I’ve been writing about investments for almost 20 years. And yet I may have just stumbled across the stupidest piece of financial advice yet. According to the headlines: “MATANA is the new FAANG!”

And what, pray tell, is MATANA?

It’s not a curved Japanese samurai sword. That’s “katana” with a “k.” Though recommending you buy a collection of antique weapons might be more sensible advice.

Nor is it Montana. Though buying a bunker in that faraway state to escape this nonsense also sounds like solid advice.

No, MATANA is the new investing acronym de jour. It stands for:

- Microsoft Corp. (Nasdaq: MSFT).

- Apple Inc. (Nasdaq: AAPL).

- Tesla Inc. (Nasdaq: TSLA).

- Alphabet Inc. (Nasdaq: GOOGL).

- Nvidia Corp. (Nasdaq: NVDA).

- Acom Inc. (Nasdaq: AMZN).

And yes, it is designed to replace the now-defunct FAANG (Facebook, Apple, Amazon, Netflix, Google) now that Meta Platforms Inc. (Nasdaq: META), aka Facebook, and Netflix Inc. (Nasdaq: NFLX) have fallen out of favor.

Let’s start with the obvious here. An acronym is not an investment strategy. It’s glitzy PR designed to generate buzz.

And to that end, it works.

We’ve Seen This Before…

Remember BRIC? That was a trendy investment theme back in the mid-2000s. It stood for Brazil, Russia, India and China. Later, an “S” was added to the end for South Africa, making it BRICS.

These countries had nothing in common, other than that the fact they were developing and enjoying bull markets, along with most emerging markets.

At the time:

- China was a manufacturing economy.

- India’s economy focused on services.

- Brazil and South Africa were commodity-based economies.

- And Russia was a petrostate.

There was no strategy here … and no rationale for excluding other promising emerging markets in Asia, Latin America and Eastern Europe.

It was never a coherent strategy. But it did sell exchange-traded funds!

Nothing but a Name

FAANG, at the height of its popularity, also never made sense:

- Apple was a hardware company.

- Facebook and Google were social media/internet companies.

- Netflix focused on entertainment.

- And Amazon was a retailer with a growing cloud computing business.

There was no overriding investment theme here. They just happened to all be mega-cap growth stocks enjoying a good run at the same time. Their names combined to make a cool — and marketable — acronym.

And MATANA … really?! Adding Microsoft, Tesla and Nvidia somehow makes this a more coherent strategy?

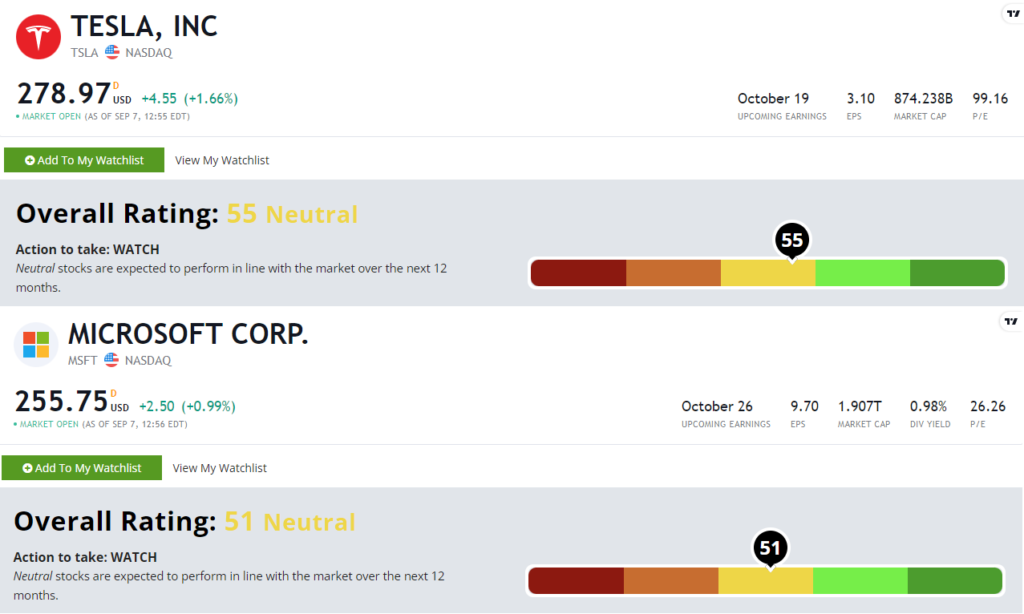

There is nothing wrong with buying any of these stocks, by the way. I certainly have, and some are at least worth watching, according to our Stock Power Ratings system.

Click here for a full breakdown of TSLA’s rating. Click here for MSFT’s breakdown.

But buying stocks based on a marketing acronym is no way to invest. You have no rationale for buying other than the snazzy name.

Even worse, you have no clear indication of when to sell. There’s no exit strategy in a cutesy name game.

So don’t play with “strategies” like MATANA.

Acronym Investing Lacks Structure

In Money & Markets, Chief Investment Strategist Adam O’Dell, Research Analyst Matt Clark and I believe in being structured and systematic in our investing. Using our Stock Power Ratings system, we rank every stock in our universe based on objective, quantifiable criteria.

We break this down into three broad fundamental factors:

- Value.

- Quality.

- Growth.

And three technical factors:

- Momentum.

- Size.

- Volatility.

We use these factors because our research has proven they work. Historically, stocks rating 61 and above on our Stock Power Ratings system have outperformed the market by 2X on average over the following 12 months.

Stocks rated 81 or higher have outperformed by 3X on average!

In our premium monthly newsletter, Green Zone Fortunes, we take it a step further.

We identify powerful investing mega trends and then look for top-rated stocks that stand to benefit.

And what may be the most important part of our approach: We have an exit strategy. We have price targets that inform when we take profits on the upside and when we should cut losses after a trade doesn’t go our way.

To find out more, click here to watch Adam’s “Imperium” presentation and find out how you can join us in Green Zone Fortunes.

On top of a model portfolio full of stocks in today’s most mega of mega trends, you’ll also receive trading guides, weekly updates from Adam and me on the overall market and what’s on our radars, our highest-conviction stock recommendations and much more!

In fact, next week we are putting an income twist on the service that taps into my decades of expertise investing in solid dividend stocks.

We won’t tell you to buy any boring old blue chip… We’r targeting income stocks that focus on growth and multiplying their payouts year after year.

Stay tuned for more on that. (Or click here to join now, and be one of the first to get the scoop next week!)

Now, back to scouring eBay for katanas to defend myself in the future zombie apocalypse from my Montana bunker (I kid, I kid).

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.