Money & Markets Week Ahead for the week of January 24, 2021: Watch this IPO launch and a load of big earnings reports.

Stocks moved slightly higher as the nation inaugurated a new president last week.

Bitcoin’s rise … and subsequent fall … dominated financial headlines.

The cryptocurrency almost crested the $40,000 mark, but in just two days, a massive sell-off wiped more than $100 billion off the entire crypto market.

Looking ahead, it’s a big week for earnings as several large companies will unveil their quarterly numbers. Here’s what to look for in the week ahead on Wall Street:

Money & Markets Week Ahead: On the IPO Front

There are a few initial public offerings (IPO) on the schedule this week.

Tennessee-based Shoals Technologies Group plans to launch its IPO on Thursday.

What is it? Shoals Technologies Group is headquartered in Portland, Tennessee — a small town located outside of Nashville.

The company produces energy balance of system (EBOS) products primarily used for solar energy projects.

EBOS products help carry electric current produced by solar panels to an inverter and then to a power grid.

In its prospectus, the company said it believed that “approximately 54% of the solar energy generation capacity installed in the U.S. during the 12 months ended Sept. 30, 2020, used at least one of our EBOS products.”

For the 12 months ending Sept. 30, 2020, the company booked $175 million in revenue.

The IPO launches at a time when the new Biden administration has pledged to spend more on the nation’s renewable energy infrastructure.

The offering. The company plans to trade on the Nasdaq Global Market exchange under the ticker SHLS.

Renaissance Capital reported that Shoals Technologies is looking to raise $1 billion by offering 50 million shares at a price range of $19 to $21 per share.

Using the midpoint of that price range, the company could see a market value of around $3.4 billion.

Of the shares being offered, BlackRock and ClearBridge Investments are planning to buy $150 million and $125 million worth of shares, respectively.

Shoals wants to capitalize on what could be a huge boom for renewable energy.

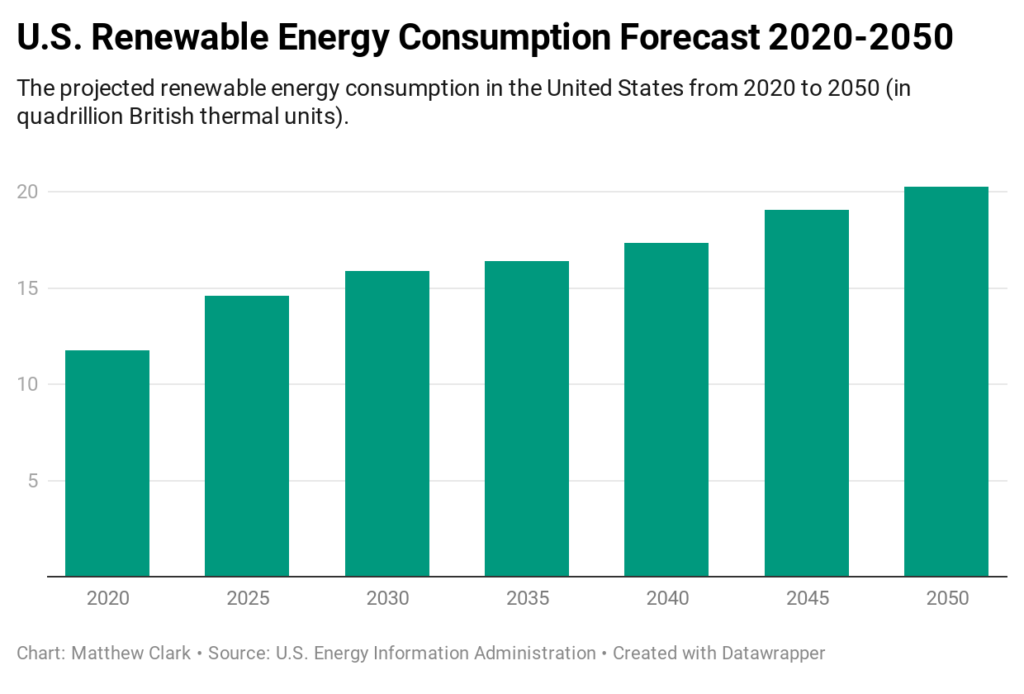

The U.S. Energy Information Administration projects that the U.S. could consume more than 20 quadrillion British thermal units of renewable energy by 2050.

That would be close to double the amount consumed in 2020.

Renewable Energy Consumption Projected to Scale Higher

The company said it plans to use the proceeds of the IPO to repay outstanding debt.

Goldman Sachs, J.P. Morgan, Guggenheim Securities, UBS Investment Bank, Morgan Stanley, Barclays and Credit Suisse are bookrunners on Shoals Technologies’ IPO.

Deeper Dive: Big Earnings Week

The quarterly earnings season kicked off two weeks ago, but a lot of big names are reporting over the next five days, including:

- Microsoft Corp. (Nasdaq: MSFT)

- Verizon Communications Inc. (NYSE: VZ)

- Advanced Micro Devices Inc. (Nasdaq: AMD)

- Apple Inc. (Nasdaq: AAPL)

- Tesla Inc. (Nasdaq: TSLA)

- Facebook Inc. (Nasdaq: FB)

- AT&T Inc. (NYSE: T)

- Visa Inc. (NYSE: V)

- Mastercard Inc. (NYSE: MA)

- McDonald’s Corp. (NYSE: MCD)

So, instead of focusing on just one company, I want to look at the data surrounding the overall earnings season.

