So, as is the norm in the corporate world, when your company takes a hit, the chief executive officer and largest shareholder profit nicely.

You’ve heard about businesses who suffer through massive layoffs or “reductions in force,” only to be followed by a fat pay raise for the CEO and shareholders who get a nice bump in the stock price.

The latest on the “get a fine and get a raise” wagon is none other than Facebook CEO Mark Zuckerberg.

Following the announcement of a gargantuan $5 billion fine against Facebook by the Federal Trade Commission following its investigation into the Cambridge Analytica scandal, Facebook shares jumped 1% to the highest level they’ve been in a year.

According to Business Insider, Zuckerberg owns 410,497,115 shares of Facebook.

Before the announcement of the fine, those shares were valued at $202.31 per — valuing Zuckerberg’s shares at right around $83 billion.

After the news broke that the federal government was levying the record fine, shares of Facebook went up to $204.87. Now, doing some quick math in my head … carry the 1 … bring down the 2 … and that brings Zuck’s share value to $84.1 billion.

So, in about 15 minutes, Zuckerberg gained more than $1 billion in share value.

And, keep in mind, that was on the heels of one of the largest fines in history being laid at Facebook’s feet.

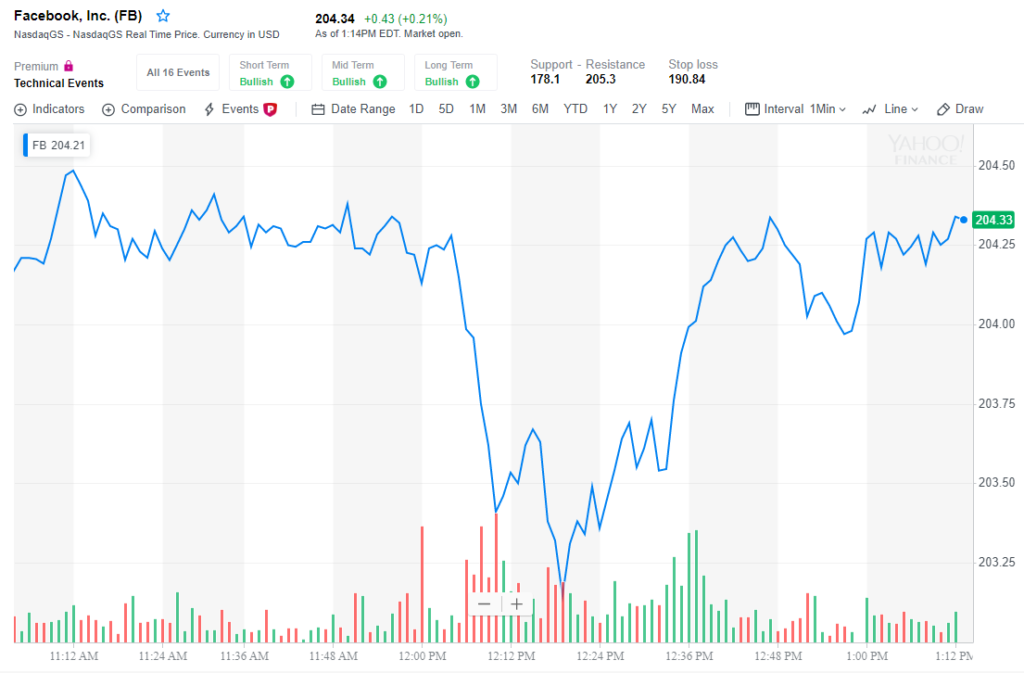

In intraday trading Tuesday, the value of Facebook had leveled a bit but was still up to $204.21 per share, and was up 0.2% to $204.33 through Tuesday afternoon trading.

Essentially, instead of punishing Facebook for an egregious breach of private user data, its CEO gets a nice, fat windfall because of the stock price bump.

At the end of the day, you really can’t fault the business for being proactive. You see, Facebook was already aware of the fine it was getting. In fact, it had built that fine into its financials. So when the fine came in at what everyone expected, investors loved it.

Hence, the price bump.

Conversely, if a fine doesn’t impact your stock price, the Treasury Secretary telling the world your new cryptocurrency can be used by criminals and terrorists should, right?

Wrong.

Despite a Monday news conference held by Steven Mnuchin suggesting Facebook’s Libra cryptocurrency “could be misused by money launderers and terrorist financiers,” the social media company’s stock only blipped downward but remained in strong territory.

Basically, no matter how hard the government comes after Facebook and Zuckerberg, both he and the company remain unscathed.

In fact, I would go so far as to suggest the harder the government hits, the better position Facebook comes out in.

After all, recent news would certainly suggest both of the above statements are true.