One of the most followed economic reports is the Manufacturing ISM® Report On Business®.

The Institute for Supply Management releases the report on the first business day of every month.

Economists and traders study this report because it offers the first glimpse of economic activity in the prior month.

The latest data showed that economic activity in the manufacturing sector fell in October.

That trend may continue as new orders fall and manufacturers run out of the backlogs that have kept them busy for the past few months.

The Backlog of Orders Index’s sharp fall indicates order backlogs are shrinking after a 27-month expansion period.

While the report was bearish for the economy, there was some good news.

Inflation pressures are easing.

Data Shows Slowing Inflation Pressures

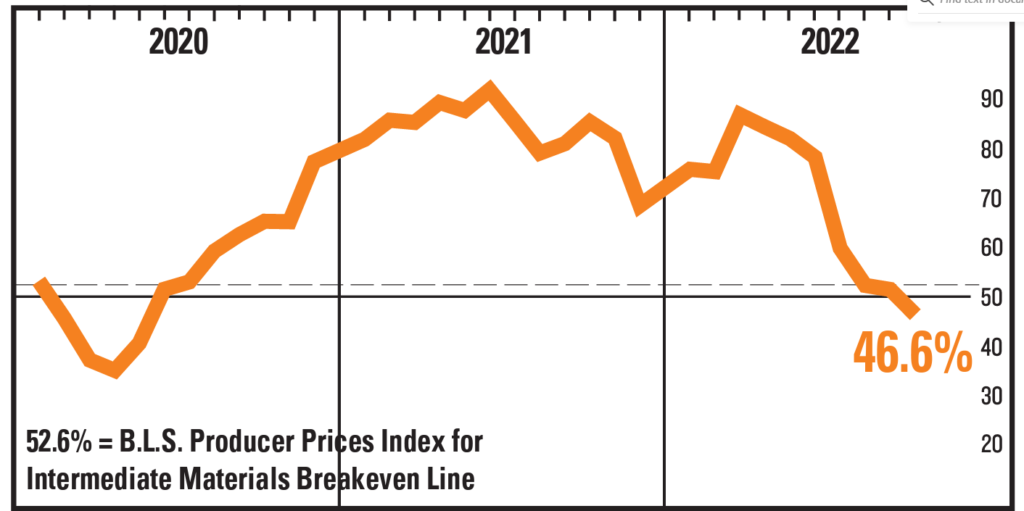

The index fell below 50% for the first time since the economic recovery began in 2020.

This indicates raw material prices are falling for a majority of supply managers.

Manufacturing Prices Are Falling

Source: ISM.

Lower prices are good news.

The reason for the decline is bad news…

But it’s not all negative.

One Optimistic Spot From Manufacturers’ Pessimism

Orders are falling everywhere, including:

- A computer manufacturer said: “Flat business activity.”

- A chemical product industry manager raised alarms: “Customers are canceling some orders. Inventories of finished goods increasing.”

- In the transportation equipment industry: “Order levels are slowing down after pent-up demand in the previous month.”

- And a manager in the food, beverage and tobacco sector believes: “[The] growing threat of recession is making many customers slow orders substantially.”

There is some reason for optimism.

One electrical equipment manufacturer noted that this could lead to consumer price cuts:

Housing market is down, so our business is affected. Capacity has increased over the last two years due to high orders of consumer goods and appliances, so now we’re trying promotions to get our orders up to where we can use all our capacity.

Bottom line: Consumers may see lower prices and 0% interest for large purchases.

That’s a silver lining in the news for those who can afford to buy as the economy contracts.

P.S. Stock options are easier to trade than ever, and I’m glad more people are taking advantage of them.

However…

I want to make sure no one takes advantage of YOU.

I’ve been trading options ever since I retired from the military at 42.

They’ve changed my life.

And now I want to show you how this trading strategy can change yours too.

I want to give you a chance to learn how to trade options the right way, from a seasoned pro who’s seen it all.

Click here to see how you can gain access to my Options Master Class.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.