The national average price of a gallon of gas is $4.52.

It’s better than last month’s average of $5.01, but I sure miss the $3.14 we paid a year ago!

In the meantime, the world is hunting for cleaner-burning fuel that reduces pollution.

Enter methanol:

In this chart, you can see how much methanol we’ll use in the U.S. through 2027.

The 5.7 million metric tons of methanol we used in 2020 will increase 47.4% in just seven years!

See, methanol produces lower carbon emissions and improves fuel efficiency. Not only is it better for our vehicles, but it’s better for the environment.

Today’s Power Stock produces and sells methanol around the world: Methanex Corp. (Nasdaq: MEOH).

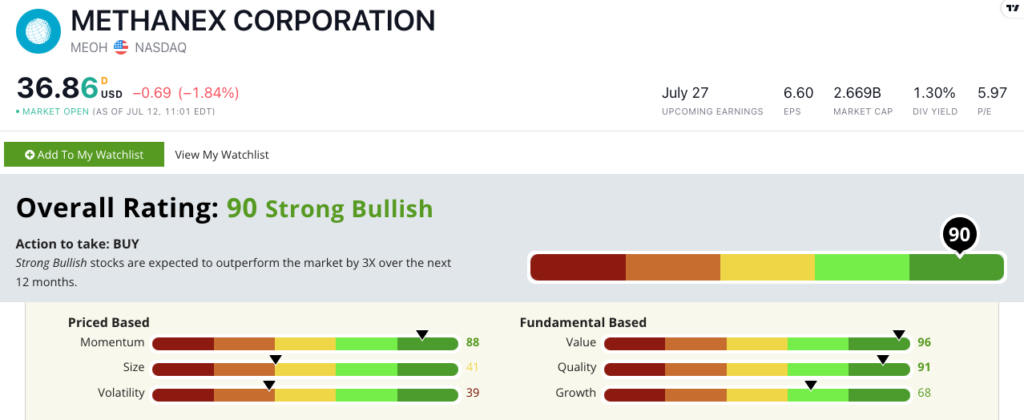

MEOH Stock Power Ratings in July 2022.

Methanex uses its fleet of 30 ships to transport its product.

The company owns and leases methanol storage and transfer facilities, making it a one-stop shop for methanol.

Methanex stock scores a “Strong Bullish” 90 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

MEOH Stock: Top Value + Quality

Highlights from Methanex’s excellent first quarter include:

- Produced 1.8 million tons of methanol — a 20% increase over the same quarter last year.

- First-quarter revenue was 20% higher than the same quarter in 2021.

In MEOH, we have an outstanding value stock with strong quality.

Its price-to-earnings ratio is a reasonable 5.7 — about half the commodity chemicals industry average.

MEOH’s price-to-sales and price-to-cash flow multiples tell the same story: The stock is a terrific value compared to its peers.

This kind of performance earns MEOH a rating of 96 on our value metric — in the top 4% of all stocks we rate!

MEOH’s return-ons (assets, investment and equity) are light-years ahead of its peers.

For instance, its return on equity is 30.2%. The industry average, on the other hand, is just 4.9%.

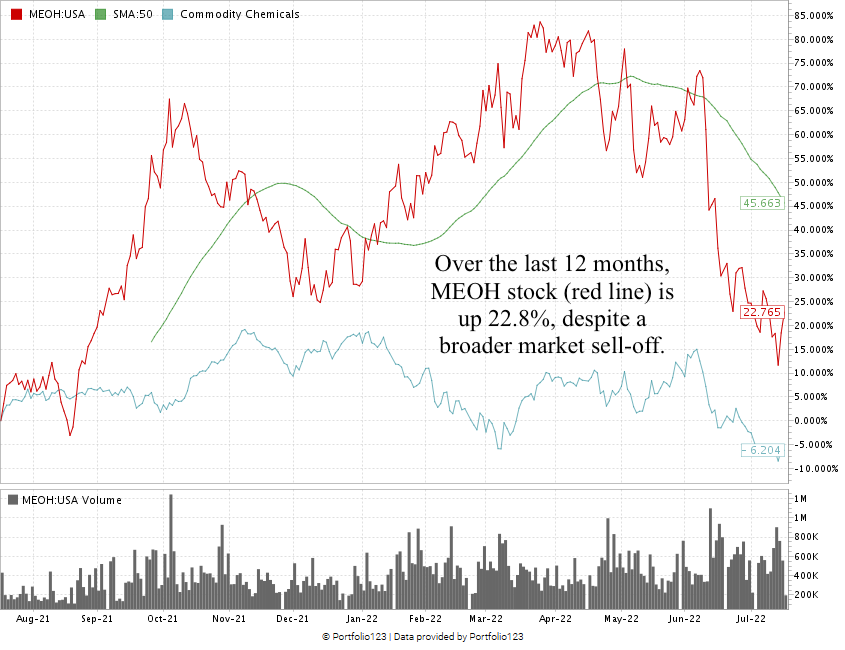

From January to March 2022, MEOH stock climbed 43.5% to hit a new 52-week high.

While the broader sell-off affected MEOH, the stock remains 22.8% higher than a year ago. It continues to outpace the commodity chemicals industry, which is down 6.2% over the same time.

Methanex Corp. stock scores a 90 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The world is shifting from “dirty” energy to clean sources. Methanol’s clean-burning properties catapult it to the forefront of green energy.

MEOH’s excellent value and quality make it a solid Power Stock for your portfolio!

Bonus: The company’s 1.5% forward dividend yield pays shareholders a $0.58 annual dividend for every share they own.

Stay Tuned: Well-Known Power Stock to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top maker of office supplies.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.