Quarterly guidance is up … According to market data specialists FactSet, the number of S&P 500 companies giving positive earnings guidance in the fourth quarter is up.

More S&P 500 Companies Give Positive Guidance

The data company said 56 companies have given positive earnings guidance in the quarter — the most since 2017.

The last time more than 50 companies gave positive guidance was in the first quarter of 2018.

FactSet said of the 56 companies providing that guidance, 29 of those were in the information technology and industrials sectors.

If the number holds, it will be the highest number of S&P 500 companies issuing positive earnings-per-share guidance since FactSet started tracking the data in 2006.

Earnings growth… As of a week ago, S&P 500 companies are expected to report an earnings decline of 6.8% for the fourth quarter.

Over the last five years, FactSet said actual earnings have exceeded estimates by 6.3%. During that time, 74% of S&P 500 companies have reported earnings per share above the mean EPS estimate on average.

Companies Beat Earnings Estimates

But in Q2 and Q3 of 2020, actual earnings of S&P 500 companies have exceeded estimates by 21.3% on average.

In the last two quarters, 84% of S&P 500 companies have reported actual earnings per share above the mean estimate.

What does it mean? … Well, it may mean nothing.

But it could signify that more companies will continue to outperform earnings-per-share estimates in the fourth quarter.

Money & Markets Week Ahead: Data Dump

This week’s data dump starts on Tuesday when the Federal Housing Finance Authority releases its U.S. House Price Index reading for November.

The index reflects the change in house prices across the country. A high reading is a bullish signal for the U.S. dollar, while a lower reading is a bearish signal.

Home Prices Have Risen Since May

In October 2020, home prices jumped 10.2% — more than the 9.1% increase shown in September.

On Wednesday, the Federal Open Market Committee votes on where to set the Fed’s interest rate.

The interest rate is a key component in currency valuation.

Fed Expected to Hold Interest Rates

The committee has held interest rates at 0.25% since the outbreak of the COVID-19 back in March 2020.

It’s expected to hold steady.

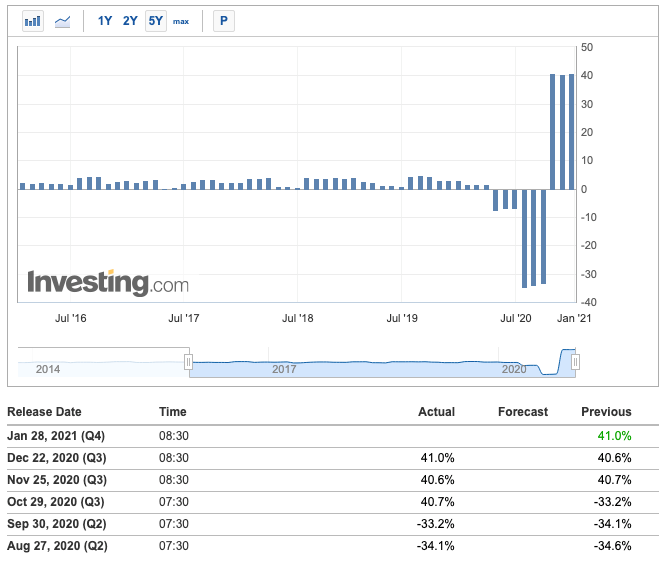

The Commerce Department unveils real consumer spending for the fourth quarter on Thursday.

The study reflects inflation-adjusted money spent by U.S. households.

Real Spending Up 40% In Last Three Months

Real consumer spending has been up more than 40% in each of the last three months of 2020 following consecutive 30%+ declines.

An increase in consumer spending could spell higher short-term demand in the U.S. economy.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out next week:

Monday

Archer Daniels Midland Co. (NYSE: ADM)

Steel Dynamics Inc. (Nasdaq: STLD)

Tuesday

Microsoft Corp. (Nasdaq: MSFT)

Verizon Communications Inc. (NYSE: VZ)

Advanced Micro Devices Inc. (Nasdaq: AMD)

Raytheon Technologies Corp. (NYSE: RTX)

Lockheed Martin Corp. (NYSE: LMT)

General Electric Co. (NYSE: GE)

Wednesday

Apple Inc. (Nasdaq: AAPL)

Tesla Inc. (Nasdaq: TSLA)

Facebook Inc. (Nasdaq: FB)

AT&T Inc. (NYSE: T)

Boeing Co. (NYSE: BA)

General Dynamics Corp. (NYSE: GD)

Thursday

Visa Inc. (NYSE: V)

Mastercard Inc. (NYSE: MA)

Comcast Corp. (Nasdaq: CMCSA)

McDonald’s Corp. (NYSE: MCD)

Mondelez International Inc. (Nasdaq: MDLZ)

Northrup Grumman Corp. (NYSE: NOC)

Friday

Ely Lilly And Co. (NYSE: LLY)

Chevron Corp. (NYSE: CVX)

Honeywell International Inc. (NYSE: HON)

Caterpillar Inc. (NYSE: CAT)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.