A country is “energy independent” when it generates at least as much energy as it consumes.

It can then avoid two issues that cause gas prices to skyrocket:

- Supply chain problems, which prevent exporting oil and gas.

- Geopolitical unrest in exporting countries.

It’s true that some countries produce more energy than they consume — the United States, for example — but it’s cheaper to import some forms of energy than it is to use what you make.

Right now, Europe faces a massive energy situation.

Russia’s status as a major exporter of natural gas and oil to European countries is in danger due to its invasion of Ukraine.

The European Union and other countries have imposed economic sanctions targeting several industries, including coal imports.

Are oil and natural gas next?

You can see in the chart above that in 2021, Russia sold 74% of its natural gas exports (6.6 billion cubic feet) to European nations.

It sold almost half of its crude oil exports to Europe.

Russia has a virtual gun to the head of nearly every European nation. If Russia shuts off the supply, Europe loses energy.

That leads me to the Power Stock I think you need to consider today: TotalEnergies SE (NYSE: TTE).

The French oil and gas producer specializes in liquefied natural gas (LNG), electricity and even renewable energy sources.

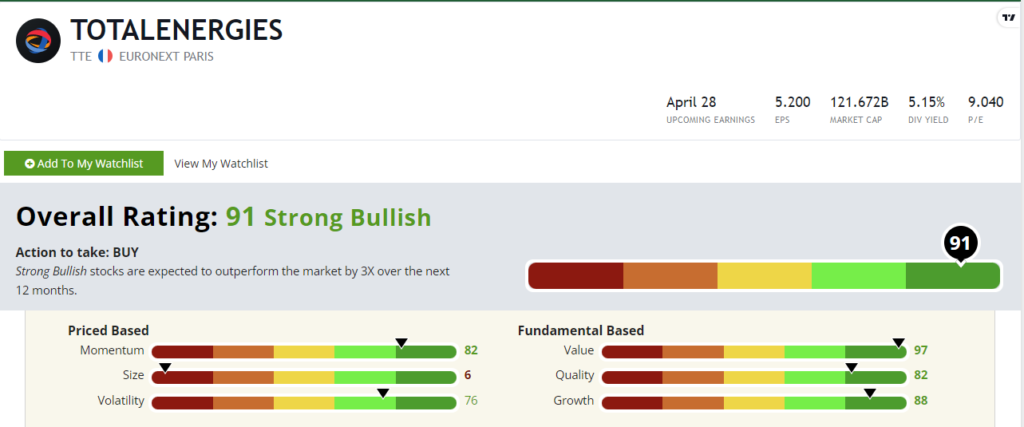

TTE scores a “Strong Bullish” 91 out of 100 on our Stock Power Rating system, and we expect it to beat the broader market by 3X in the next 12 months.

TTE Stock: Strong Bullish Value + Momentum

My research pointed me to TTE for two main reasons:

- It bought the commercial and industrial sides of American renewable energy company SunPower (Nasdaq: SPWR) in February for $250 million to broaden its portfolio in solar energy projects.

- TTE is already the second-largest public LNG company, with a global market share of nearly 10%.

TotalEnergies rebounded in a big way after the COVID-19 pandemic shut down oil and gas exploration worldwide. Take a look:

In 2020, TTE reported total annual revenue of $119.7 billion, but that grew 54% to $184 billion in 2021.

The company projects it will rake in $237.5 billion this year — up 30% from last year.

In the last two years, TTE stock rose 60% to reach a new 52-week high on the heels of Russia’s invasion of Ukraine.

Here’s why: Sanctions against Russian oil and gas force countries, not only in Europe but also abroad, to seek out new sources for energy-producing natural gas … leading them right to TTE.

TotalEnergies SE stock scores a 91 overall on our Stock Power Rating system.

That means we are “Strong Bullish” on TTE and expect it to crush the broader market by at least three times in the next 12 months.

This fantastic value and momentum stock scores a 97 on value (in the top 3% of all stocks on the metric) and an 82 on momentum.

Its recent downside is due to the price increases in oil and natural gas, not investor sentiment toward the stock.

TTE boasts an impressive 5.82% forward dividend yield, which means you’ll make $3.04 per share each year just to own the stock.

Stay Tuned: High-Quality Retail Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a high-quality retailer that rates a “Strong Bullish” 97 out of 100!

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.