Yesterday, I noted that investors are optimists. Today, I want to share a specific example of optimism in action.

A little over a week ago, on March 24, the Dow Jones Industrial Average gained more than 11%. Looking at the 2,100-point gain in the Dow, many investors felt relieved. They believed this marked the end of the bear market.

There’s an appealing logic to that analysis. A big gain could mean the decline was an overreaction. For most of March, traders were selling everything. Finally, on March 24, they stopped selling. It made sense to assume stocks must be bargains after falling more than 20%.

So, they bought since they believed the worst was over.

Instead of reacting emotionally, investors should look at history. In this case, history crushes optimism.

A Look at Bear Markets of the Past

March 24 was the second time the Dow gained more than 11% in one day. The only other time that happened was October 13, 2008. Investors turned bullish after that jump, but they were early. The Dow found its bottom five months later. Prices fell another 31% after posting the biggest one-day gain in history.

One example like that is not considered statistically significant. To study a larger group of big up days, I looked at the 17 times the Dow gained at least 9% in one day since 1900. That’s still not a large sample but a clear message emerges.

Most of the jumps — 13, or 76% — came in bear markets. That’s the case right now. But the big gain wasn’t the end of the bear market.

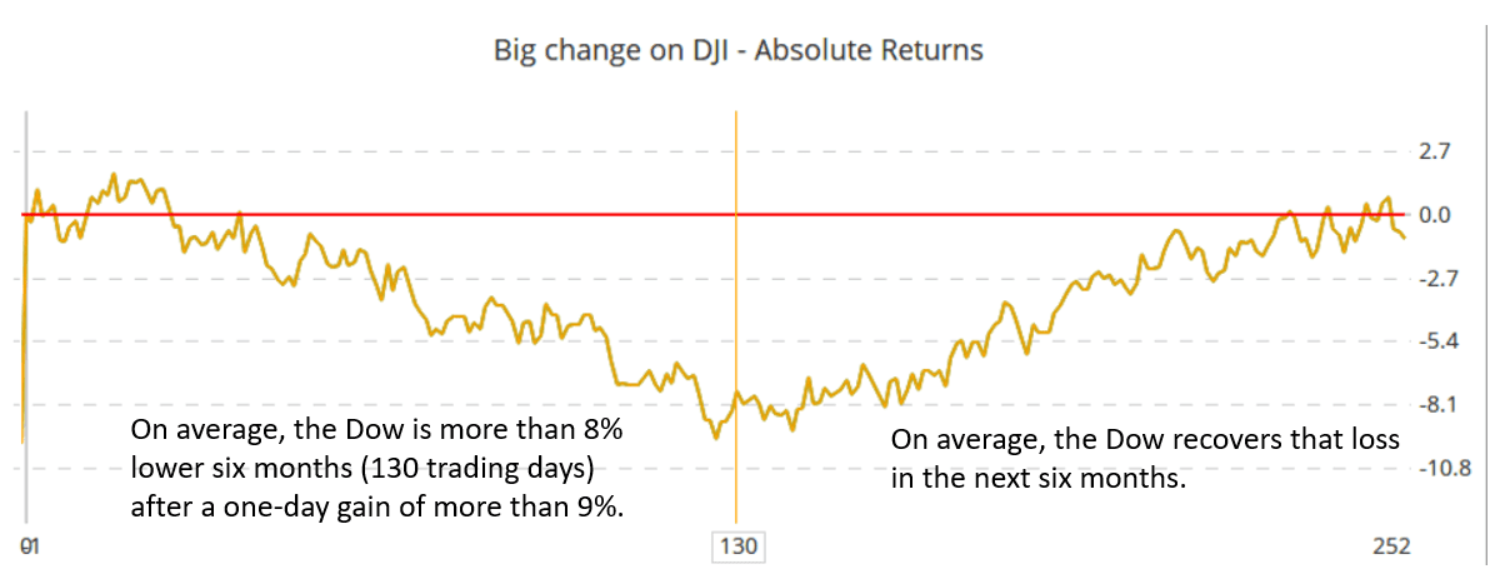

The chart below shows the average price change in the year after a large one-day gain.

On average, the Dow continued falling over the next six months, losing another 8%. On average, a year later, prices recovered those losses.

This time might be different, but it probably isn’t. The news is still bad, and the truth is we don’t even know how this crisis will end.

Optimists believe businesses will reopen soon and employees will get back to work. That’s unlikely.

Some businesses will not reopen. Others will need months to recover from the shutdown. As the reality of business closings sets in, stock prices will drop more.

For now, it’s best to plan on another six months of declining prices. In the worst case, if prices rise, we can buy in later. If history repeats as it almost always does, we will have a chance to buy at lower prices later this year.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru