Microsoft Corporation reported a 19% jump in revenue for its fiscal third quarter, leaning heavily on its cloud computing platform.

The Washington-based tech giant said its earnings were $8.8 billion along with a profit of $1.14 per share, which was higher than analysts’ projections of $1.

Since the first of the year, Microsoft shares have jumped 23%, beating the S&P 500 Index by six percentage points.

The company bested year-over-year revenue projections after reporting $30.6 billion — more than the $29.8 billion forecast by Zach’s Investment Research.

One of the biggest reasons for the jump in revenue was the company’s cloud platform. Microsoft Chief Financial Officer Amy Hood said the “commercial cloud” segment of the company grew 41% year-over-year to $9.6 billion, in a company statement.

“We continue to drive growth in revenue and operating income with consistent execution from our sales teams and partners and targeted strategic investments,” she said.

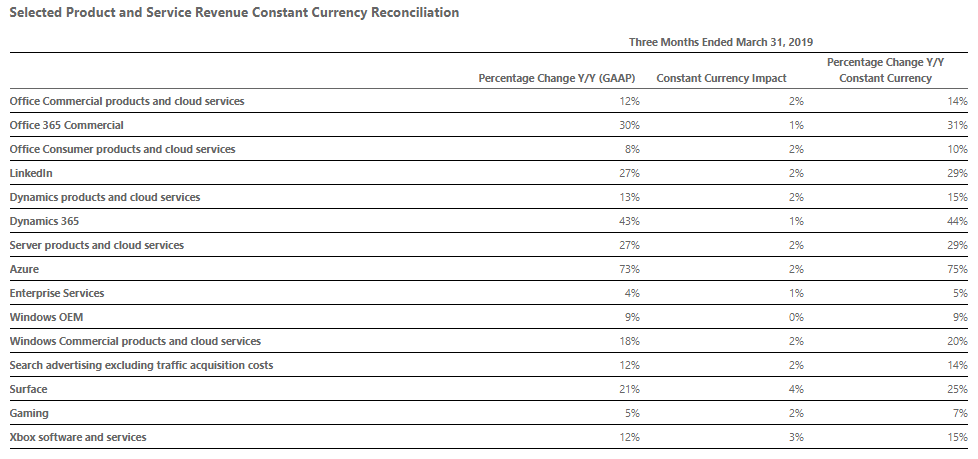

Within the cloud division, server products and cloud server revenue were up 27% thanks to its Microsoft Azure program, which experienced revenue growth of 73%.

The company’s gaming division also saw revenue growth in the third quarter. Microsoft reported its Xbox division grew 5% on the heels of it working on a “disc-less” console in response to Google’s free game streaming service, expected to come out later this year.

News of the revenue growth and per-share profit propelled Microsoft into uncharted territory as its share price jumped by as much as 5.1% in early trading Thursday to $131.37. That brought the company to a $1 trillion valuation — joining Apple Inc. and Amazon.com Inc. as the only companies to surpass the $1 trillion mark.

Since the first of the year, Microsoft shares have jumped 23%, beating the S&P 500 Index by six percentage points.

Both Apple and Amazon dropped below the $1 trillion valuation mark during the market downturn late last year.

However, investors are getting back into tech stocks after the Federal Reserve’s stance on interest rates exercised caution. That news drove the Nasdaq Composite to an all-time high Tuesday with that potentially being eclipsed Thursday after Microsoft’s quarterly report and strong news from Facebook Inc.