Story originally published on May 11, 2022.

One down, two to go.

The Nasdaq Composite is the only major U.S. index in a bear market after falling more than 20% from recent highs.

The S&P 500 and Dow Jones indexes have a little further to go. But it already feels like a bear market out there.

And the most remarkable aspect of this current sell-off is that there’s nowhere to hide. Stocks are getting crushed … bonds are getting crushed … and when you take inflation into consideration, even cash is getting crushed.

In a market like this, income investors must find a balance between bringing in current income and protecting capital. You need something that will continue to pay the bills without tanking our portfolios.

With that in mind, consider the diversified retail real estate investment trust (REIT) W. P. Carey Inc. (NYSE: WPC).

W. P. Carey Has Weathered It All

W. P. Carey has been in the business for nearly half a century. It’s survived booms, busts, inflation, deflation and everything in between. It owns a portfolio of over 1,300 properties, across 356 tenants totaling more than 150 million square feet of space.

The mix of those properties is what’s appealing to me.

WPC is known mostly as a retail REIT, but retail properties only account for about 17% of its rents. Industrial and warehouse properties make up about half the portfolio. These properties tend to be more recession-proof and, importantly, “Amazon-proof.” The internet economy requires massive amounts of warehousing and light industrial space, and that’s what WPC delivers.

WPC’s Dividend and Stock Power Rating

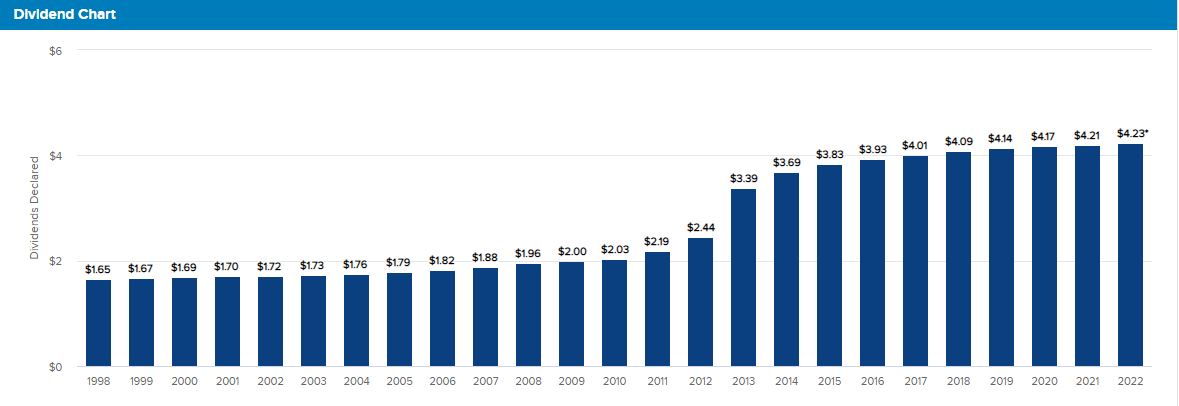

Oh, and it also pays a fantastic 5.1% dividend. If you’re wondering how WPC is keeping up with rising prices, it has raised its dividend every quarter since early 2010.

WPC: A Serial Dividend Raiser

That’s not every year, mind you. That’s every quarter. WPC has reliably raised its dividend four times per year for over a decade.

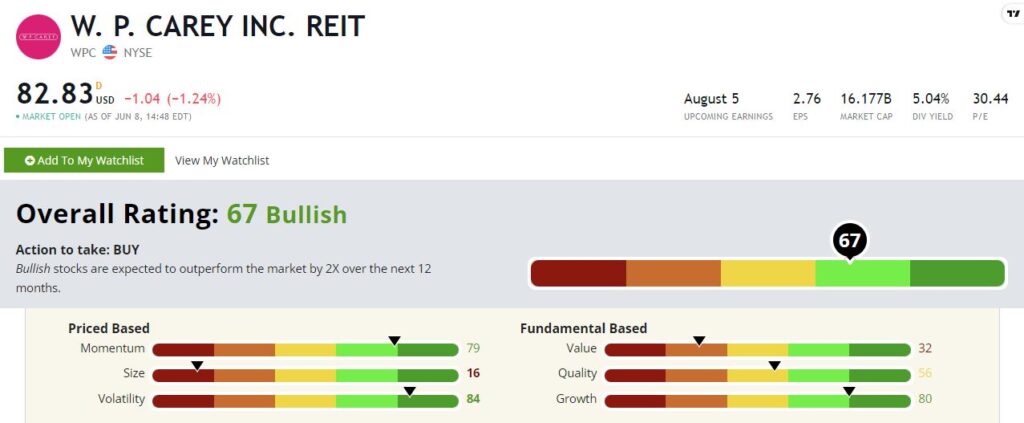

WPC rates a “Bullish” 67 in our Stock Power Ratings system.

That’s good, but I’m more interested in the individual factors driving that rating. WPC rates well where I want it to in this environment.

Volatility — WPC rates an 84 on our volatility factor, meaning its less volatile that all but 16% of the stocks in our universe. That’s critical in a bear market, where you win by not losing.

Avoiding major losses give you flexibility. You can sell and potentially buy dips in the shares of other stocks that have fallen harder … while collecting a dividend along the way.

Momentum — Not surprisingly at all, WPC also rates well on our momentum factor at 79. With the market in free fall, low-volatility stocks show momentum by not rolling over on us.

BHP has done well in that regard. It’s up around 11% from its recent bottom in May.

Growth — Don’t throw out the baby with the bathwater in a bear market.

Right now, growth stocks are getting obliterated. But buying “cigar butts,” or cheap stocks that are long past their growth years, isn’t a great long-term strategy either.

You need growth because that’s what ultimately fuels stock price gains and dividend hikes. And WPC rates a super solid 80 on our growth factor.

Quality — REITs aren’t known for high quality factor ratings, as quirky accounting depresses reported profit margins and debt levels. This is normal in real estate, but it makes REITs look highly leveraged.

Despite these handicaps, WPC is still in the middle of the pack with a 56 rating on our quality factor. That’s solid.

Value — As was the case with quality, REITs also get punished on our value factor. WPC rates a 32 here. I’m good with that because it's a solid, low-volatility REIT with a great dividend. These rarely go on sale.

Size — WPC is also a large REIT with a market cap of nearly $15 billion. It rates a 16 on our size factor. But that's OK because stability is key in a bear market. That’s where larger companies shine.

Bottom Line: I don’t know when this bear market runs its course. That’s OK.

WPC is a dividend workhorse that should get you through this difficult time while continuing to throw off a healthy stream of growing income payouts.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.