Renewable energy is the future.

It’s one of chief investment strategist Adam O’Dell’s mega trends to follow in the years to come. (Find more of our takes here, here and here.)

But smart investors like you can’t ignore what’s going on in traditional energy (think fossil fuels and natural gas) right now.

Using Adam’s proprietary six-factor Green Zone Ratings system, I found an energy stock achieving “maximum momentum.” Its share price jumped 38% since August 2021. It even hit a new 52-week high as the broader market pulled back over the last couple of weeks.

This company rates “Strong Bullish,” which means it is poised to crush the broader market by at least three times over the next 12 months.

Here’s why you should buy this energy stock now.

The Energy Stock Resurgence

When you have a pandemic, rising inflation and pressure from lawmakers to move away from fossil fuels, conventional wisdom would tell you it’s not a good time for energy stocks.

Conventional wisdom is wrong this time.

It was a bumpy ride, but the Energy Select Sector SPDR ETF (NYSE: XLE) has more than tripled the returns of the S&P 500 in the last 12 months.

This year alone, XLE is up more than 18% compared to the S&P 500 being down almost 7%.

A big reason for the resurgence in energy stocks is the rising cost of oil and natural gas.

The price of a barrel of West Texas Crude jumped from $47.02 to more than $84 today. That’s an almost 80% increase in the last year!

So, there is a strong correlation between the price of oil and the rise of traditional energy stocks.

On top of that, a recent report from Morningstar suggested our demand for oil is only going to go higher until 2030.

I found a strong player in the energy market … one whose stock price is achieving “maximum momentum” after rising 38% in the last five months.

Warming the Frigid Northeast: Global Partners LP

Massachusetts-based Global Partners LP (NYSE: GLP) is a midstream (delivery) and downstream (supplier) energy company. It distributes gasoline, oil and even renewable fuels to wholesalers, retailers and commercial companies in New England and New York.

The company also:

- Sells home heating oil, diesel, kerosene and propane.

- Operates and leases around 1,600 gasoline stations in the Northeast, Maryland and Virginia.

- Sells 359,000 barrels of its oil and gas … every day.

On the renewable front, Global Partners is advocating for reducing carbon emissions through its “Project Carbon Freedom” initiative. It aims to promote renewable liquid heating fuel as an alternative to electricity.

From 2017 to 2019, GLP‘s total annual revenues grew from $8.9 billion to $13 billion — a 46% increase.

The COVID-19 pandemic pushed revenue lower in 2020, but the decline was short-lived.

In 2021, GLP is expected to beat 2019’s record revenue which should set off massive growth. From 2021 to 2023, GLP is expected to raise its total annual revenue 37.4% to nearly $18 billion.

GLP Achieves Maximum Momentum

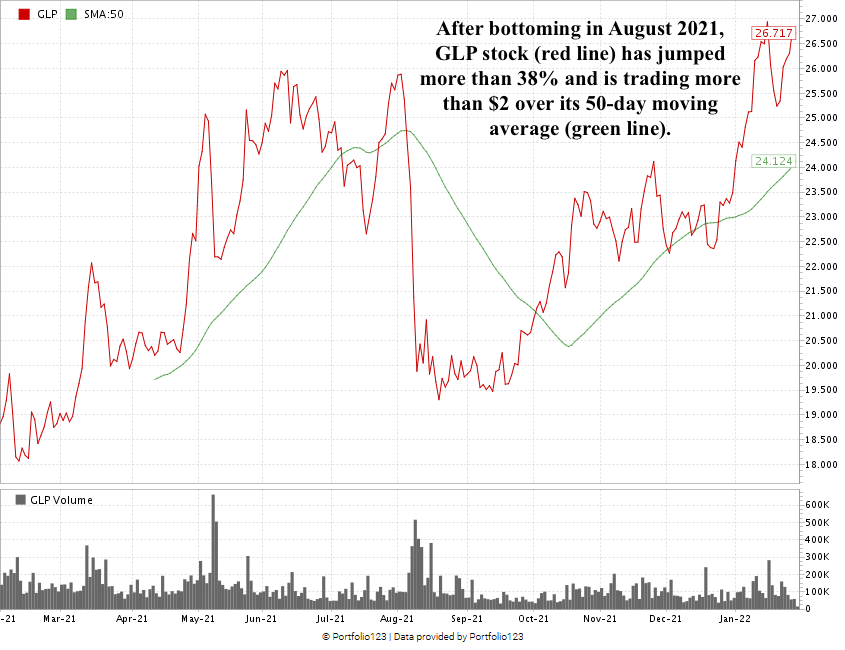

The crude oil crash last summer hit GLP hard. Its second-quarter report stated a more than $60 million drop in gross profit due to the oil price drop.

