A day after the Dow Jones Industrial Average plummeted 1,000 points to close its worst day in two years, investors may have the urge to buy the dip in equity prices.

But one well-known economist is warning that now is not the time to buy.

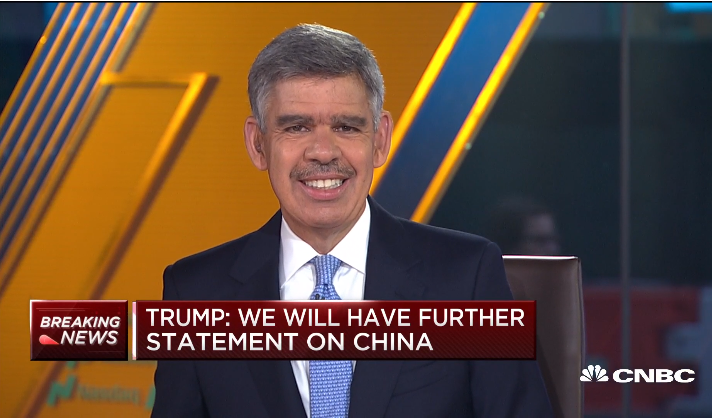

Allianz chief economic adviser Mohamed El-Erian told CNBC’s “Squawk Box” on Tuesday that conditions now are “different” and investors should resist buying the coronavirus dip.

“I would continue to resist, as hard as it is, to simply buy the dip,” El-Erian said.

Earnings Tell a Story

One big reason El-Erian cautions against buying is the trend for negative corporate earnings.

While 70% of companies in the S&P 500 have reported earnings and revenue surprises for the fourth quarter of 2019, nearly two-thirds of those companies have issued negative earnings guidance for the first quarter of 2020, according to FactSet.

“The blended revenue growth rate for the fourth quarter is 3.6%, which is slightly below the revenue growth rate of 3.7% last week,” FactSet said. “Eight sectors are reporting year-over-year growth in revenues, led by the health care sector. Three sectors are reporting (or have reported) a year-over-year decline in revenues, led by the materials sector.”

Analysts expect earnings growth of only 1.5% in Q1 2020.

Resist Buying the Coronavirus Dip

That suggests companies are trying to factor in the potential negative impacts of the coronavirus into next-quarter sales.

Now, the biggest issue is the spike in virus cases being reported outside of China.

Earlier this month, El-Erian said investors should avoid buying the dip, suggesting the coronavirus would “paralyze China.”

But with those impacts now reaching Europe and the Middle East — Italy, Iran and South Korea have recently reported spikes in infections — the negative reaction is now global.

That will likely spark continued concerns over a global economic slowdown as the virus shaved $1.7 trillion off global stock market values Monday.

“We’re going to have a lot of risk aversion on the part of economic actors. It’s going to take time,” El-Erian said. “Economic sudden stops are hard to restart.”

Heeding the Warning

As of Tuesday morning, U.S. equities markets returned any gains made when the market opened. All three major indices opened in the black but moved steadily lower.

It implied investors heeded El-Erian’s advice and continued to sell off as coronavirus fears persisted.

Additionally, the benchmark Treasury yield fell to an all-time low. On Tuesday morning, the 10-year Treasury yield fell to 1.32%, below the previous record of 1.325% set on July 6, 2016.

CNBC analyst Jim Cramer echoed El-Erian Tuesday, saying the drop in the markets may not be short-lived. He cited a lack of positive news surrounding the virus in Italy as well as drug trials either not working or not being close to fruition.

“I put those negatives out there because they are all possibilities and can’t be overlooked. Which is why I don’t like to buy into a rally,” Cramer said.