I just started a new video series on our Money & Markets YouTube channel, called Ask Adam Anything.

The name says it all … it’s a Q&A format where you can ask me anything, and I’ll give my best short answer.

Check it out! You can watch the first video here, where I tackled everything from hot cannabis stocks to dogecoin. For a sneak preview into one of the topics of this week’s episode premiering later today, keep reading.

And please, write to me at feedback@moneyandmarkets.com with your most pressing questions.

Ask Adam Anything: TransOcean Ltd. (NYSE: RIG)

Last week, one YouTube viewer asked for my opinion on Swiss oil drilling company TransOcean Ltd. (NYSE: RIG).

As you know from pieces I’ve written recently — here and here — I’ve grown increasingly bullish on the energy sector, specifically the oil and gas industry, over the past few months. So, I was more than happy to have a look at RIG on the upcoming episode of Ask Adam Anything.

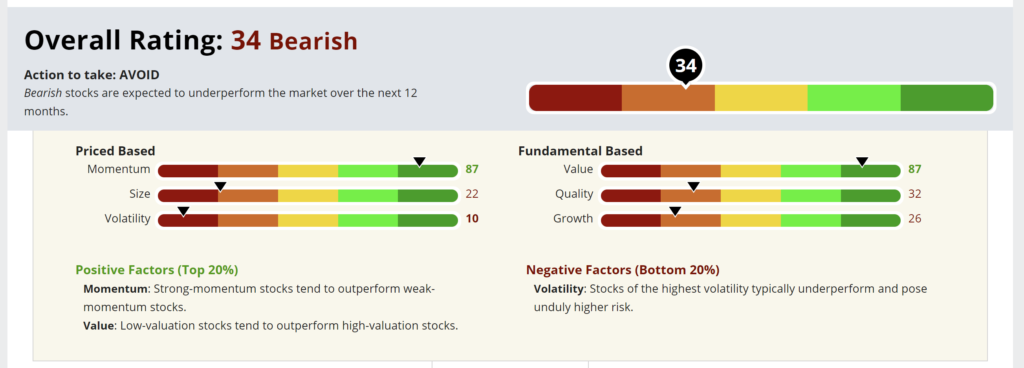

Of course, I did that through the lens of my Green Zone Ratings model, which rates stocks based on six proven investment factors: momentum, size, volatility, value, quality and growth.

If you’ve read at least half a dozen articles on our Money & Markets, you already know that Green Zone Fortunes co-editor, Charles Sizemore, research analyst Matt Clark, and I often leverage my model to identify top-rated “Green Zone” stocks — ones that score at least 80 out of 100, and often greater than 90.

These are truly well-rounded stocks. They must score well above average on at least five of the six factors to score an 80 or above overall.

Well, TransOcean is not one of them. My model rates it a 34 out of 100 overall, a “Bearish” rating.

TransOcean Ltd.’s Green Zone Rating on March 19, 2021.

But in this case, that doesn’t mean I’m not a buyer.

In fact, I’m quite positive on RIG. Here’s why.

Energy Is a Contrarian Trade

The Green Zone Ratings model has proven predictive value. Though, like all models, it must rely on historical data.

In the case of a contrarian opportunity — specifically, a sector or stock that’s been down in the dumps … one you expect to make a bullish recovery — there are three factors that nearly always rate poorly: volatility, quality and growth.

This is intuitive. But let’s walk through what’s happened in the oil & gas industry in recent years, and how these three factor ratings have been affected.

First, when an industry group contracts, as oil and gas has, its growth rates are negative. That can apply to revenues, profits and cash flows — all metrics my six-factor model considers when assigning a “growth” rating to a stock.

In RIG’s case, sales have contracted by around 15% over the last five years. So, it’s no surprise to me the stock rates a lowly 26 out of 100 on the growth factor.

Similarly, we can’t expect the quality-factor rating of a contrarian investment to be high. In the lean years, companies like TransOcean see their profit margins contract, if they even remain profitable. And debt levels tend to rise.

In short, a company that’s struggling to remain profitable certainly won’t rate well on my quality factor. And that certainly holds true for RIG, which earns a quality-factor rating of just 32.

Finally, falling stock prices tend to be more volatile than rising prices … as do the stocks of companies with questionable futures. All told, stocks that have suffered through a multi-year decline don’t tend to have the character of low-volatility stocks. This is naturally the case for RIG, which rates just 10 out of 100 on volatility.

All that said …

RIG is a Tremendous “Value” and “Momentum” Stock

Conversely to the factors that almost always rates poorly when a stock is bottoming (growth, quality and volatility) … there are two factors that show remarkable strength when a stock starts making a bullish recovery from that bottom: value and momentum.

Get this …

RIG rates an 87 out of 100 on my value and momentum factors.

It’s counterintuitive to think a stock can have the market-beating characteristics of both value and momentum. But contrarian opportunities, like the one I’m seeing in the oil and gas industry now, typically present this precise combination — of cheaply valued stocks that are also surging higher.

The distinction, of course, is that the high-momentum nature of these opportunities is different than the high-momentum stocks that have been making new highs year after year (think technology stocks, between 2017 and 2021).

Oil-and-gas industry stocks are now experiencing a “brand-new” episode of market-beating bullish momentum. And, since their valuations are so much lower than the valuations of the “high-flyers” of recent years (cough: tech stocks) … this new burst of momentum is likely just the beginning of a multi-year bull run.

As more investors take note of the dirt-cheap valuations in energy stocks today, they’ll have an increasing appetite to buy. That will fuel the new rally that’s just begun. And they won’t stop buying until these energy stocks have reached higher, “fair value” prices … or beyond.

Here’s one shocking valuation metric I shared in my Ask Adam Anything video on TransOcean: RIG trades with a price-to-book value of 0.23!

Essentially, if TransOcean were to dismantle and sell itself, in something of an “estate sale,” it could garner enough to pay its shareholders $18.59 per share. Yet, on the open market, you can buy shares of RIG today for just $4.22.

You can buy shares for just 23% of its book value. It’s the classic deep-value goal of buying companies for “cents on the dollar.”

Of course, there is risk in contrarian trades. Remember, RIG’s growth, quality and volatility ratings show the damage the company has suffered in recent years, as investors have turned against the oil and gas industry. And there’s no guarantee oil and gas will ever return to the level it once enjoyed, in its glory days.

Frankly, I don’t think oil and gas will ever be as big or profitable as it once was. But that doesn’t mean I’m not a buyer of oil and gas stocks at these uber-depressed levels.

Pessimism and price punishment have reached extreme levels … and those are the hallmarks of bullish contrarian trades that are about to motor higher.

If RIG’s top-rated value and momentum factors are any indication, a new bull market may be just beginning for TransOcean.

This was only one topic I tackled in the latest Ask Adam Anything. To see my analysis of other top market trends, subscribe to our YouTube channel here.

To good profits,

Adam O’Dell

Chief Investment Strategist

P.S. If you are interested in more ways to get into the next energy bull market, check out the latest issue of Green Zone Fortunes. Charles and I revealed the tickers of our two highest-conviction energy stocks to buy right now. And there’s still plenty of time to invest.

To find out how to gain access to these top energy recommendations, along with how I use the Momentum Principle to “buy high … sell higher,” check out the details on my Millionaire Master Class here.

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.