Commercial real estate is coming back, with 2021 sales nearing records highs.

Companies tightened their fiscal belts as more employees worked from home in 2020, and plants shut down to prevent the spread of COVID-19.

That caused sales in the space to drop from $405.4 billion in 2019 to $280 billion in 2020 — a 31% decline.

But then the market started its resurgence.

From January 2021 to September 2021, commercial real estate sales of $494.3 billion were greater in the first three quarters of last year than all of 2019.

And investors are optimistic. Take a look:

A recent survey by data firm CrowdStreet found that more than half of commercial real estate investors expect more activity for the foreseeable future.

That sentiment means companies specializing in commercial real estate will see big gains now and in the future. So will their investors!

Today’s Power Stock is Marcus & Millichap Inc. (NYSE: MMI).

MMI is a California-based investment commercial brokerage company.

It provides financing, research and advisory services for all kinds of real estate, including:

- Multifamily.

- Retail.

- Office.

- Industrial.

- Self-storage.

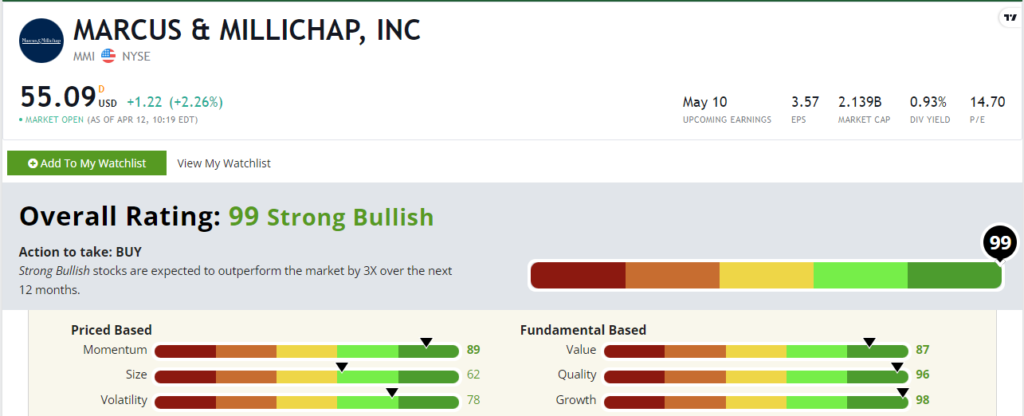

MMI scores a perfect “Strong Bullish” 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

MMI Real Estate Stock Checks All of Our Boxes

Two drivers make MMI stand out to me:

- The company scores in the green in all six factors that make up our proprietary Stock Power Rating system.

- In 2021, MMI increased its total annual revenue from $716.9 million to $1.3 billion — an 81% increase compared with the same period last year. It expects to hit almost $1.7 billion by 2023.

Commercial real estate sales dropped by $125.4 billion in 2020.

Through the first three quarters of 2021 (fourth-quarter numbers aren’t available yet), volume of almost $495 billion surpassed pre-pandemic levels.

MMI capitalized on that trend by more than doubling its volume from $32 billion in 2020 to $67.5 billion last year.

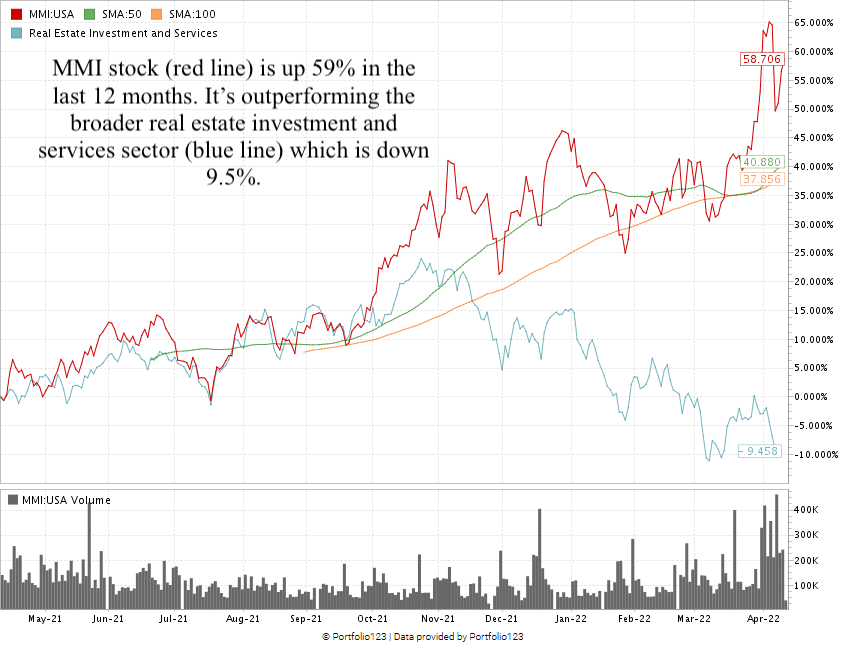

MMI climbed 59% in the last year, meeting only slight resistance on its way up as it capitalized on the resurgence in the commercial real estate market.

The stock outperforms its cousins in the real estate investment sector — which fell 9.5% during the same 12 months.

Rating 99 overall, MMI stock is one of the highest-rated stocks in our universe.

That also means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

The stock rates in the top 2% of all stocks we rate in growth and shows the “maximum momentum” my team and I love to see in stocks — scoring an 89 on momentum.

With a one-year annual earnings-per-share growth rate of 228.8% and a one-year sales growth rate of 80.8%, it shows no sign of slowing down.

Stay Tuned: Stock for Exposure to Renewables AND Old Energy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a promising stock that offers exposure to both “old energy” and the renewable energy mega trend!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.