Investors are optimistic by nature. Buying a stock is a bet that the future will be better. This is true in good times and bad.

But optimism can lead to financial ruin. And the alternative to optimism isn’t pessimism. It’s realism. Being realistic can help investors beat the market.

Optimism, rather than realism, explains the market’s recent gyrations.

In early February, investors believed the economy was growing. Growth would increase earnings. Stocks were undervalued under these beliefs. So, investors bought.

Just four weeks later, stock prices were falling as investors worried about coronavirus. Then, stock prices bounced higher and optimism returned. So, investors bought.

History says the optimism is early.

SARS Warns Investors of More Bad Times Ahead

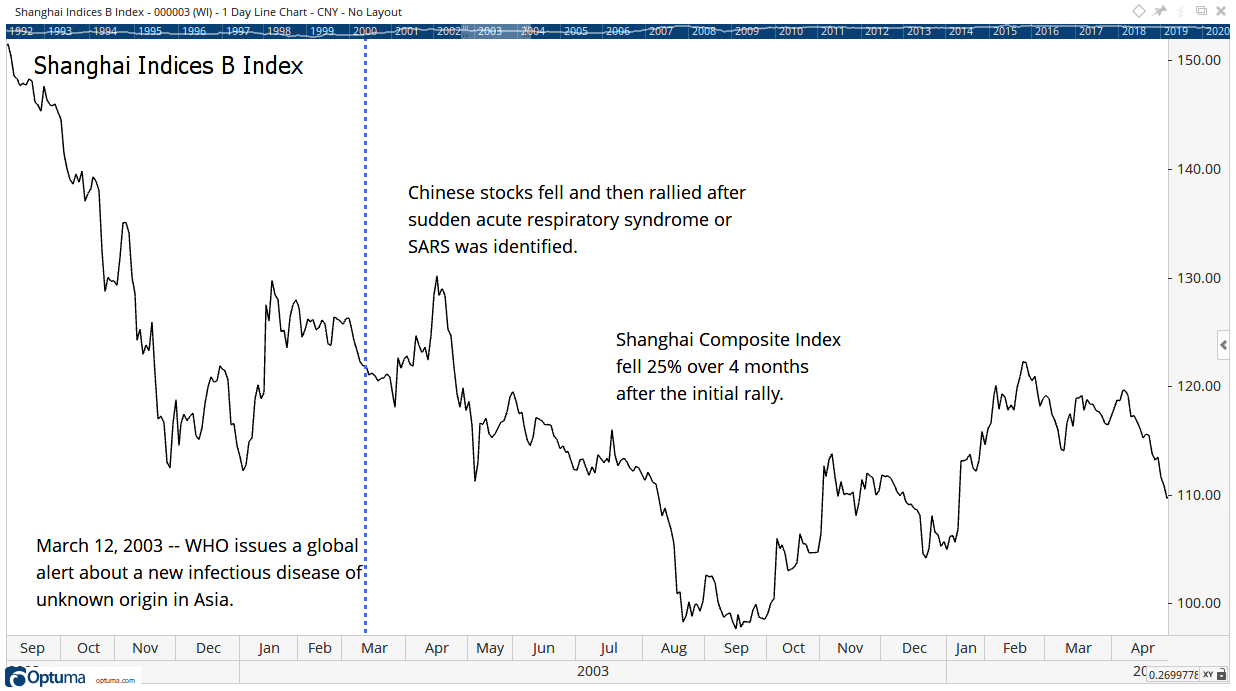

The chart below shows the Shanghai Composite Index in 2003. The Shanghai Composite is a benchmark for Chinese stocks and a possible benchmark for investing in an epidemic.

SARS presented an existential crisis for China according to the National Center for Biotechnology Information:

The SARS epidemic was not simply a public health problem. Indeed, it caused the most severe socio-political crisis for the Chinese leadership since the 1989 Tiananmen crackdown. Outbreak of the disease fueled fears among economists that China’s economy was headed for a serious downturn.

A fatal period of hesitation regarding information-sharing and action spawned anxiety, panic, and rumor-mongering across the country and undermined the government’s efforts to create a milder image of itself in the international arena.

As Premier Wen Jiabao pointed out in a cabinet meeting on the epidemic, “the health and security of the people, overall state of reform, development, and stability, and China’s national interest and international image are at stake.”

That chart also shows the optimism of investors. There was a bounce after news broke of the deadly disease.

A bounce after bad news is common. It’s simply investor optimism. Some investors believe they should buy bad news because “stocks always come back in the long run.”

China’s stock market did come back in the long run. It delivered an after-inflation average annual return of 0.8% since the 2003 bottom.

A simple market timing strategy delivered an after-inflation average annual return of 6.8% over that time. This strategy uses the 200-day moving average (MA). The rules are to buy when the index closes above its 200-day MA and sell and hold cash when the index falls below the MA.

A simple market timing strategy delivered an after-inflation average annual return of 6.8% over that time. This strategy uses the 200-day moving average (MA). The rules are to buy when the index closes above its 200-day MA and sell and hold cash when the index falls below the MA.

That’s a simple strategy but it’s difficult for many investors to follow. The problem is that investors are optimistic and believe markets always go up. The truth is markets go up and down. Avoiding downturns with the 200-day MA improves returns.

Despite the evidence, many investors believe the U.S. stock market is going to recover from the coronavirus sell-off. The history of SARS warns investors that is unlikely.

History says the time to buy is when the S&P 500 Index closes above its 200-day MA. That simple rules-based strategy can help investors, but few will use it.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru