Let’s talk about bonds.

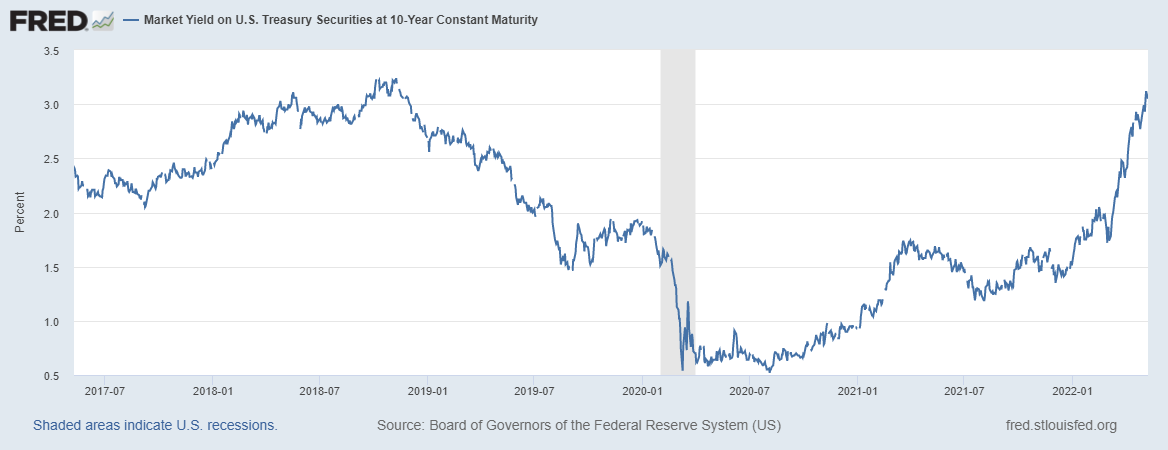

With the 10-year Treasury now floating around the 3% mark, bonds are the most attractive they’ve been in years.

Stocks selling off only strengthens the case for bonds.

But as the dividend guy, I have to step in.

I’m not here to bash bonds. I think they serve a purpose, especially when managing risk.

When it comes to income, though, I want to show you why dividends are king with one simple chart.

It’s all part of this week’s Investing With Charles.

Bond Yields Are the Most Attractive They’ve Been in Years

Matt: In times like this, because interest rates and bond rates are up, there is the potential for more payout on a bond coupon.

However, we’ll show everyone that it may not be the best approach if you want to maintain income in your portfolio, even during a market downturn.

Let’s dive in.

Right now, the bond payout is about 3% give or take?

Charles: Yeah. Yield on a 10-year Treasury as we record this on Tuesday, May 10 is about 3%. It’s been dancing around that.

Matt: So a 10-year Treasury bond is going to pay you a coupon of 3% every six months, I believe, is how that works.

Charles: Yeah. That 3% is annualized, so they divide it into semiannual payments.

Matt: Right. So I want to compare it with a dividend stock over the same time frame.

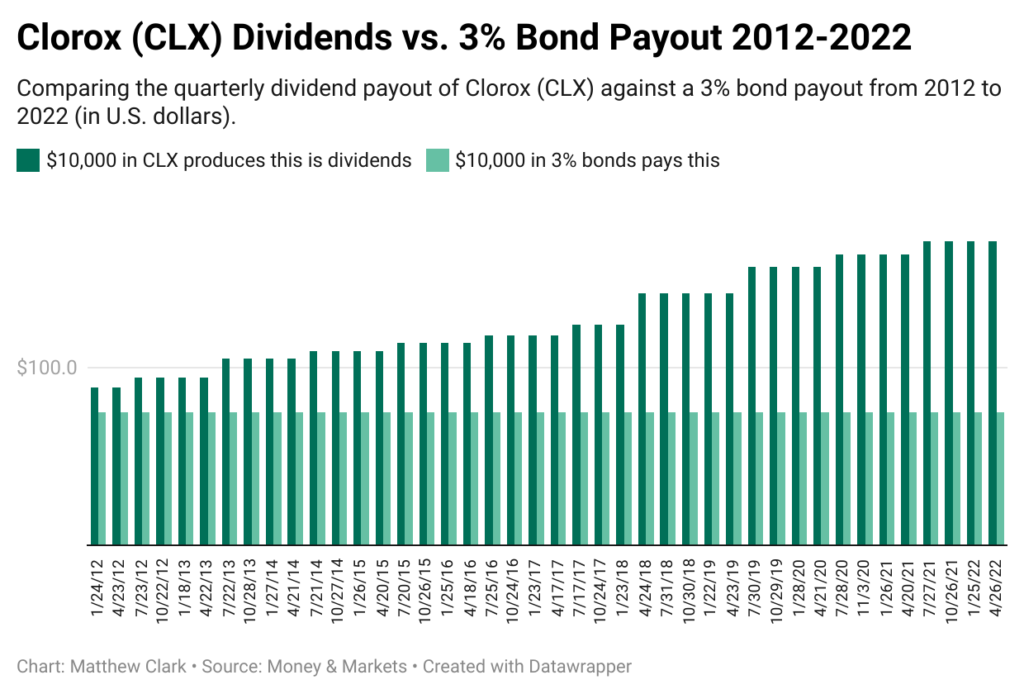

Charles: This stock also isn’t known for dynamic growth: Clorox Co. (NYSE: CLX).

Matt: Yeah. We chose Clorox.

Charles: Why did we choose Clorox? Because it’s about the most boring company you can imagine.

It sells bleach and wipes for crying out loud, just basic cleaning supplies. This is not a hypergrowth business. It’s a slow and steady, stable business.

I thought that would be fairer for comparing than using some dividend workhorses. I don’t want to skew the results with some fast-growing dynamic tech stock or something.

This is a better apples-to-apples comparison.

Bonds vs. Dividends Over 10 Years

Matt: And we’re looking strictly at the dividend payment that Clorox pays out.

We want to compare that with what you would receive on a 3% bond payout. We aren’t comparing the actual 10-year Treasury yield because it hasn’t always been at 3%. We wanted to flatten everything out and make everything equal.

We tracked what you would receive on a quarterly basis from a 3% bond payout. I realize they pay semiannually, but in order to even things out, we made it quarterly.

And then we compared what you would receive on a quarterly dividend payout from Clorox. Here’s that chart:

If you had invested $10,000 in Clorox, or if you had invested $10,000 in a 3% bond, here’s what those investments would pay out. And the chart is pretty telling.

Walk us through what this chart is illustrating and what it means for investors.

Charles: It’s simple. You look at that payout for the bond, it doesn’t move. It is frozen in time at that same level for 10 years.

You look at Clorox, and again, this is a boring, stable company you’d never even think twice about. You have their products under your sink at home probably and you never even think twice about it.

But it’s still managed to grow its dividend like clockwork pretty much every year. And what’s the result? A decade later, it’s a substantially higher payout.

Now, what does this mean for your life? I imagine most people watching this are employed. Imagine working a job for 10 years and never getting a raise. The rest of the world’s moving on, and you’re frozen at the same level for a decade.

Well, that wouldn’t be fun in your working years. It’s not fun in your retirement years either.

You may be retired for decades. And the idea that your living standard gets frozen at that level of the day you retire, and you start living off your investments — that’s a scary thought. And no matter what inflation does, what your grocery bill looks like or the bill to take your grandkids to Disneyland… All those expenses rise over time, and you’re just frozen. It’s a poor way to be positioned for a long retirement.

Now, I chose Clorox because I wanted a boring, conservative stock. But you can never just put all of your eggs in one basket.

Don’t Bank on a Single Dividend Stock … Diversify!

