In 2020, what Amazon.com Inc. did was unheard of in retail…

It offered same-day delivery to Amazon Prime subscribers.

That pressured other retailers to speed up getting products from their warehouses to your front door.

Since then, companies that specialize in moving freight fast have become integral to the retail and grocery sectors.

The logistics market — moving goods from a starting point (i.e., a warehouse) to your house — has grown consistently since 2010:

The chart above shows the U.S. third-party logistics market’s revenue.

By next year, revenue will increase 29% from 2020.

Today’s Power Stock provides third-party transportation and logistics services: Covenant Logistics Group Inc. (Nasdaq: CVLG).

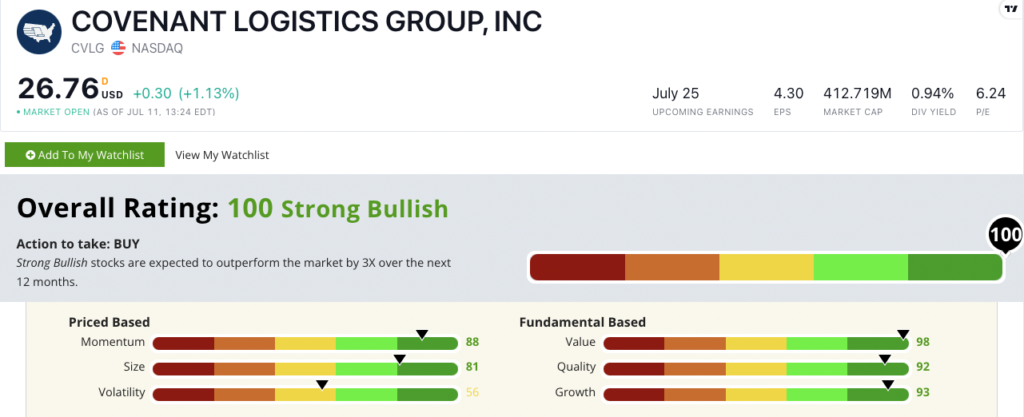

CVLG Stock Power Ratings in July 2022.

CVLG can deliver truckloads of freight for distances short and long: 1,000 miles in 22 hours … or a few miles in 15 minutes.

It operates 2,291 tractors across the U.S. and works with customers in the retail and food and beverage industries.

Covenant Logistics stock scores a “Strong Bullish” 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CVLG Stock: Excellent Fundamentals

Covenant had a strong start to this year.

Check out this inside information:

- In the first quarter, CVLG reported total revenue of $291.6 million — a 32% increase over the same quarter a year ago.

- Increased sales every quarter in 2021.

CVLG is a terrific growth stock, as you can see from its Stock Power Ratings above.

Its one-year annual earnings-per-share (EPS) growth rate is 258.8%, while its annual sales growth rate is 24.7%.

In the last 12 months, its EPS grew a massive 346.7%!

After hitting a 52-week low in April 2022, CVLG stock jumped 48.7% and continues to rise … showing the “maximum momentum” we love to see in stocks.

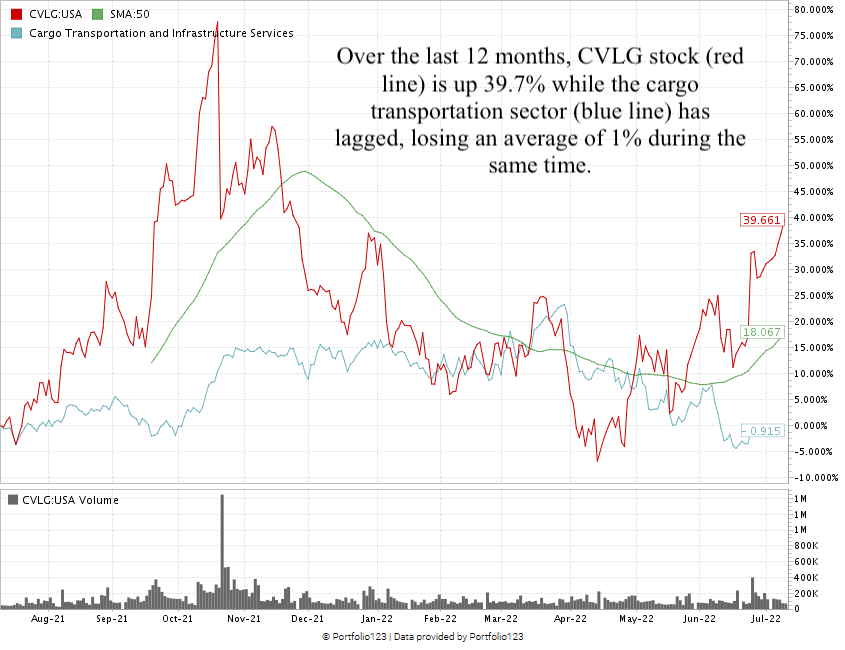

Over the last 12 months, CVLG is up 39.7%. It blows away its industry peers, which are down 1%.

Covenant Logistics stock scores a perfect 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Grocery stores, manufacturers and retailers continue to speed up the time it takes to get products from warehouses to your house.

Covenant Logistics steps in with the best way to make that happen. CVLG is an excellent candidate for your portfolio.

Bonus: Covenant Logistics’ forward dividend yield of 0.9% translates to a $0.25 per share, per year payout for shareholders.

Stay Tuned: Stock for Renewables Mega Trend

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a “Strong Bullish” stock with exposure to the renewable energy mega trend.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.