Global Partners’ stock price sank 25% following the weak report.

However, GLP roared back in the fall and winter to gain more than 38% and hit a new 52-week high. It’s currently testing that high, and I believe it will break through it.

Global Partners LP Stock Rating

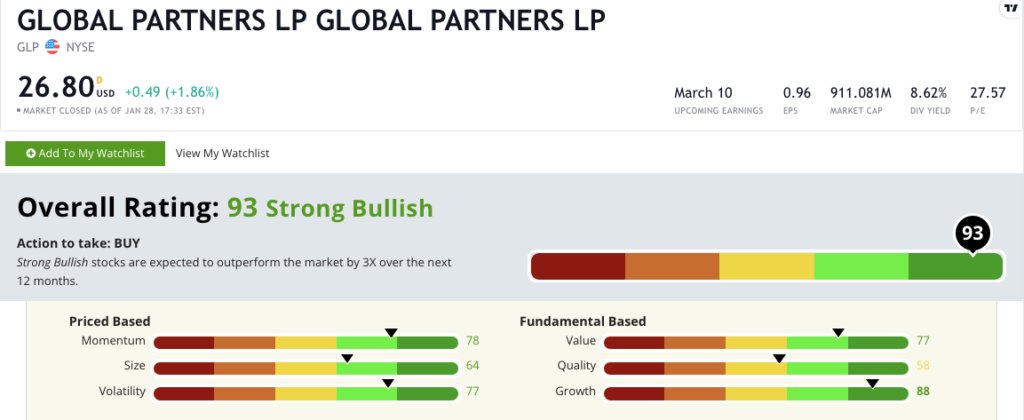

Using Adam’s six-factor Green Zone Ratings system, Global Partners LP stock scores a 93 overall. That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

Global Partners’ stock rates in the green in five of our six rating factors:

- Growth — GLP’s one-year annual earnings-per-share growth rate is a massive 239%. Its trailing 12-month sales growth rate is 20%. It scores a strong bullish 88 on growth.

- Momentum — Since August, GLP has risen more than 38%. This is the definition of “maximum momentum.” It rates a 78 on momentum … exactly what we look for in a stock.

- Volatility — GLP faced headwinds in August 2021 after a lackluster quarterly report, but since then, its stock has seen higher highs and higher lows. The company scores a 77 on volatility — meaning its volatility is lower than 77% of the stocks we rate.

- Value — In a world where most of the market seems overvalued, GLP is undervalued — especially compared to its peers. It’s price-to-sales ratio is 0.08 compared to its peer average of 0.47. It scores a 77 on value.

- Size — With a market capitalization (shares outstanding times current share price) of $911 million, GLP scores a bullish 64 on size.

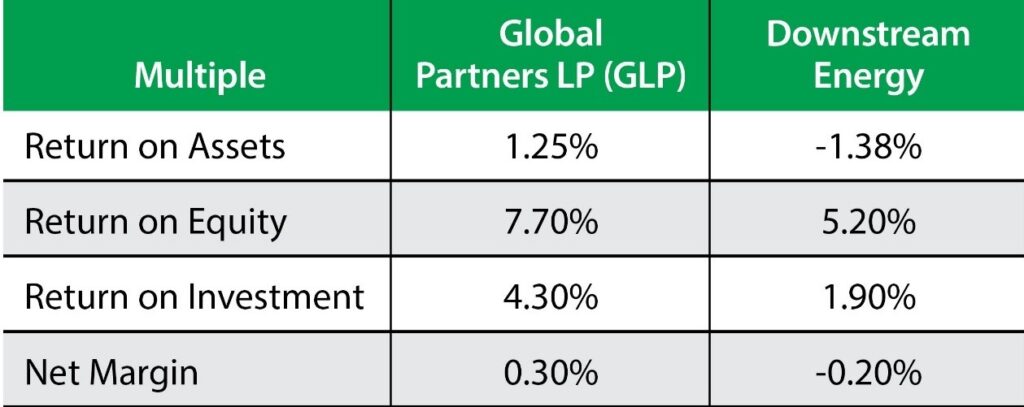

GLP rates a 58 on quality. This by no means suggests Global Partners has weak returns, though.

As you can see in the table below, its quality multiples are higher than its energy peers:

As a bonus, GLP offers an 8.73% forward dividend yield. Global Partners will pay its shareholders $2.34 per share this year — just for owning the stock.

Bottom line: Until we see the world reach net-zero carbon emissions, the need for gasoline and home heating oil will remain strong.

We are still bullish on renewable energy, but we can’t ignore the demand for oil-based products.

Global Partners LP is a strong leader in providing these products to one of the largest population centers in the U.S.

But it is also making strides to become more renewable.

It’s why Global Partners LP has a lot of future upside and why it is a strong candidate for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.