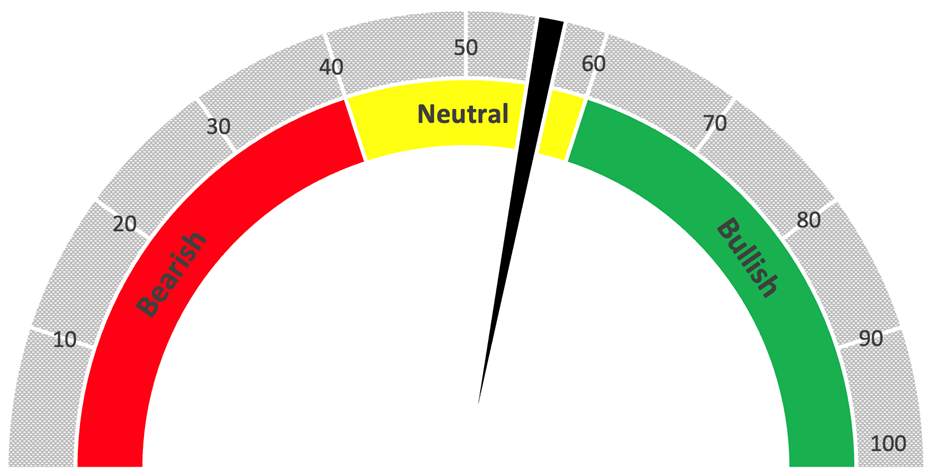

Old Mag 7 Rates “Neutral”

Overall, the current Mag 7 group earns a “Neutral” 55 out of 100 based on the average ratings of the seven stocks.

However, more importantly, the group earns a 68 on Momentum, a 50 on Volatility, a 94 on Quality, and a 90 on Growth.

The group rates “High-Risk” on both Size and Value, not a huge surprise considering these are massive tech companies that trade at incredibly high premiums.

Now, we can strip out AAPL, AMZN and TSLA and add PLTR, AVGO and ORCL in their place to see how the ratings change.

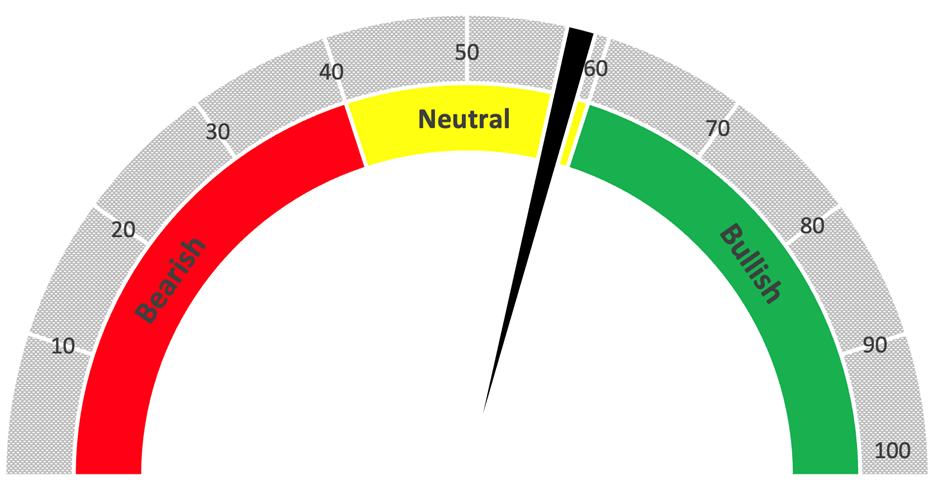

New Magnificent 7 Rates “Neutral”

By swapping out three and adding three, the overall average rating increases by 2 points to 57 out of 100.

However, the more telling is the individual factor rating of the group, specifically Momentum.

As a group, the New Mag 7 stocks rate an 81 on Momentum, 13 points higher than the old seven. The new group still earns a 50 on Volatility and scores 89 on both Quality and Growth.

This all tells me that it might be time to change the conversation when we discuss the Mag 7 to focus more on stocks aimed explicitly at advancing AI tech.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. If you want to see precisely how each Mag 7 stock (both “old” and “new”) stacks up in our Green Zone Power Rating system, click here to learn how you can join our flagship investing service, Green Zone Fortunes, now. After joining, you’ll have unlimited access to our system to look up thousands of tickers — not just today’s top tech stocks.

On that note, Adam’s Green Zone Fortunes model portfolio already contains one of 2025’s top AI plays, and he just recommended a new way to play the growing AI mega trend with his latest monthly recommendation. It rates a “Strong Bullish” 96 out of 100!