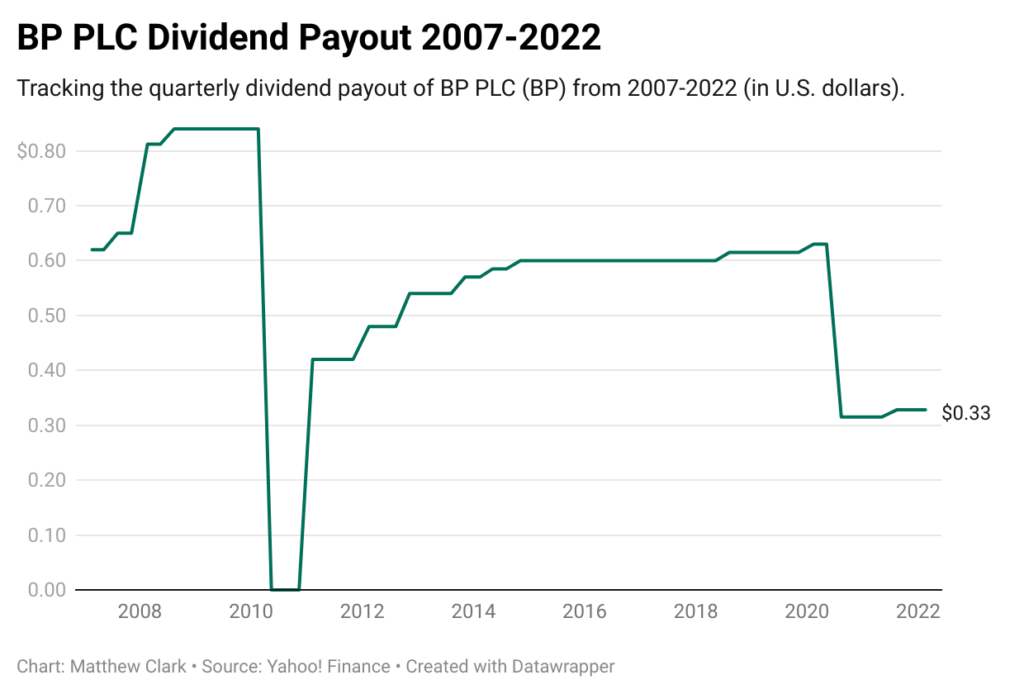

Imagine you had just said: “I’m betting my entire portfolio on a really nice paying particular oil stock, BP PLC (NYSE: BP). It’s one of the oldest stocks in existence. It’s paid dividends like clockwork forever. This is one of the most boring, conservative global companies, right?”

Well, remember what happened to BP back in 2010? It whiffed bad. It had one of the biggest screwups in the history of finance, the history of the world. It blew up that rig in the Gulf of Mexico and had the biggest oil spill in the history of marine oil exploration.

That was bad. It had to cut its dividend to zero for a year, and then it brought it back at a reduced level a year later. And its payout is still below pre-oil spill levels 12 years later.

So be careful if you say: “I’m not doing any bonds at all. I’m just going with straight dividend stocks to pay for my retirement.”

You still have to diversify. You still have to be careful because if you bet the wrong horse here and put a disproportionate amount of your portfolio in a handful of dividend stocks, and then something like this happens, all of a sudden that boring bond that never changes starts looking pretty good.

So the takeaway here: A diversified bond portfolio is not going to grow over time.

It’s just the payout you get the day you buy the portfolio. That’s what you’re stuck with forever or for the maturity of the bond.

Trim Down Dividend Risk

Charles: Now, dividends aren’t immune to market pressures. There will be the occasional blowup. Every time a recession hits, some business that you thought was bulletproof shows its weakness and cuts its dividends. General Electric Co. (NYSE: GE) had to cut its dividend a few years back. It happens. Some of the best companies run into trouble from time to time.

You eliminate that risk, or you reduce it, by diversifying. If you have 20 or 30 solid dividend stocks, you can survive a couple screwing up like BP did. It’s fine. You’re diversified. You’re still going to come out ahead due to the dividend growth of the risk portfolio.

Matt: Maybe do a blend of bonds and dividend-paying stocks to where you see a cost of living increase. Because again, if you’re living on a fixed income, one of the biggest challenges you have are things like rent increases. I think we’ve seen the average rent here in South Florida increase by 50% recently.

It’s massive. It’s unreal. And if you’re living on a fixed income, that prices you out of the market, even as a renter.

Charles: You may be forced to move at that point. You may be forced to take a ticket, pack your bags and leave.

Matt: And even if you’re a homeowner, the increase in homeowner’s insurance is matching that increase in rent. So think of it like that.

Charles: Or next time you need a new roof, a new carpet or whatever. I mean, all those expenses rise over time.

Matt: Exactly. And so investing just solely in bonds is like living on a fixed income where there is no increase whatsoever.

Charles: Yeah. It gets worse than that.

A Final Bond Risk

Charles: There’s one aspect we didn’t cover at all.

When you buy a bond, you’re locking in that payout for the life of the bond. But then you have the reinvestment risk. What do you do at the end of that bond’s life when you get the bond’s face value back?

You could get a pay decrease if you buy that bond today and you’re locking in that 3% yield.

If you get the experience of Japan, yields could be zero or close to it.

Now all of a sudden that 3% that you thought was OK … you’re having to reinvest that 10 years later at 0% or 0.2% — or in the case of Europe or Japan for a while, negative yields.

Don’t play that game. If you need to have some bonds, OK. Have a few for volatility reduction purposes, fine.

But for your actual income needs, dividend stocks are likely going to be better. Again, diversify, have many dividend stocks in different industries that are not affected by the same factors.

But if you want to stay ahead of inflation, if you want to keep your standard of living at least stable and ideally rising, then bonds aren’t going to do it for you.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.  Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss his weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.