My wife, Amanda, and I are polar opposites when it comes to one thing: what to do on the weekend.

For the longest time, we kept it simple and didn’t have any plans.

Now, we find ourselves on Saturdays and Sundays wondering what to do.

She likes to get out of the house and go exploring. I’m OK with that… sometimes. I’m pretty content staying at home and working around the house.

Lately, I have an edge in the argument because, for no other reason, the price of gas makes traveling more expensive.

Here in South Florida, the average price of a regular gallon of unleaded gas is more than $3.50 per gallon.

While that might spell bad news for my wife’s exploration plans, there is a silver lining when it comes to investing.

Oil and Gas Is Making a Comeback

A year ago, the oil and gas industry started to show signs of life as demand started to pick up after winter storms and outages.

As a result, oil prices started to climb.

Brent crude — the international benchmark — went from $75 per barrel to $85 per barrel in two weeks.

West Texas Intermediate Crude — the U.S. benchmark — jumped from $71 per barrel to $81 in less than a month.

But then, prices flattened out for the rest of the year and into 2024.

Now, oil prices are starting to come back — WTI Crude has pushed past $83 per barrel late last week. As a result, oil and gas stocks are on the ride.

The iShares Oil & Gas Exploration & Production ETF (BATS: IEO) tracks a market-cap-weighted index of companies in the U.S. oil and gas exploration and production space.

Since hitting a January low, the exchange-traded fund (ETF) has rebounded more than 19% to hit a fresh 52-week high.

A big reason for this is oil refinery stocks have also hit new 52-week highs.

However, stocks related to production and exploration aren’t the only stocks benefitting from this trend.

Don’t Forget About Getting Oil From One Place to the Next

Oil doesn’t just magically appear from the oil fields of Texas to refineries on the Gulf Coast.

It has to be transported — usually by pipeline.

Midstream companies are responsible for transporting and storing oil and gas before they are refined and processed.

It is the halfway point between oil and gas exploration (known as upstream) and the refining process (known as downstream).

Because upstream and downstream stocks are on the rise — along with oil and gas prices — it stands to reason that these midstream transporters are on the way up as well.

And using Adam O’Dell’s proprietary Green Zone Power Ratings system, I found one that, like IEO and oil refiners, just hit a new 52-week high.

PAGP: Inside the Green Zone Story

Plains GP Holdings LP (Nasdaq: PAGP) was a recent addition to Adam’s Green Zone Fortunes Hotlist. Adam and I parse through our database every week to put together this hotlist and share it with Adam’s Green Zone Fortunes subscribers.

And PAGP was on the list for good reason.

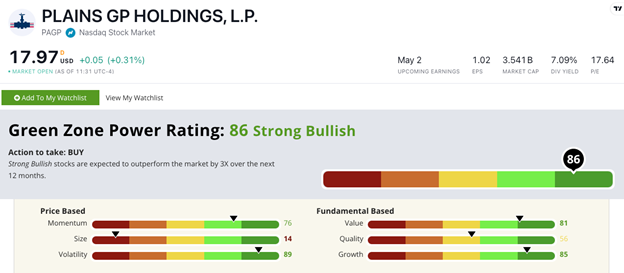

PAGP earns an 86 out of 100 overall on Adam’s Green Zone Power Ratings system. This means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

While the stock has a low level of Volatility — it scores an 89 on this factor — its growth stands out as well.

PAGP earns an 85 on Growth thanks to a trailing 12-month earnings growth rate of 44.6%. The company recently posted quarter-over-quarter earnings growth of 321%.

Its price-to ratios (earnings, sales, cash flow and book value) are all either in line or below the midstream industry average — earning it an 81 on Value.

I can’t overlook the stock’s recent momentum:

PAGP Outperforming Its Peers

PAGP earns a 76 on Momentum due to a 51% run over the last 12 months. That has pushed the stock to a new 52-week high.

The stock is also outperforming its peers — which are only up an average of around 24% over the same time.

Bottom line: Oil and gas prices are rising, bringing stock prices along with it.

Demand will continue to jump as we approach the Spring and Summer vacation months, with millions of Americans hitting the road for family trips or even weekend getaways.

PAGP has a strong overall Green Zone Power Ratings score, rating high on Value, Growth, Volatility and Momentum.

That’s what makes it a compelling addition to your portfolio.

And if you’re looking for even more ways to play oil’s next bull run, click here to see how to follow Adam’s guidance in 10X Stocks. His top oil stock recommendation has gained 10% over the last week and is up 200% since September 2022. And he believes its potential run is just getting started.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets