In the great dividend debate of high-growth versus high-yield, there’s one metric that might help settle the score: yield on cost.

Anyone keeping up with my weekly dividend analysis knows I value growth over yield 99 times out of 100. A stock with consistent, growing dividends that beat inflation year after year is the linchpin of a healthy income portfolio. It also leads to less heartburn while you maintain your retirement nest egg.

Sure, a smattering of high-yield dividend payers is fine, but the vast majority of your dividend portfolio should be dedicated to stodgy companies that increase their payouts every year.

With inflation rearing its ugly head again, those consistent dividend growers will come out ahead. And the yield on cost metric shows how powerful dividend growth is.

How Yield on Cost Works

The yield on cost is the current annual dividend or interest income divided by your original purchase price. This isn’t going to be a meaningful metric for a short-term trader, but it’s something every long-term income investor should keep in mind.

It’s best explained by example. Let’s compare the yield on cost between a hypothetical 30-year junk bond yielding 4.1% trading at par and Realty Income Corp. (NYSE: O), one of my very favorite income stocks. Realty Income also happens to yield 4.1% at current prices.

We’ll start with the bond: $10,000 invested in the bond will produce exactly $410 per year in income in Year 1. By year 30, it’s still producing $410 per year. Your yield on cost is no different than your current yield. (We’ll also just ignore the likelihood that a company issuing a junk bond goes bankrupt long before we hit the 30-year market. Work with me here!)

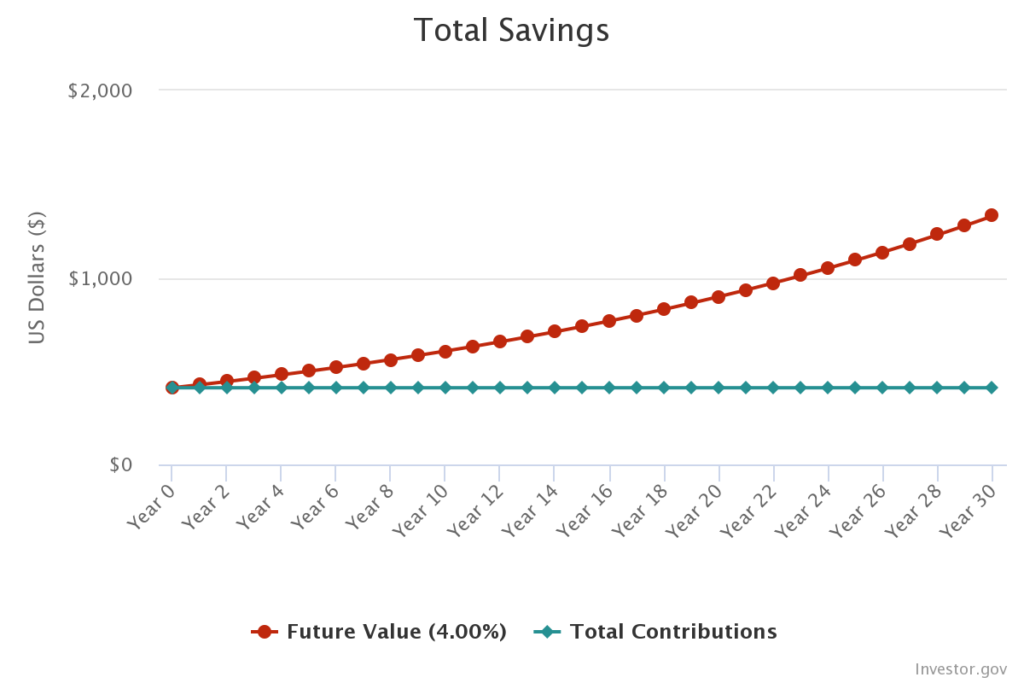

Now, let’s compare that to Realty Income. Since going public in 1994, Realty Income has raised its dividend at a 4.4% compound annual rate. That’s solid, inflation-crushing growth for almost 30 consecutive years. Just for grins, we’ll assume that dividend growth is a little slower over the next 30 years and compounds at just 4%.

In Year 1, a $10,000 investment in Realty Income also pays $410. But after 10 years of compounding at 4%, that annual payout jumps to $606.90 per year. After 20 years, it grows to $898.36. And after 30 years, it grows to $1,329.79.

- $606.90 represents a yield on cost of 6.1%.

- $898.36 represents a yield on cost of 9%

- And $1,329.79 represents a fantastic yield on cost of 13.3%.

Now, there are a couple of things to keep in mind here. Yield on cost compares the current payout to the original purchase price. It takes no account of the current stock price, which also would presumably rise over time. Compare that to a bond again. The best you can ever hope to get from a bond at maturity is its original par value.

Also, 30 years is a long time to own a stock and isn’t realistic for all investors. I’ve owned Realty Income for over 10 years and would like to own it for another 20 years. But I also bought the shares when I was a spry 32 years old. Had I bought the shares at retirement age, the 30-year yield on cost would be a little ridiculous.

And finally, it’s important to remember that companies can cut dividends just as easily as they can be raised. We got a stark reminder of that in 2020. Global dividends declined 12.2% to $1.26 trillion last year, according to asset manager Janus Henderson.

So, you’ll still want some cash and bonds in your portfolio, particularly if you’re in or near retirement. But if inflation runs hot for a while, you’ll want to own assets that throw off income streams that keep pace.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Story updated on June 1, 2021.