Some investors think of buying biotech stocks as throwing a big plate of spaghetti against the wall and seeing what sticks.

It sounds silly, but it’s a solid analogy. Drug trials are, by their nature, experimental.

Sometimes — when the experiment is a success — you end up with a new multibillion-dollar blockbuster drug. These are the noodles that stick.

But often, you end up with a bust. The drug is a failure, and the noodles fall to the floor.

The binary nature of drug trials compounds the risk here. Drugs don’t kind of work. Either they’re viable, or they aren’t. They make it to pharmacy shelves … or they don’t.

There’s not room for middle ground.

And finally, the old refrain that “past performance is no guarantee of future results” is particularly true in this space.

A new blockbuster drug can completely alter the trajectory of the company. So, if you’re trying to value the stock based on past data, there’s a good chance that your numbers won’t make a lot of sense.

COVID Vaccine Stocks

Case in point: Moderna stock (Nasdaq: MRNA).

Moderna, of course, makes one of the three highly efficacious COVID-19 vaccines distributed in the United States.

But beyond the pandemic, Moderna is a leader in the emerging field of messenger ribonucleic acid (mRNA) vaccines. Its mRNA COVID-19 vaccine was a game-changer — and it could be the tip of the iceberg. The company is working on cancer vaccines using the same technology.

Nipping cancer in the bud would be the greatest medical breakthrough since the discovery of penicillin in 1928.

I ran Moderna stock through our Green Zone Ratings model. (Adam O’Dell, our chief investment strategist, designed this proprietary model. It rates stocks on the six factors proven to drive market-beating returns. More on those below.)

Moderna’s Stock Rating

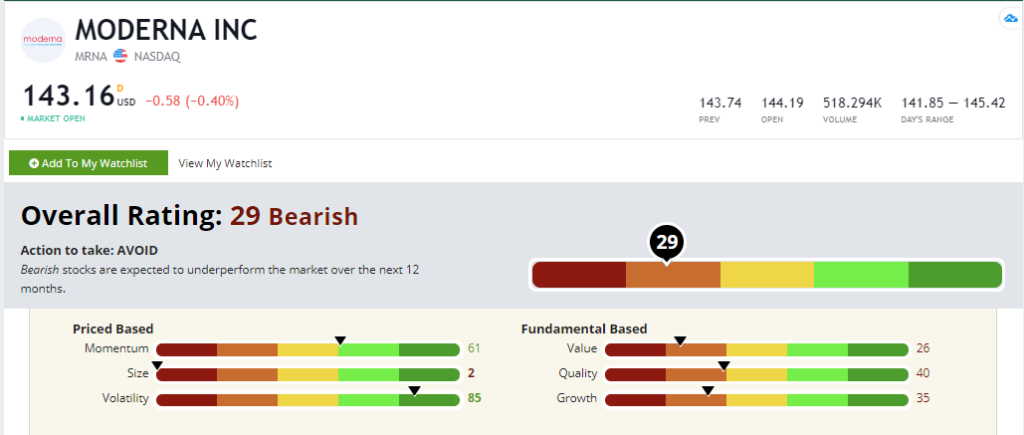

At first glance, it’s not pretty. You can see below that the stock’s overall rating is 29 out of 100, which is distinctly bearish. Let’s break it down further.

Moderna’s Green Zone Rating on March 22, 2021.

Volatility — Moderna rates highest on volatility, at 85. This implies it’s less volatile than 85% of all companies in our universe. But to clarify, Moderna’s stock price is volatile. It has a beta of 1.5. The market — for example, the S&P 500 — has a beta of 1.0. So at 1.5, Moderna stock is about 50% more volatile than the broader market. The stock rates deceptively well on this metric because it just went public in 2019, and the shares went straight up in 2020 as the pandemic unfolded.

Momentum — Moderna rates a respectable 61 based on momentum. But I want to explain this further: If you took the last year’s worth of data alone, Moderna would rate much higher. The stock finished 2019 at around $20 per share and now sits at a lofty $143. The issue is timing. Our Green Zone model calculates the momentum score based on a variety of time horizons, some of which stretch back years. Moderna’s lack of history here unfairly penalizes it.

Quality — Moderna rates a 40 based on quality. But I hesitate to draw strong conclusions from this. Its limited operating history doesn’t give us a lot of data to work with. I should note, though, that the company’s small debt load is a high-quality attribute.

Growth — Growth is also low, with a score of just 35. But again, the lack of operating history unfairly penalizes Moderna here. For crying out loud, the company sells one of the most sought-after drugs in human history in its COVID-19 vaccine by the hundreds of millions.

Value — Like many biotech stocks, Moderna rates low on value, at 26. The issue is that valuation metrics look at historical data, whereas the value in a biotech stock is the potential future earnings from a new blockbuster.

Size — Moderna’s market cap has exploded with the popularity of its COVID vaccine. As a result, the company rates a 2 out of 100. This is not some yet-to-be-discovered hidden gem; it’s a recognized leader in mRNA technologies.

Bottom Line: Running screens can be useful, particularly in identifying biotech stocks with high momentum. But before we buy these stocks, we need to dig further and do another layer of analysis.

This is where we come in. My colleague Adam O’Dell has been researching biotech and DNA plays for over a year.

We’ve identified one top DNA play that we think will profit from the coming DNA revolution in the same way Intel stock skyrocketed with the mass adoption of the internet.

We also found three speculative DNA stocks that trade for under $10.

We’ll release all the details to members of one of our monthly investment service, Green Zone Fortunes, in the coming days. Stay tuned!

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

P.S. Check out The Bull & The Bear podcast every week for more investment tips from Adam O’Dell, Matt Clark and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.