My oldest son moved back to Kansas when the rest of my family loaded up for Florida.

He has a great job and is starting a family.

Lately, when I talk to him, our conversations center around one thing: stocks.

He’s always asking for my advice on things he reads on the internet.

“Meme” stocks … specifically AMC Entertainment Holdings (NYSE: AMC) … came up in our latest chat.

These are stocks that see a sudden rise in price fueled by social media attention and not on the company’s performance.

He is like any investor — looking for ways to increase his income through the stock market.

After reading what social media did to a company’s stock like GameStop Corp. (NYSE: GME), he was drawn into the hype.

Full disclosure: I do own shares of AMC Entertainment Holdings.

In this episode of The Bull & The Bear, I examine some of these meme stocks and tell you whether they are ones to invest in.

The Rise (and Fall) of Meme Stocks

The Reddit community r/wallstreetbets is one of the biggest factors behind the rise of meme stocks.

This is a band of retail investors bound and determined to make big short-sellers of stock pay out the nose for their short bets.

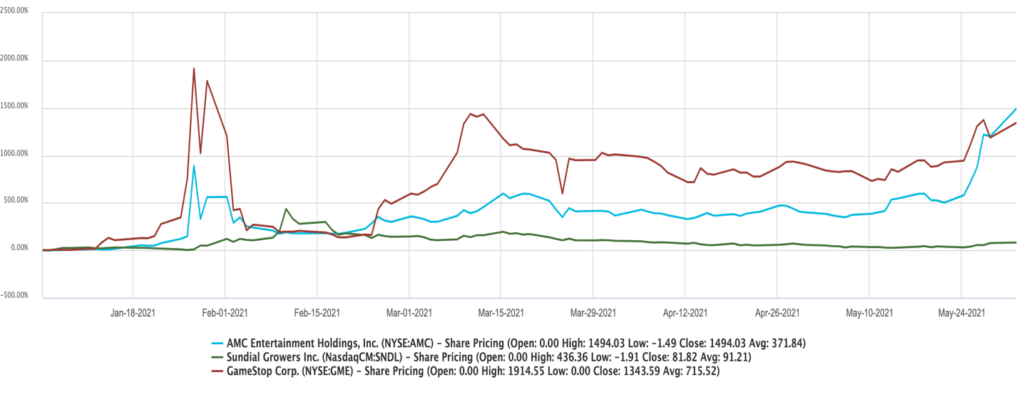

GameStop was their first attempt … and it worked as GameStop’s shares are up 1,300% since the first of the year.

Meme Stocks Start to Take Off Again

Sundial Growers Inc. (Nasdaq: SNDL) is another example of a meme stock. Sundial’s share price has grown 82% since January.

AMC is the latest effort by retail investors to run up the stock price and test short sellers’ mettle. Short sellers borrow stock to sell on the market with the intent of buying the stock back for less money (betting on a downturn in the stock price).

The biggest problem here is that stock price run-up is based on social media and not on any technical or fundamental analysis of these companies.

But that hasn’t stopped these stock prices from rocketing to new highs.

I’m going to share my view on some of these meme stocks and tell you whether they are worth adding to your portfolio or not.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Facebook

Twitter

LinkedIn

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.